-This question was submitted by a user and answered by a volunteer of our choice

Every year or after a certain period, the ledger accounts are balanced after posting the transactions. The difference in the totals of the two sides of an account is written on the side with the smaller total. The credit balance of a trading account means the company has earned a gross profit for that period. Let us break this down for you,

Credit Balance

While preparing an account, if the credit side of an account exceeds the debit side of an account then the difference is called a “credit balance”. In short, if Cr. Side > Dr. Side, it is said to have a Credit Balance.

Assets have a debit balance, and Liabilities have a credit balance. Similarly, Expenses have a debit balance, and Revenues and Capital have a credit balance.

Due to the fact that they are the balancing figures, a debit balance appears on the credit side while a credit balance appears on the debit side.

Related Topic – Debit Balance and Credit Balance in Accounting (Detailed)

Meaning in Trading Account and What it Indicates

A trading account records all the trading activity (buying and selling) of the firm’s main products/services during an accounting period. It is the first stage in the preparation of financial statements.

The debit side shows “opening stock” + “expenses“, whereas the credit side has “closing stock” + “revenues“.

As a result, if the right side (Cr.) is greater than the left side (Dr.), revenues will exceed expenses, resulting in a profit.

Note: Direct expenses are shown in the trading account, whereas indirect expenses are shown in the income statement.

The credit balance of a trading account means gross profit. However, a debit balance of the trading account indicates a gross loss.

This signifies that the company earned more money than the expenses incurred by it. This number is transferred to the credit side of a profit & loss account to further calculate net profit or a net loss.

Gross Profit = Net sales proceeds > (Cost of Goods sold + All Direct Expenses)

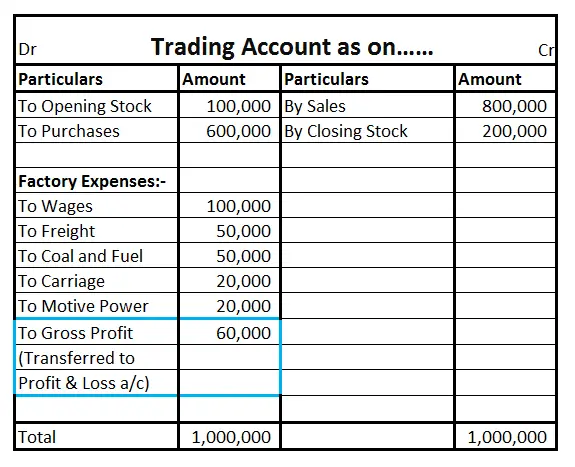

Example Showing Gross Profit

Prepare a trading account for the year ending 31 Mar YYYY from the following balances.

| Account | Balance |

|---|---|

| Opening Stock | 40,000 |

| Wages | 25,000 |

| Sales | 2,20,000 |

| Freight | 5,000 |

| Purchases | 80,000 |

| Carriage Inwards | 10,000 |

Closing stock is valued at 30,000 at the year-end.

Trading Account for the year ending 31 Mar YYYY

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

| To Opening Stock | 40,000 | By Sales | 2,20,000 |

| To Purchases | 80,000 | By Closing Stock | 30,000 |

| To Wages | 25,000 | ||

| To Carriage Inwards | 10,000 | ||

| To Freight | 5,000 | ||

| To Gross Profit | 90,000 | ||

| Grand Total | 2,50,000 | Grand Total | 2,50,000 |

Frequently Asked Questions Related to this Topic

A question that is commonly asked around this topic is,

Question – 1 – Select the most appropriate alternative from those given below:

The credit balance of the Trading Account means _____?

- Gross Loss

- Net Loss

- Net Profit

- Gross Profit

Answer – The answer is D. The reason is clearly explained in the above text in this article.

Question – 2 – What is the credit side of a trading account?

Answer – The credit side of a trading account shows a combination of Closing Stock and Sales less Return Inwards.

Question – 3 – Trading Account is a _____ account?

- Personal

- Real

- Nominal

- Valuation

Answer – The answer is C. It is a nominal account prepared at the end of an accounting period.

Related Topic – Trading Expenses in Final Accounts

Conclusion

A trading account is an important indicator used by various internal and external parties to know the overall business performance and efficiency.

- To summarize, a trading account is a type of financial statement that is utilised by companies in order to keep track of the buying and selling activities that take place during an accounting cycle.

- The reason why it is so crucial is that it helps to determine whether the company made a gross profit or a gross loss during the year.

- A credit balance of the trading account represents that it has a greater credit side as compared to the debit. It shows that the company has earned a profit from trading activities, which is an indication that more money has been earned than expensed.

- A gross profit is then transferred to the credit side of the profit and loss account in order to further calculate net profit or a net loss.

Gross profit indicates the ability of a company or individual to meet its financial goals. If a company suffers a gross loss, it may have difficulty paying its bills in the future.