Every year or after a certain period, the ledger accounts are balanced after posting the transactions. The difference in the totals of the two sides of an account is written on the side with the smaller total. The debit balance of a trading account means the company has incurred a gross loss for that period. Let us break this down for you,

Debit Balance

While preparing an account, if the debit side of an account is greater than the credit side, the difference is called “Debit Balance”. In short, if Dr. Side > Cr. Side, it is said to have a debit balance.

Assets have a debit balance, and Liabilities have a credit balance. Similarly, Expenses have a debit balance, and Revenues have a credit balance.

Due to the fact that they are the balancing figures, a debit balance appears on the credit side while a credit balance appears on the debit side.

Related Topic – Debit Balance and Credit Balance in Accounting (Detailed)

Meaning in Trading Account and What it Indicates

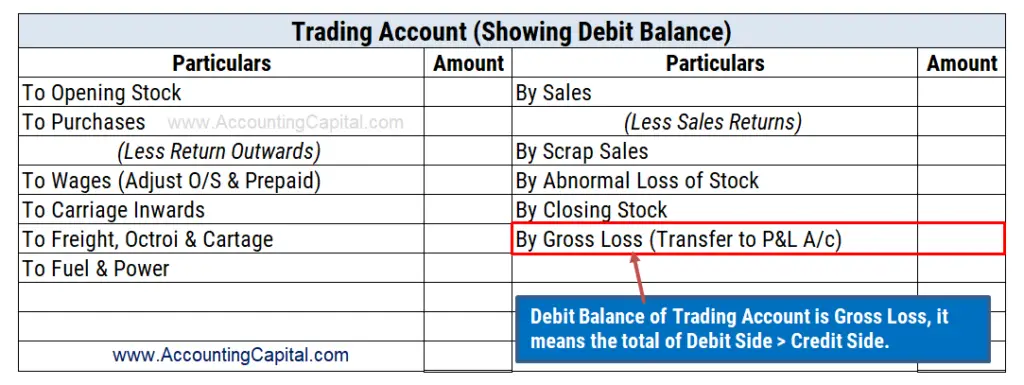

A trading account is a financial statement which records all the trading activity (buying and selling) of the firm’s main products/services during an accounting period. As part of the preparation of final accounts, this is the first financial statement prepared.

The debit side shows “opening stock” + “expenses“, whereas the other side has “closing stock” + “revenues“.

As a result, if the left side (Dr.) is greater than the right side (Cr.), expenses will exceed revenues, resulting in a loss.

Note: Direct expenses are shown in the trading account, whereas indirect expenses are shown in the income statement.

The debit balance of a trading account means gross loss. However, a credit balance of the trading account indicates a gross profit. This signifies that the company lost more money than it made. This number is transferred to the debit side of a profit & loss account to further calculate net profit or a net loss.

Related Topic – What are Sales Returns and Allowances?

Example Showing Gross Loss

Prepare a trading account for the year ending 31 Mar YYYY from the following balances. This example has deliberately been chosen to show the debit balance of the trading account.

| Account | Balance |

|---|---|

| Opening Stock | 40,000 |

| Wages | 25,000 |

| Sales | 70,000 |

| Freight | 5,000 |

| Purchases | 80,000 |

| Carriage Inwards | 10,000 |

Closing stock is valued at 30,000 at the year-end.

Trading Account for the year ending 31 Mar YYYY

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

| To Opening Stock | 40,000 | By Sales | 70,000 |

| To Purchases | 80,000 | By Closing Stock | 30,000 |

| To Wages | 25,000 | By Gross Loss | 60,000 |

| To Carriage Inwards | 10,000 | ||

| To Freight | 5,000 | ||

| Grand Total | 1,60,000 | Grand Total | 1,60,000 |

Related Topic – Is Purchase Return a Debit or Credit?

Short Quiz for Self-Evaluation

Related Topic – Treatment of Closing Stock in Trading Account

Frequently Asked Questions Related to this Topic

A question that is commonly asked around this topic is,

Question – 1 – Select the most appropriate alternative from those given below:

Debit balance of Trading Account means _____?

- Gross Loss

- Net Loss

- Net Profit

- Gross Profit

Answer – The answer is A. The reason is clearly explained in the above text in this article.

Question – 2 – What is debit side of trading account?

Answer – The debit side of a trading account shows a combination of Opening Stock, Purchase & Return Outwards, and Direct Expenses.

Question – 3 – Trading Account is a _____ account?

- Personal

- Real

- Nominal

- Valuation

Answer – The answer is C. It is a nominal account prepared at the end of an accounting period.

Related Topic – Trading Expenses in Final Accounts

Conclusion

A trading account is an important indicator used by various internal and external parties to know the overall business performance and efficiency.

- To summarize, a trading account is a type of financial statement that is utilised by companies in order to keep track of the buying and selling activities that take place during an accounting cycle.

- The reason why it is so crucial is that it helps to determine whether the company made a profit or a loss during the year.

- A debit balance of the trading account represents that it has a greater debit side as compared to the credit. It shows that the company has suffered a loss from trading activities, which is an indication that more money has been lost than earned.

- A gross loss is then transferred to the debit side of the profit and loss account in order to further calculate net profit or a net loss.

The ability of a company or individual to meet its financial goals can be negatively affected by a gross loss. If a company suffers a gross loss, it may have difficulty paying its bills in the future. Therefore, it may need to borrow or dissolve its assets to stay operational.

>Read Accounting Fundamentals Quiz – Level Intermediate (#3)