-This question was submitted by a user and answered by a volunteer of our choice.

Equity is the capital raised by a company for the purpose of purchase of assets or for making an investment in a specific project or for the smooth functioning of operations. It’s important as it represents the value of an investor’s stake in a company.

It can also be aid that its the sum of money that the company is required to pay at the time of its liquidation to its shareholders after realising all of its assets and paying off all of its debts. Equity is presented in the financial statement as a component of a Balance Sheet.

The formula for calculating the company’s equity

Shareholder’s Equity = Total Assets – Total Liabilities

Inclusive list of items under the head” Equity”

| Particulars |

| Equity Share Capital |

| Reserves and surplus |

| 1. Securities Premium Reserve |

| 2. General Reserves |

| 3. Capital Redemption Reserve |

| 4. Revaluation Reserve |

| 5. Debenture Redemption Reserve |

| 6. Share Option Outstanding Account |

| 7. Others- (Specify the Nature and Purpose of such reserve) |

| 8. Retained Earnings |

| Other Comprehensive Income |

| 1. Foreign Currency Translation Reserve |

| 2. Cash Flow Hedge Reserve |

| Vesting and Exercise of Warrants |

| Issuance of Non-Controlling Interest |

| Repurchase of Stock option |

| Issuance of Common Stock |

| Stock-Based Compensation |

| Exercise of Stock Options |

| Additional Paid-in Capital |

| The Cumulative Effect of Changes in Accounting Principles related to Revenue Recognition, Income Taxes and Financial Instruments |

It is generally presented under two subheads – Equity and Other Equity.

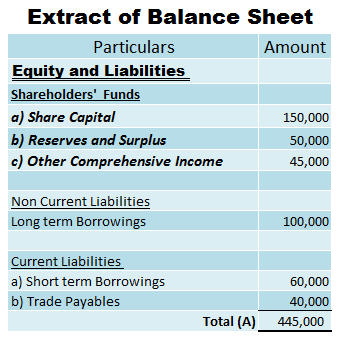

The extract shown below indicates the position of Equity in a Balance Sheet;