-This question was submitted by a user and answered by a volunteer of our choice.

Types of Financial Statements

- Statement of financial position

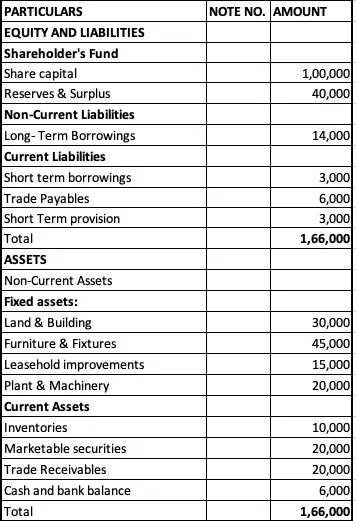

A statement of financial position is also known as a balance sheet. It comprises a company’s assets, liabilities, and equity. With the help of a balance sheet, the financial position of a company is displayed on a particular date which is usually at the end of a fiscal period.

Presentation of a balance sheet.

Balance sheet as of 31st March, YYYY

- Income statement

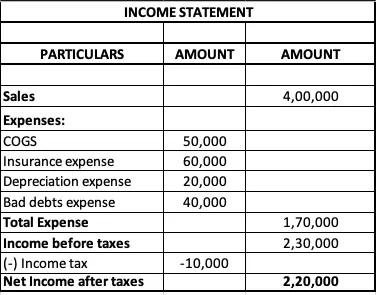

Unlike a balance sheet, the income statement of a company shows the revenues, expenses, net income, and earnings per share. It is also referred to as the profit and loss a/c. It is the most important financial statement because it depicts the overall performance of a company.

The sales of a company are put forward followed by the deduction of all expenses to ascertain the net profit or loss. In case the public companies issue the financial statements the earnings per share figure might also be added.

Presentation of an Income statement

- Cash flow statement

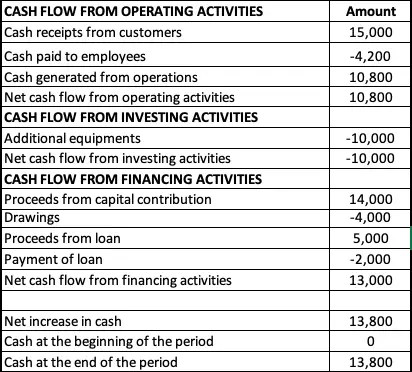

As the name suggests, a cash flow statement shows the monetary position of a company with the help of cash inflows and outflows during a particular financial period.

It is broadly divided into three categories, operating activities, investing activities, and financing activities. It measures how a company pays off its liabilities, and funds its expenses and investments.

Presentation of a cash statement

- Statement of changes in equity

This financial statement shows the changes in owners’ equity over a financial period. The changes are observed through the net profit or loss in the income statement, the issuance or repayment of the share capital, payment of dividends, the gains or losses recognized in equity, etc. It Is also referred to as the statement of retained earnings.

>Read Where is Amortization Shown in Financial Statements?