-This question was submitted by a user and answered by a volunteer of our choice.

Zero Working Capital

Before diving into the concept of Zero Working Capital, let me help you understand the meaning of Working Capital.

Working Capital is the term used to demonstrate whether the company possesses adequate current assets to discharge off its current liabilities. It is calculated as follows:

Working Capital = Total Current Assets – Total Current Liabilities

Now, taking this forward let us interpret the theory of Zero Working Capital.

The Working Capital of a company can be positive or negative, i.e. the total current assets may exceed the total current liabilities or vice-versa. However, there can be a situation when the total current assets are equivalent to the total current liabilities of the company. Such a situation is referred to as Zero Working Capital. Zero Working Capital is when,

Total Current Assets = Total Current Liabilities, or

Total Current Assets – Total Current Liabilities = Zero

Example

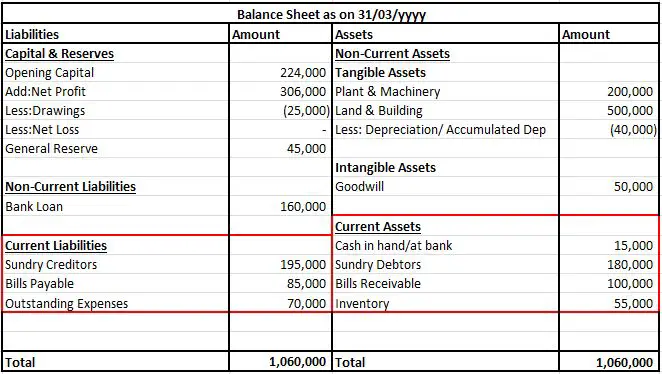

Using the data given in the balance sheet above, let us calculate the zero working capital.

1. Total Current Assets = Cash in hand/bank + Sundry Debtors + Bills Receivable + Inventory

= 15,000 + 1,80,000 + 1,00,000 + 55,000

= 3,50,000

2. Total Current Liabilities = Sundry Creditors + Bills Payable + Outstanding Expenses

= 1,95,000 + 85,000 + 70,000

= 3,50,000

As there is no excess of Total Current Assets over the Total Current Liabilities, this situation is referred to as Zero Working Capital.

Benefits and Approach of Zero Working Capital

Zero Working Capital is one of the latest techniques in working capital management. Let us now understand the benefits and approach of zero working capital in a real-life scenario.

1. Reduction in the level of investments in working capital

Zero Working Capital is a strategy to reduce the level of investment in the working capital and thereby increase the investments in the long term assets. Following this strategy, companies avoid excess investments in current assets and prefer paying off their current liabilities using the existing current assets only.

2. Savings in Opportunity Cost of Funds

Working Capital earns a very low rate of return as compared to long term investments. Also, maintaining zero working capital will help save the opportunity cost of funds as the company can now use the excess funds to exploit various other opportunities. So, owing to its benefits, the management would certainly prefer zero working capital.

3. Just-in-Time Methodology

Zero Working Capital approach will be possible only if the Just-in-Time methodology is adopted by the company. Following the demand-based production and distribution system is advised. Very low or zero inventory is emphasized. Everything should be produced and supplied as and when the demand for the same arises.

To keep in pace with the Just-in-Time practice, the receivable and payable terms should also be modified. Payable time granted by the supplier should be extended and the credit terms granted to the debtors should be cut back. This will ensure that you have the cash required to fund the supplier’s payment.

Conclusion

Zero Working Capital eventually helps in better management of the current assets and current liabilities but is still considered to be a difficult scenario to be implemented in practical business life.

>Related Long Quiz for Practice Quiz 33 – Working Capital