-This question was submitted by a user and answered by a volunteer of our choice.

What is a Suspense Account?

A Suspense account is maintained by a business to record transactions that are doubtful and unidentifiable for the time being. It is a temporary account that records certain transactions that have occurred, but there is uncertainty as to which ledger such entries may be posted.

Accounting Process of Suspense Account

If the suspense account is shown in the trial balance then it will be directly shown in the statement of financial position (say- Balance Sheet).

If the suspense account appears on the debit side of the trial balance, it will be shown on the Asset side of the balance sheet. If the suspense account appears on the credit side of the trial balance, it will be shown on the Liabilities side of the balance sheet.

A suspense account appears in the trial balance if either side of the trial balance doesn’t agree (or) if any error occurs during the trial balance preparation. A suspense account is a temporary account and it gets closed once the particular error is found and rectified.

A Suspense account never appears in the Income Statement because income statements are prepared to ascertain gross profit (or) net profit. If the income side exceeds the expenses side then it is gross profit or vice-versa.

A practical example and a snippet of the balance sheet are added below for a better explanation and a clear understanding.

Example

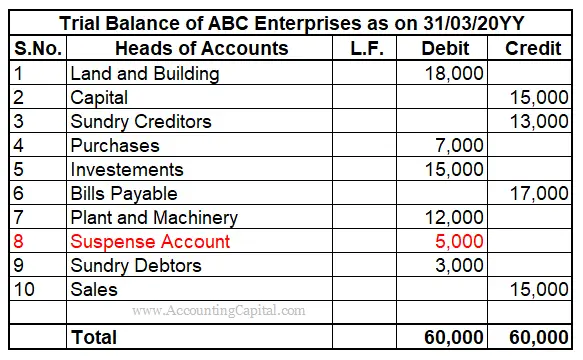

ABC Enterprises furnishes you with the following information. They have maintained a Suspense Account and the balance is given here. Prepare the financial statements with the Trial Balance of ABC given below:

Trial Balance of ABC Enterprises

From the above Trial Balance of ABC Enterprises, we may observe a Suspense Account with a Debit Balance of 20,000. This is shown on the Assets Side of the Balance Sheet under the head Current Assets.

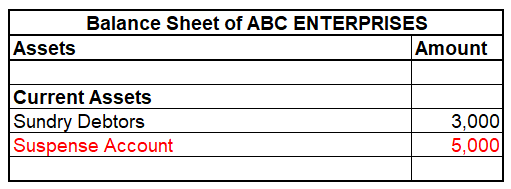

The Balance Sheet of ABC showing the presentation of the Suspense Account is given below:

Extract of Balance Sheet of ABC Enterprises

Conclusion

The above discussion may be summarised as follows:

- A suspense account makes the trial balance agree and facilitates the further preparation of financial statements.

- A suspense account can be placed on either side of the balance sheet depending on the placement of the Trial Balance.

- A Suspense account never appears in the Income Statement because income statements are prepared to ascertain gross profit (or) net profit.

- A suspense account is a temporary account and it gets closed once the particular error is found and rectified.