What is Suspense account?

A suspense account is a general ledger account prepared in the following situations;

1. Transactions are unidentified or unclassified at the time of occurrence, or

2. Differences arises between the total debit side & the credit side of the trial balance.

When the right account is determined or the error is rectified, the amount shall be moved from the suspense account to its proper account.

Features Suspense account?

Here are some key features of a suspense account:

- Temporary Holding: A suspense account serves as a temporary holding place for transactions that cannot be immediately classified into the appropriate permanent accounts.

- Resolution: The purpose of a suspense account is to provide a means to temporarily record transactions until their proper classification or resolution can be determined.

- Corrective Action: Transactions in a suspense account often require further investigation or correction to resolve discrepancies or uncertainties in the accounting records.

- Balance Sheet Impact: Transactions recorded in a suspense account may impact the balance sheet temporarily until they are properly classified or adjusted.

- Income Statement Impact: Depending on the nature of the transactions, entries in a suspense account may also affect the income statement temporarily until they are resolved.

- Clearing Account: Once the discrepancies or uncertainties are resolved, the entries in the suspense account are typically cleared by transferring them to their appropriate permanent accounts.

- Audit Trail: A suspense account provides an audit trail, allowing auditors and accountants to track transactions that required further investigation or correction.

- Disclosure: In financial statements, any transactions recorded in a suspense account are typically disclosed in the notes to the financial statements to provide transparency to stakeholders.

- Common Use: Suspense accounts are commonly used in situations where there are timing differences, errors, or missing information in accounting records.

- Control Mechanism: Maintaining a suspense account helps in maintaining control over the accounting process by ensuring that all transactions are eventually properly classified and recorded.

Presentation of Suspense account in Financial Statements

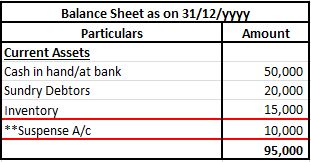

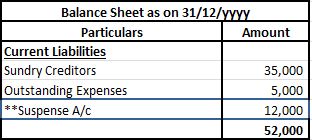

In case Suspense A/c is not closed at the end of the accounting period, the balance in the Suspense A/c is presented in the Balance Sheet.

| Particulars | Financial Statement | Presentation |

| Debit balance in Suspense A/c (ie. Total of Debit side > Total of Credit side) | Balance Sheet | Presented under the head “Current Assets” |

| Credit balance in Suspense A/c (ie. Total of Credit side > Total of Debit side) | Balance Sheet | Presented under the head “Current Liabilities” |

Extracts of the balance sheet have been attached for better understanding.

Example of Suspense A/c

A customer of ABC Ltd makes an online payment of 50,000 but he did not specify against which open invoice (out of the 20 open invoices) the amount needs to be settled. In this case, the accountant will pass the initial entry in the suspense account till he identifies the correct open invoice.

Journal entry to park the unidentified amount in the suspense account

| Bank A/c | Debit | 50,000 |

| To Suspense A/c | Credit | 50,000 |

The accountant identifies the open invoice against which the amount of 50,000 is to be settled.

Journal entry to close the suspense account and post the amount received against the appropriate invoice and proper account-

| Suspense A/c | Debit | 50,000 |

| To Accounts Receivable (Invoice No. xx) A/c | Credit | 50,000 |