Meaning and Explanation

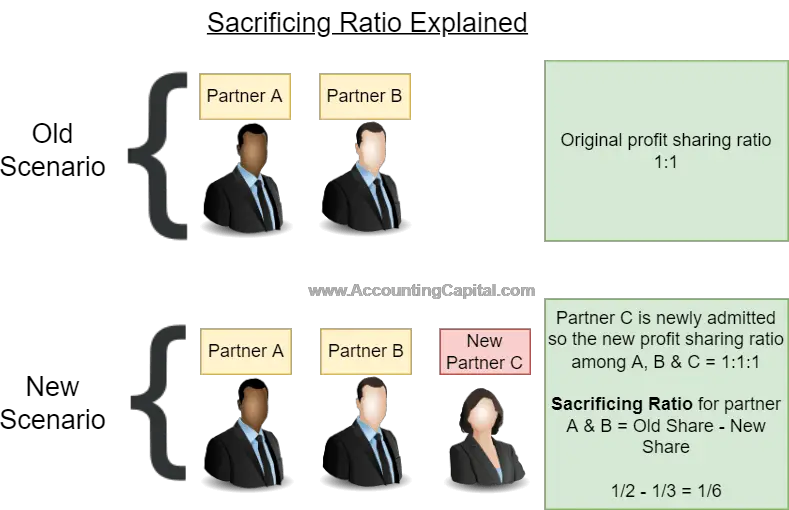

Sacrificing ratio is the proportion in which old partners of a firm forego their share of profits in favour of new partner(s). The sacrificed portion is given to the new partner by the existing partner(s). On the other hand, the partner who gains the share calculates a gaining ratio at his/her end.

Such a ratio is calculated in two situations;

- When partners change their profit/loss sharing ratio.

- When a new partner is admitted.

Sacrificing ratio helps a partnership firm calculate the profit or loss that current partners have given up as a result of newly admitted partners. This ratio results in a decrease in the profit-sharing ratio of existing partners.

When existing partner(s) sacrifice their share of profit for a newly admitted partner, they are compensated in the form of goodwill by the new partner to the extent of their sacrifice.

Related Topic – Can goodwill be Negative?

Formula

This ratio is important because the new partner will compensate the old partners accordingly for offering their share of profit. The sacrifice is set off against the gain in this way.

How to Calculate Sacrificing Ratio

Knowledge of the following two ratios is necessary to calculate the sacrificing ratio for each of the partners who are sacrificing a share in the partnership firm’s profits.

- Old Profit-Sharing Ratio – It is the ratio in which the existing partners have been sharing the profits & losses until the change in their profit sharing ratio/change in the terms of the partnership agreement.

- New Profit-Sharing Ratio – It is the ratio in which all the partners including the newly admitted partners will share the future profits & losses of the partnership firm.

Sacrificing ratio can be calculated in the following manner;

Case I: When the old and new ratios of partners are mentioned

Calculate the sacrificing ratio using the formula;

Sacrificing Ratio = Old profit sharing ratio – New profit sharing ratio

Case II: When the Profit Sharing Ratio of the incoming partner is mentioned and the new ratio of old partners is missing.

- Calculate the total share of profits left for all the old partners by deducting the share of the new partner from the total i.e., 1

- Calculate the new share of old partners by multiplying their old profit sharing ratio with the total share calculated in the previous step (1).

- Calculate the sacrificing ratio using the formula-Sacrificing Ratio = Old profit sharing ratio – New profit sharing ratio.

Related Topic – Interest on Capital Adjustment in Final Accounts

Example

Alpha and Beta are partners in a partnership firm sharing profits in the ratio 2:1. Gamma is the new partner admitted for a 25% share (1/4th) of the profits.

| Alpha | Beta | Gamma | |

| Old Profit Sharing Ratio | 2/3 | 1/3 | – |

| Share of Admitted partner | – | – | 1/4 |

Let the total profit of the firm be = 1

Gamma’s share of profit = 1/4

Share of profit left for Alpha and Beta = 1 – 1/4 = 3/4

Post induction of the partner,

| Alpha | Beta | Gamma | |

| New Share Calculation*

(Old Ratio x Share of Profit Left for Partners) |

2/3 * 3/4 = 2/4 | 1/3 * 3/4 = 1/4 | 1/4 |

| New Profit Sharing Ratio | 1/2 | 1/4 | 1/4 |

| Sacrificing Ratio | = Old Profit Sharing Ratio – New Profit Sharing Ratio | ||

| = | 2/3 – 1/2 = 1/6 | 1-3 – 1/4 = 1/12 | No Sacrifice |

Note: In a partnership firm, the old profit-sharing ratio and the sacrificing ratio will be the same if mentioned in the partnership deed, and mutually agreed upon by all partners.

Related Topic – Difference Between Revaluation Account and Realisation Account

Gaining Ratio Vs Sacrificing Ratio

The Gaining Ratio refers to the share of profit gained by a partner, from the other partners of a partnership firm.

| Basis | Sacrificing Ratio | Gaining Ratio |

| Meaning | It is the proportion in which old partners of a partnership firm forego their share of profits in favour of new partner/s | It refers to the share of profit gained by a partner, from the other partners of a partnership firm |

| Purpose | It helps in calculating the share of profit sacrificed by existing partners. | It helps in calculating the share of profit gained by existing partners. |

| Event | It is calculated while admission of a new partner or during the change in profit sharing ratio among existing partners. | It is calculated while the retirement or death of an existing partner or during the change in profit sharing ratio among existing partners. |

| Formula | Sacrificing Ratio = Old profit sharing ratio – New profit sharing ratio | Gaining Ratio = New profit sharing ratio – Old profit sharing ratio |

| Outcome | Compensation is received by the sacrificing partners for foregoing their share in profit. | Compensation is paid by the gaining partners to the ones who are sacrificing. |

Short Quiz for Self-Evaluation

>Read Difference Between Debt and Liability