Debt to Asset Ratio

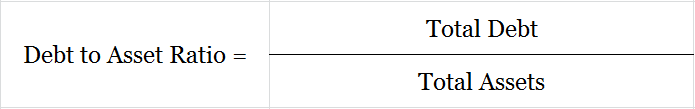

It is also called debt to total resources ratio or only debt ratio. The debt to asset ratio measures the percentage of total assets financed by creditors. It is computed by dividing the total debt of a company with its total assets. This ratio provides a quick look at the part of a company’s assets which is being financed with debt.

It shows the amount of debt obligation a company has for each unit of an asset that it owns, this enables the viewer to determine the financial risk of a business. This ratio measures the extent to which borrowed funds support the firm’s assets.

Formula to Calculate Debt to Asset Ratio

Total Debt: Includes both long-term debt & long-term provisions.

Total Assets: Includes both current assets and noncurrent assets.

Example of Debt to Asset Ratio

From the balance sheet of Unreal corporation calculate its debt to asset ratio

| Liabilities | Amt | Assets | Amt |

| Share Capital | 2,00,000 | Tangible Assets | 1,00,000 |

| Long-Term Borrowings | 60,000 | Non-current Investments | 1,10,000 |

| Trade Payable | 40,000 | Current Assets | 90,000 |

| Total | 3,00,000 | Total | 3,00,000 |

Total Debt – Long-Term Borrowings

Total Asset – Tangible Assets + Non-Current Investments + Current Assets

Total Debt/Total Assets = 60,000/3,00,000 = 0.20

A debt to asset ratio of 0.20 shows that the company has financed 20% of its total assets with outside funds, this ratio shows the extent of leverage being used by a company.

High & Low Debt to Asset Ratio

A lower percentage shows that the company is less dependent on borrowed money from outside parties, or in other words, has less debt as compared to its total assets, this situation is desirable from the point of view of external parties such as creditors & lenders as there is sufficient safety available to them.

A higher percentage, on the other hand, shows that the company depends a lot on its debt (borrowed funds + money owed to others) which ultimately puts external parties such as creditors & lenders to high risk. Debt to asset ratio for a business should be balanced & controlled in a way where it’s not too low but it should also not be too high.

Short Quiz for Self-Evaluation

> Read What is Debt to Equity Ratio?