Proprietary Ratio

This ratio shows the proportion of total assets of a company which are financed by proprietors’ funds. The proprietary ratio is also known as the equity ratio. It helps to determine the financial strength of a company & is useful for creditors to assess the ratio of shareholders’ funds employed out of the total assets of the company.

The word “Proprietors” is a synonym for “owners of a business”, proprietors’ funds, in this case, would only be the funds which belong to the owners/shareholders of the business. Proprietors’ funds are also known as Owners’ funds, Shareholders’ funds, Net Worth, etc.

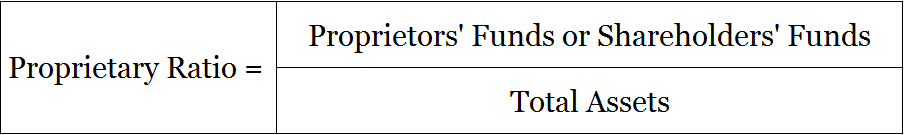

Formula to Calculate Proprietary Ratio

Proprietors’ funds or Shareholders’ funds = Share Capital + Reserves and Surplus

Total Assets = Includes total assets as per the balance sheet

Related Topic – Debt to Equity Ratio

Example of Proprietary Ratio

From the balance sheet of Unreal Corporation calculate its proprietary ratio

| Liabilities | Amt | Assets | Amt |

| Share Capital | 10,00,000 | Tangible Assets | 10,00,000 |

| Reserves & Surplus | 2,00,000 | Long-Term Investments | 5,00,000 |

| Short-Term Borrowings | 40,000 | Stock | 70,000 |

| Trade Payable | 4,00,000 | Trade Receivable | 70,000 |

| Total | 16,40,000 | Total | 16,40,000 |

Shareholders’ Funds/Total Assets

S/H Funds = 10,00,000 + 2,00,000

Total Assets = 16,40,000

12,00,000/16,40,000

Proprietary ratio = 0.73

A proprietary ratio of 0.73 shows that the company has 0.73 units of shareholders’ funds for each unit of total assets or in other words, 73% of the total assets of the company are financed by proprietors’ funds.

High & Low Proprietary Ratio

High – This ratio indicates the relative proportions of capital contribution by shareholders in comparison to the total assets of a company. It is used as a screening device for financial analysis, a higher ratio, say more than 75% means sufficient comfort for creditors since it points towards lesser dependence on external sources.

Low – Whereas, a lower ratio, say less than 60% means discomfort for creditors since it shows more dependence on external sources, a lower ratio can be seen as a threat and may increase the unwillingness of creditors to extend credit to the company. A company should mix and balance its external and internal sources in a way that none of them is too high in comparison to the other.

Short Quiz for Self-Evaluation

>Read Stock Turnover Ratio