Super Quick Ratio or Cash Ratio

This ratio goes one step ahead of current ratio, liquid ratio & is calculated by dividing super quick assets by the current liabilities of a business. It is called super quick or cash ratio because unlike other liquidity ratios it only takes into account “super quick assets”. This is the most stringent test of a business’ current liquidity situation.

Super quick assets strictly include cash & marketable securities (since they can almost instantly be converted to cash)

Current liabilities would include overdraft, creditors, short-term loans, outstanding expenses, etc.

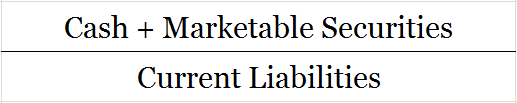

Formula to Calculate Super Quick or Cash ratio

Example of Super Quick or Cash Ratio

Unreal corp. has submitted the below information regarding their current assets and current liabilities, calculate their super quick ratio.

| Current Assets | Amt | Current Liabilities | Amt |

| Cash & Equivalents | 20,000 | Outstanding Expenses | 15,000 |

| Marketable Securities | 150,000 | Provision for Expenses | 10,000 |

| Inventories | 40,000 | Creditors | 20,000 |

| Debtors | 25,000 | Bills Payable | 15,000 |

| B/R | 5,000 | ||

| Total | 2,40,000 | Total | 60,000 |

Calculation:

Super Quick Assets/Current Liabilities

(Cash + Marketable Securities)/Current Liabilities

= (20,000 + 150,000)/60,000

= 1,70,000/60,000

= 2.833

Higher the super quick ratio better the liquidity condition of a business. In the above case for every 1 unit of current liability, the company has 2.833 units of super quick assets, which is good.

Short Quiz for Self-Evaluation

>Read What is Operating Cash Flow Ratio?