Working Capital Turnover Ratio

Working Capital Turnover Ratio is used to determine the relationship between net sales and working capital of a business. It shows the number of net sales generated for every single unit of working capital employed in the business.

Companies may perform different types of analysis such as trend analysis, cross-sectional analysis, etc. to find out effective utilization of its resources, in this case, working capital.

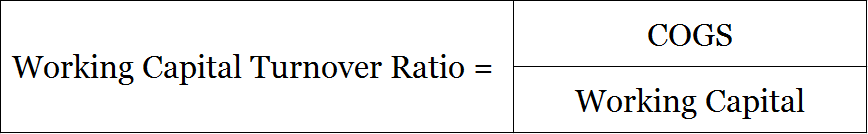

In a practical scenario, net sales may not be provided, which can then be calculated on the basis of the cost of revenue from operations or cost of goods sold. Working capital is calculated by subtracting current liabilities from current assets.

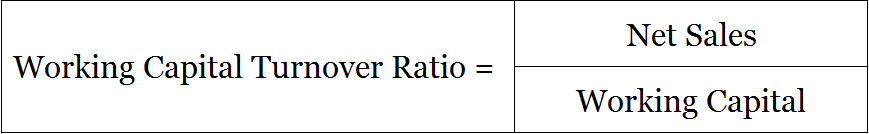

Formula to Calculate Working Capital Turnover Ratio

Net Sales = Sales – Returns

Working Capital = Current Assets – Current Liabilities

(or)

COGS = Net Sales – Gross Profit (or) Opening Stock + Purchases – Closing Stock

Example

Question. Calculate working capital turnover ratio from the following data.

| Current Assets | 1,00,000 |

| Current Liabilities | 50,000 |

| Sales | 2,00,000 |

| Sales Returns | 50,000 |

Answer. Net Sales = Sales – Sales Returns

Net Sales = 2,00,000 – 50,000

Net Sales = 1,50,000

Working Capital = Current Assets – Current Liabilities

WC = 1,00,000 – 50,000

WC = 50,000

Working Capital Turnover Ratio = Net Sales/Working Capital

= 1,50,000/50,000 = 3/1 or 3:1 or 3 Times

This shows that for every 1 unit of working capital employed, the business generated 3 units of net sales.

High and Low Working Capital Turnover

High – A high ratio is desired, it shows a high number of net sales for every unit of working capital employed in the business. However, a very high ratio is not desirable as it may signal that the company is operating on low working capital w.r.t revenue from operations.

In case of a very high ratio, it is also certain that the company may not be able to meet the sudden increase in demand due to limited working capital.

Low – Lower working capital turnover ratio means that the business is not generating sufficient sales relative to the working capital employed.

A lower than the desired ratio shows that the working capital is not optimally used to generate sales & optimization may be required.

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 33 – Working Capital

>Read Operating Profit Ratio