Credit Note

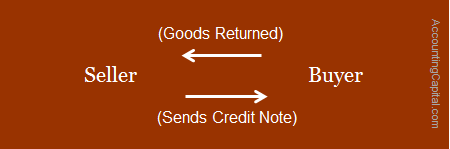

When a customer returns goods purchased on credit he/she also expects some form of confirmation from the seller along with the cancellation of related dues. A credit note is a document sent by a seller to the buyer as a notification to acknowledge that the goods have been registered as “returned” (return inwards) and a credit has been provided to them for the eligible amount.

In other words, it is a commercial document issued by a seller to the buyer. It acts as evidence of sales returns and a reduction of the amount owed by the buyer for an invoice raised earlier. A credit note is also called a “credit memo”.

It reduces the amount due to be paid by the customer, if the amount due is nil then it allows further purchases in lieu of the credit note itself.

A credit note is issued for the value of goods returned by the customer, it may be less than or equal to the total amount of the order.

Example of Credit Note

Company B purchases goods worth 1,00,000 from Amazon in a (business to business) transaction, however, 10,000 worth of goods were found damaged due to some reason & this was notified to Amazon at the time of actual delivery.

Amazon (seller) issues a credit note for 10,000 in the name of Company-B (buyer). This reduces the accounts receivable for Amazon by 10,000 and the buyer is only required to pay 90,000.

Important Characteristics

1. It is sent to inform about the credit made in the account of the buyer along with the reasons.

2. The sales return book is updated on its basis. (In case of return of goods)

3. Usual reasons range from goods found incomplete, damaged, inaccurate goods sent, etc.

4. It shows a negative amount.

Related Topic – What is the difference between credit and debit note?

Journal Entry for Credit Note

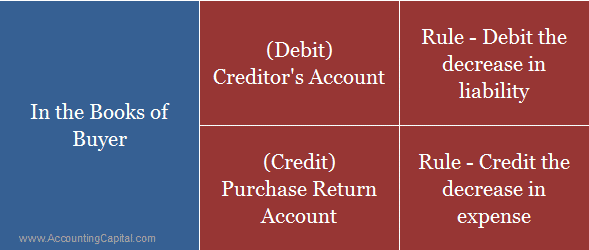

In the books of the buyer

Goods returned are purchase returns for the buyer, this action leads to the following;

- A decrease in liability to pay the respective creditor.

- A decrease in expense previously incurred to purchase goods.

| Creditor’s A/C | Debit |

| To Purchase Return A/C | Credit |

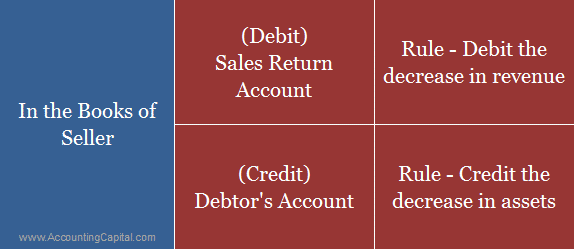

In the books of seller

Goods received as returned are sales return for the seller, this action leads to the following;

- A decrease in revenue previously booked as sales.

- A decrease in assets as money will not be received from the debtor anymore.

| Sales Return A/C | Debit |

| To Debtor’s A/C | Credit |

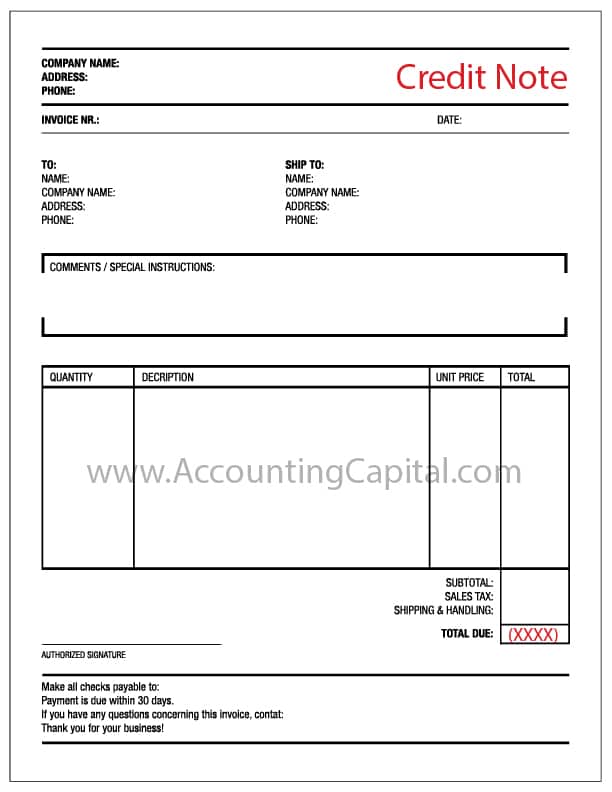

Sample Credit Note Template

Revision and Highlights

Highly Recommended!!

Do not miss our 1-minute revision video and the quiz below. This will help you quickly revise and memorize the topic forever. Try them :)

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 19 – Credit Note

>Read Debit Note