Income Received in Advance

Sometimes earned revenue that belongs to a future accounting period is received in the current accounting period, such income is considered as income received in advance. It is also known as Unearned Revenue, Unearned Income, Income Received but not Earned because it is received before the related benefits are provided.

This revenue is not related to the current accounting period, for example, Rent received in advance, Commission received in advance, etc.

It is a personal account and is shown on the liability side of a balance sheet.

Journal Entry for Income Received in Advance

| Income A/C | Debit |

| To Income Received in Advance A/C | Credit |

Example

In March 10,000 were received in advance for rent which belonged to the month of April. The journal entry to record this in the current accounting period (31st March) will be as follows:

| Rent Received A/C | 10,000 |

| To Rent Received in Advance A/C | 10,000 |

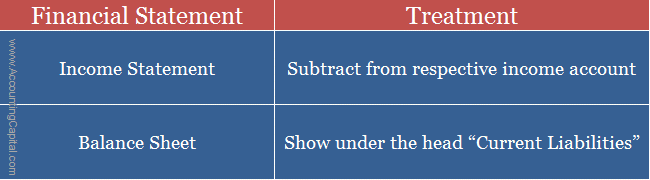

Treatment in the Financial Statements

Following is how income received in advance is treated in the final accounts and how it is shown in both the Profit and Loss Account and the balance sheet.

- Reduction from the concerned income on the credit side of the income statement.

- Show as a liability in the balance sheet under the head “Current Liabilities“.

Revision and Highlights

Highly Recommended!!

Do not miss our 1-minute revision video and the quiz below. This will help you quickly revise and memorize the topic forever. Try them :)

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 31 Income received in Advance

>Read Accrued Income