Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana (SSY) is a scheme exclusively for girl children, started by the Prime Minister of India Mr. Narendra Modi on 22nd January 2015 in Panipat, Haryana. The scheme mainly assists parents of a girl child to create a reserve for their education & marriage-related expenses.

Sukanya Samriddhi Yojana (SSY) is a scheme exclusively for girl children, started by the Prime Minister of India Mr. Narendra Modi on 22nd January 2015 in Panipat, Haryana. The scheme mainly assists parents of a girl child to create a reserve for their education & marriage-related expenses.

SSY scheme proposes a deposit plan for a girl child which offers a high-interest rate on deposits. Till October 2015 under Sukanya Samriddhi Yojana there were more than 7 Million active accounts with a total fund of about US $420 Million.

Benefits of Sukanya Samriddhi Yojana

- SSY account matures after 21 years from its inception date & the amount is disbursed to the account holder. An exception to this can be availed if the girl child is above 18 years old and intends to marry.

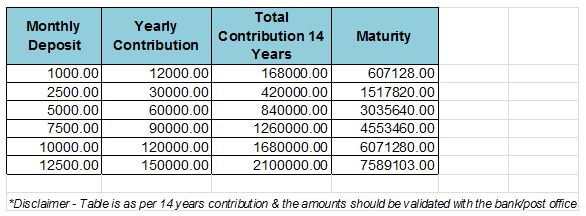

- From the year 2016-17, the rate of interest provided in this scheme is 8.6% (P.A) compounded annually. Click Here for latest Interest Rates of SSY.

- Now 100% withdrawal is allowed from the scheme when the account holder has attained the age of 18 years.

- Investment in Sukanya Samriddhi Yojana scheme is exempted from Income Tax under section 80(c). Principal, interest and outflow all three are exempted from tax.

- An SSY account can be transferred to another bank/post office on request.

Eligibility & Other Criteria

- The account can be opened by a guardian in the name of a girl child from her birth until she becomes 10 years old.

- Only one account is allowed per girl child.

- The maximum number of accounts allowed are 2 by a legal guardian for two different girl child, only exceptions provided are in case if the first or the second birth are twins or triplets.

- A minimum of *Rs 250 needs to be deposited in the Sukanya Samriddhi Account in a financial year else it is discontinued and can only be revived with a penalty of Rs 50 per year with the minimum amount required for a deposit for that year.

- Investment in an SSY account can be increased in multiples of thousands with a cap of Rs 1,50,000 in a financial year, a regular investment is to be made for 15 years (earlier it was 14 yrs).

- Sukanya Samriddhi Yojna account can be opened for an adopted girl child as well.

- Loan facility is not provided against this scheme.

How to Open an SSY Account & Documents Required

- Sukanya Samriddhi Yojana account can be opened at any Indian Post office or at a branch of an authorized bank for e.g. SBI, ICICI Bank etc.

- SSY Account Opening Form

- Identity proof

- Residence proof

- Birth Certificate of the girl child

*Amount reduced from Rs 1000 to Rs 250.

it is a very good scheme and by table you give good idea about maturity amount.

All your articles are Informative

Comments are closed.