FDI (Foreign Direct Investment)

FDI stands for Foreign Direct Investment. When a company from a particular country invests in another company based in a different country in a way that it acquires some (generally 10% as per OECD) controlling stake is known as Foreign Direct Investment.

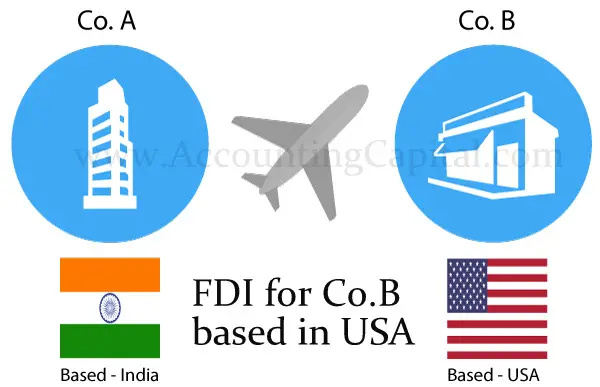

Like in the example info graphic shown below, Company A from India invests in Company B based in USA such an investment is termed as FDI (Foreign Direct Investment). The investment can happen in form of buying tangible assets, controlling stakes in ownership etc. FDI is not only a transfer of ownership as believed but it is also transfer of elements complementary to capital including technology, management and skills. FDI helps developing nations by filling in investment gaps which the domestic investors & the government can not fulfill on its own.

FDI (Foreign Direct Investment) is different from FPI (Foreign Portfolio Investment) which means holding of shares and other financial assets by foreign investors without any controlling, management or ownership rights over the company, FPI is a indirect investment whereas FDI is direct.

There are 2 primary ways to invest in FDI:

- Cross border M&A (Mergers & Acquisitions) which means buying controlling stake in a foreign company (Brownfield Investment)

- Extending company’s operations to foreign and begin building new factories & offices from scratch (Greenfield investment)

Importance & Types of Foreign Direct Investment

1. Increased FDI implies rise in economic development because of increased capital and increased tax returns for the host country.

2. New projects are channelized to hike development by FDI investment in host countries.

3. Tough competition leads to highest efficiency and productivity levels in host country.

4. FDI results in specialization of skills and creation of new jobs.

5. FDI also generates employment opportunities created by different entities, for local countries.

Top reasons to invest in foreign companies are:

- Tap new markets

- Skilled labor

- Cut down costs

- Other strategic profit making decisions

Type 1 – Horizontal FDI

If a company lets say a e-commerce company expands its business in another country however still does the same thing both at home and abroad it is knows as Horizontal FDI. So in this case the e-commerce company enters a new geographical territory but the operations remain exactly the same.

Type 2 -Vertical FDI

When a company lets say an e-commerce company either moves upwards or downwards related to its operational cycle adding value to its business cycle it is called vertical FDI. A good example of this will be the same e-commerce company (who already has established business in a foreign country) acquiring a controlling stake in a logistics company.