-This question was submitted by a user and answered by a volunteer of our choice.

Let’s first interpret the meaning and importance of the month-end close checklist.

Month-end closing is an accounting procedure that accountants usually undertake at the end of the month to close the accounting records for a particular month. So, a month-end closing checklist guides the entire month-end closing procedure.

It is crucial as it helps us remember things we might otherwise skip while finalizing the monthly books of accounts. Also, you can fix any discrepancies at the earliest, rather than it getting piled up at the year-end.

Month-end Close Checklist

| Month & Year ____________ | Initials | Date | |

| Cash and Bank | |||

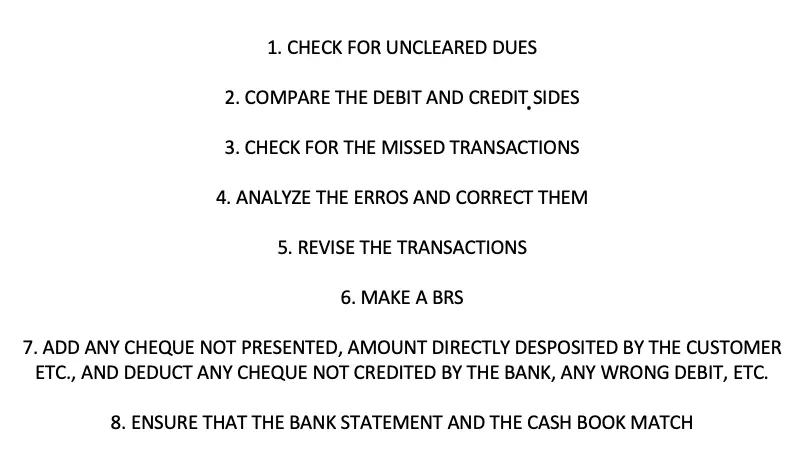

| 1 | Reconcile bank accounts and verify that bank balance on bank reconciliation agrees with respective bank statement balance | ||

| 2 | Review and approve bank reconciliations and ensure all reconciling items have been researched and properly resolved | ||

| 3 | Prepare and review the list of cheques outstanding after their expiry period eg. more than 90 days, 60 days, etc (stale cheques) | ||

| Accounts Receivable | |||

| 1 | Generate and review A/R Aging report and determine whether any A/R balances need to be written-off | ||

| 2 | Request for ledger confirmations from debtors, in case of any discrepancies | ||

| 3 | Review A/R ageing for any unapplied credits (credits in the bank account for which the payer could not be traced before) | ||

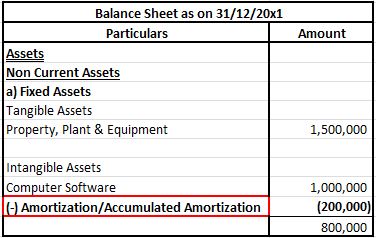

| Fixed Assets | |||

| 1 | Review new fixed assets purchased and verify whether they have been recorded properly in the books | ||

| 2 | Verify proper asset classification | ||

| 3 | Review additions/disposals of fixed assets and verify whether the same have been added/removed from fixed asset records | ||

| 4 | Record depreciation expenses for the current month | ||

| Inventory | |||

| 1 | Perform monthly inventory count, if possible | ||

| 2 | Determine if any obsolete inventory exists that needs to be written off | ||

| 3 | Reconcile the manual inventory records with the accounting inventory records | ||

| Intercompany Accounts | |||

| 1 | Verify that intercompany payables and receivables have the same balance in each entity’s books | ||

| Loans taken | |||

| 1 | Verify whether the outstanding loan balance as per the books tallies with the loan schedule provided by banks or financial institutions | ||

| Accounts Payable | |||

| 1 | Generate and review A/P Aging report and determine outstandings to be settled immediately | ||

| 2 | Request for ledger confirmations from creditors, in case of any discrepancies | ||

| Investments | |||

| 1 | Obtain investment statements | ||

| 2 | In the case of short term investments, verify whether realized and unrealized gain/loss have been recorded properly | ||

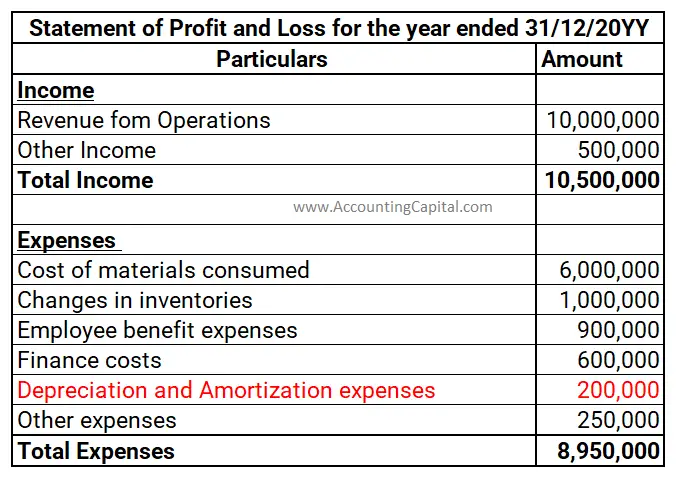

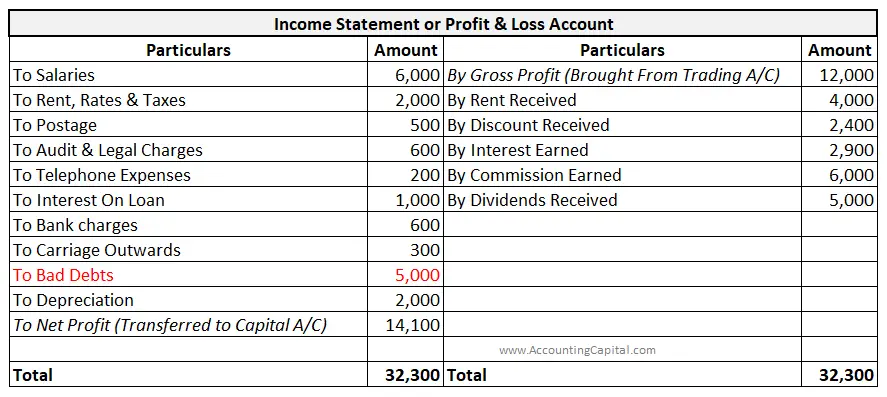

| Revenue and Expense accounts | |||

| 1 | Check whether expenses & revenues have been recorded in the correct accounts or whether re-classification to another account is required | ||

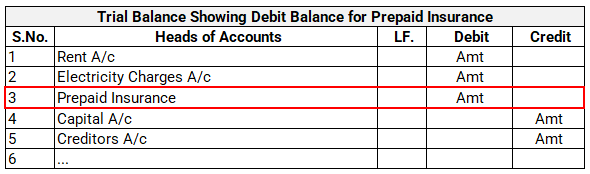

| 2 | Identify outstanding & prepaid expenses and verify whether they have been properly adjusted from the respective expense account | ||

| 3 | Review whether outstanding & pre-received incomes have been properly adjusted from the respective income account | ||

| 4 | Check for expenditures that should be capitalized |

Excel Download

A downloadable excel sheet has also been attached for your reference.

Hope after reading this you might have got an insight into the checklist for month-end closing.