This topic was approached differently and simplified so that even a 5-year-old can understand what a “Debit and Credit in Accounting” means. There’s more focus on terms than accounting.

Let us start with a frequently asked question – “Is Debit a Plus and Credit a Minus?”

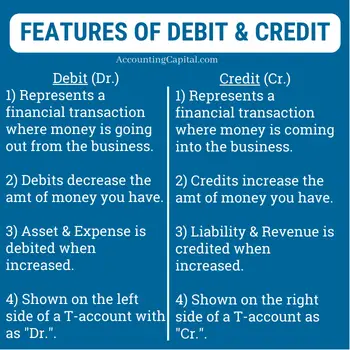

No, debit is not a plus in accounting. Debits and credits are not used to indicate positive or negative values. Instead, they record a financial transaction’s two equal and opposite effects. They are not used to indicate positive or negative values.

According to the nature of an account, debit and credit can both represent an increase or decrease. It depends on the type of account (asset, expense, liability, or revenue) you’re dealing with.

Related Topic – What is a Debit Balance and Credit Balance?

What is a Debit?

Definition – A debit is a term used in accounting and finance to describe a financial transaction where money is taken away from the business. It is a way to record financial events & keep track of how much money an individual or a firm has.

Here is a simple explanation that might be easy for a 5-year-old to understand:

- Imagine that you have a special box where you keep your pocket money.

- Every time you spend money, you take some of that money out of the box. This is called a debit. (money is going out)

For example, if you buy a toy with your pocket money, you would take money out of your box (debiting your box).

If you go to the store and buy chocolate, you will take more money out of your box (additional debit).

So, debits are like taking money out of your box. They are transactions that decrease the amount of money you have.

For example, if you spend money (such as buying a toy), that would be recorded as a debit to your account. This doesn’t mean that the money is “positive” or “good” – it just means funds are taken out of your business/box. (outwards or exiting)

Note: Asset & Expense is debited when increased.

Related Topic – Quiz on Accounting Fundamentals for Beginners (#2)

What is a Credit?

Definition – When you get money, that is called credit. For example, if you get pocket money from your parents, that would be a credit. If you save track of your money in a bank account, a credit would mean that you have deposited money into the account.

Here is a simple explanation that might be easy for a 5-year-old to understand:

- Imagine that you have a special box where you keep your pocket money.

- Every time you deposit money, you add some money to the box. This is called credit.

For example, if your parents give you 100 as pocket money, you would put that money in your box (crediting your box).

So, credits are like adding money to your box. They are transactions that increase the total amount of money you have.

This doesn’t mean that the money is “negative” – it just means it is added to the account. (it is coming inwards or entering your business)

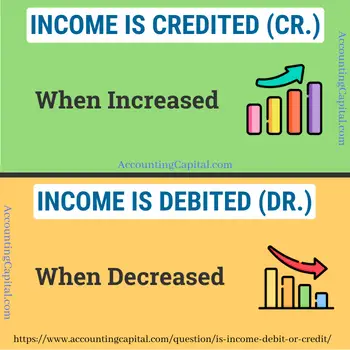

Note: Liability & Revenue is credited when increased.

Related Topic – Quiz on Accounting Terms for Beginners (#7)

Points to Remember

It is important to remember the following.

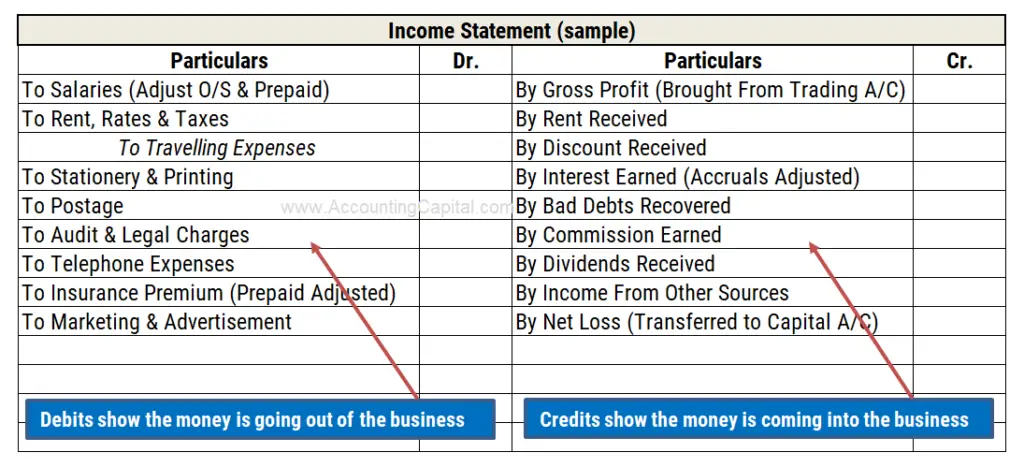

- Debit = Money is going out of your business, i.e. the business has spent money or used something.

An increase in assets & expenses is debited.

- Credit = Money is coming into your business, i.e. the business has received something or has made money.

An increase in liability & revenue is credited.

Think Like a Business

Imagine that you are running a business. A debit is an entry in your business’s financial records that shows that the business has spent or used up something. For example, if your business buys a new computer, the cost of the machine would be recorded as a debit in the business’s financial records.

A credit is an entry in your business’s books of accounts that shows that the business has received something or it has made money. For example, if a business sells a product for 50,000, then this would be recorded as a credit in the financial records of the business.

Related Topic – Quiz on Accounting Fundamentals for Beginners (#8)

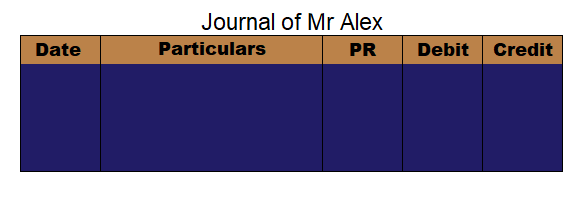

Inside a Journal Book & Ledger Account

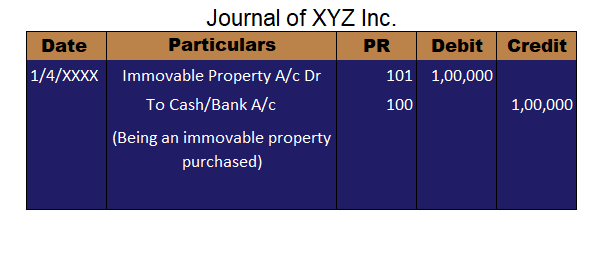

Journal Entry

It is a written record of a financial transaction that is used to record the details of the transaction in a company’s books of accounts.

| Account 1 | This is a Debit |

| To Account 2 | This is a Credit |

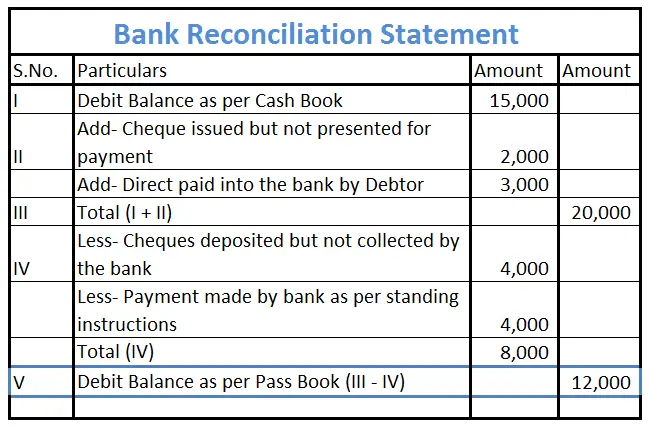

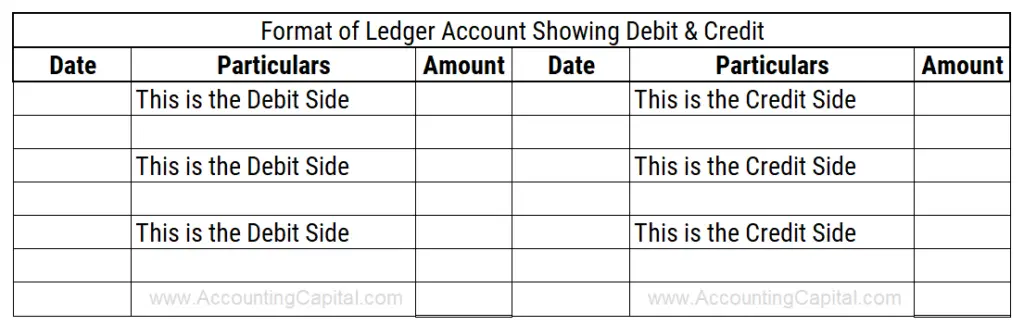

Debits and Credits have a special format known as the “T-account”. T-accounts have debits on the left side and credits on the right. In order to ensure that our records are valid, debits and credits must always balance each other.

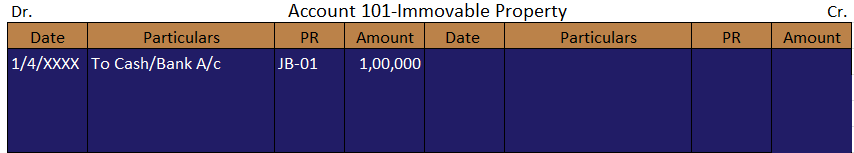

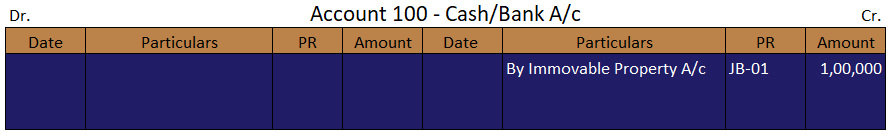

Ledger Account

A ledger account is a table that includes a record of financial events for a specific account in an organisation’s financial statements. It is used to track the movement of money in and out of the account for a specific term.

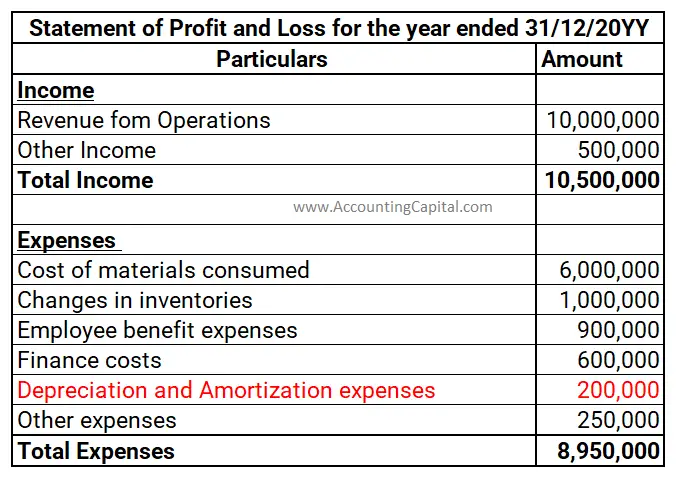

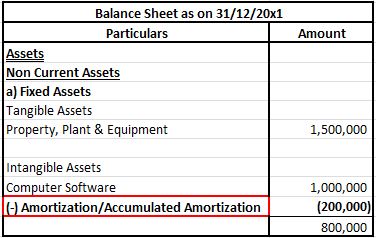

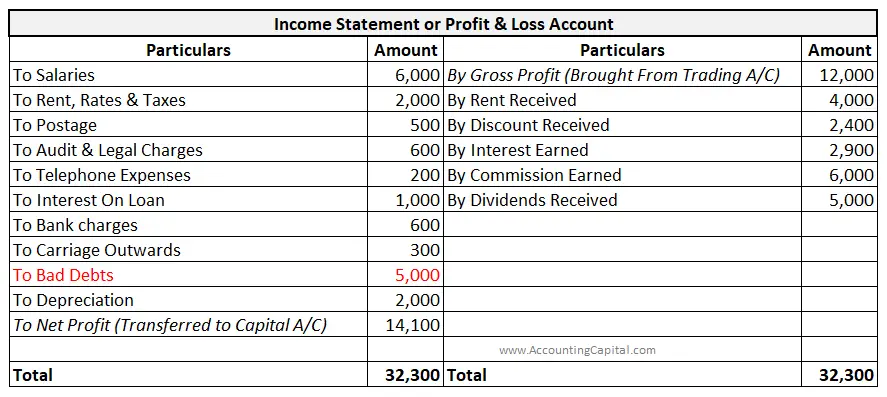

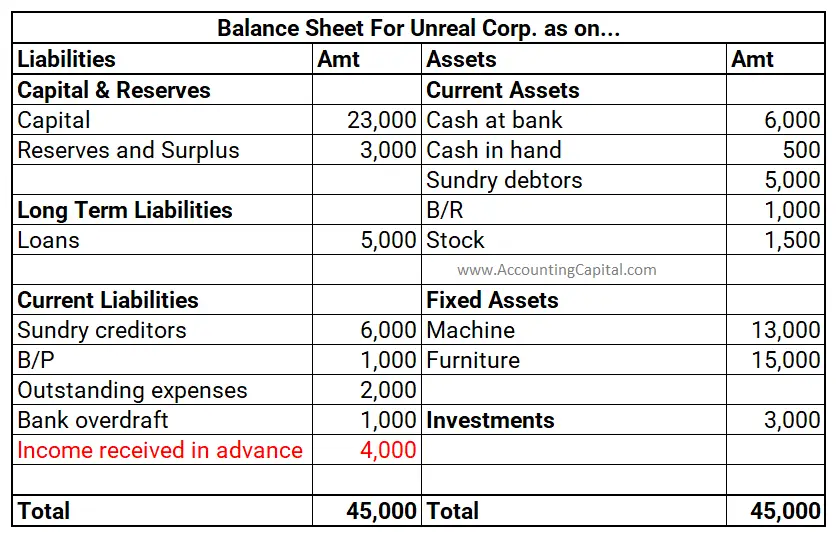

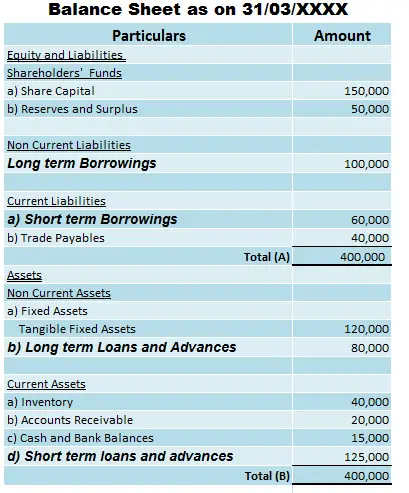

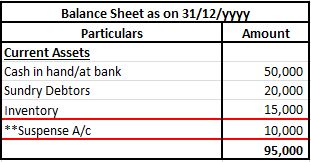

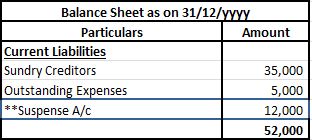

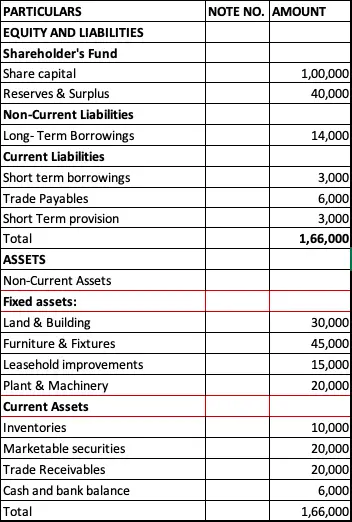

Financial Statement

The income statement is an important part of financial reporting as it shows the revenues, expenses, and net income/loss of a company over a specific accounting period. The below image is helpful in understanding how debits represent an outflow of money from the business while credits represent an inflow.

Examples

- Purchase of an asset – Is the money going out or coming into the business? Has the business spent on something or used something?

Yes, the money is going out! Therefore, the main subject of the entry, i.e. the “Asset”, will be debited. The other side is (credit) is recorded to show the opposite effect.

Entry

| Asset A/c | Debit |

| To Cash/Bank A/c | Credit |

Example

Machinery purchased by a business for 10,000 in cash.

| Machinery A/c | 10,000 |

| To Cash A/c | 10,000 |

- Payment of an expense – Is the money going out or coming into the business? Has the business spent on something or used something?

Yes, the money is going out! Therefore, the main subject of the entry, i.e. the “Expense”, will be debited. The other side is (credit) is recorded to show the opposite effect.

Entry

| Expense A/c | Debit |

| To Cash/Bank A/c | Credit |

Example

Your business pays rent expenses of 5,000 in cash.

| Rent Expense A/c | 5,000 |

| To Cash A/c | 5,000 |

- Recognizing Revenue – Is the money going out or coming into the business? Has the business received something or made money?

Money is coming in! Therefore, the main subject of the entry, i.e. “Revenue”, will be credited. The other side (debit) is recorded to show the opposite effect.

Entry

| Cash A/c | Debit |

| To Revenue A/c | Credit |

Example

Sold goods for 25,000 in cash.

| Cash A/c | 25,000 |

| To Sales Revenue A/c | 25,000 |

- Recording a Liability – Is the money going out or coming into the business? Has the business received something or made money?

In such scenarios, the business usually receives supplies or loan money. Therefore, the main subject of the entry, i.e. “Liability”, will be credited. The other side (debit) is recorded to show the opposite effect.

Entry

| Purchase A/c | Debit |

| To Liability A/c | Credit |

Example

Bought goods for 40,000 on credit (liability).

| Purchase A/c | 40,000 |

| To Accounts Payable A/c | 40,000 |

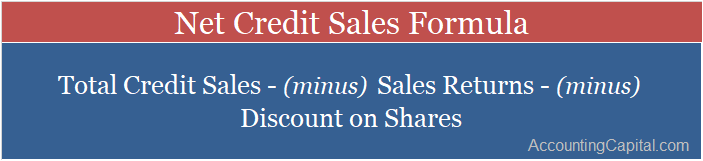

Related Topic – Is Sales Return a Debit or Credit?

Difference Between Debit and Credit

| Basis | Debit | Credit |

|---|---|---|

| 1) Side | Recorded on the left-hand side of a ledger account. | Recorded on the right-hand side of a ledger account. |

| 2) Asset | It increases an asset. | It decreases an asset. |

| 3) Liability | It decreases a liability (including capital) | It increases a liability (including capital) |

| 4) Expense | It increases an expense. | It decreases an expense. |

| 5) Revenue | It decreases income/revenue. | It increases income/revenue. |

| 6)Abbreviation | It is shown as “Dr.” in short. | It is shown as “Cr.” in short. |

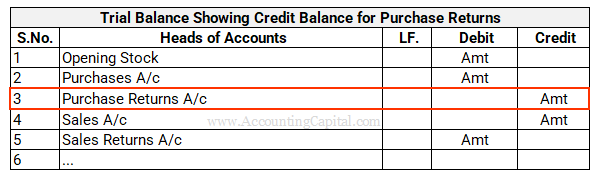

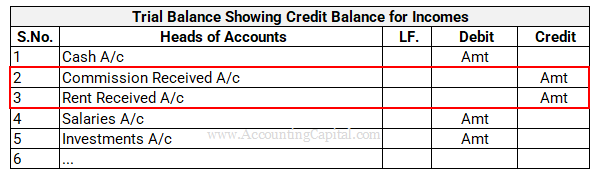

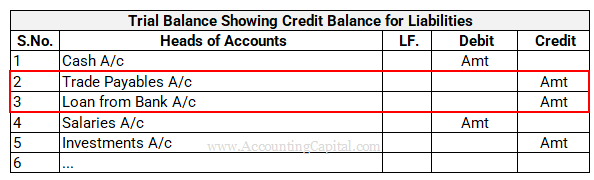

Related Topic – List of Debit and Credit Items in a Trial Balance

Short Quiz

Related Topic – Is Purchase Ledger Control Account a Debit or Credit?

Free eBook/PDF Download

Please feel free to download this article in the form of a 5-page free PDF/eBook. We request not to reproduce or copy eBook material for commercial purposes.

Related Topic – Why is Debit Written as Dr. and Credit Written as Cr.?

Conclusion

Accounting consists of four major types of accounts, which should be debited and credited as follows. This table is useful for other upcoming related topics.

The meaning of debiting an account means you are “adding” to it or “increasing” it in exchange for money/assets. As per the rules of debit and credit, a debit entry is used in accounting to show an increase.

This is why assets have a debit balance and liabilities have a credit balance.

>Read Accounting Cycle