-This question was submitted by a user and answered by a volunteer of our choice.

Meaning of Closing Stock

Closing stock refers to the value of the goods or products that remain unsold and are held by a business at the end of a specific accounting period, such as a month, quarter, or year. It represents the final inventory of goods that have not yet been sold but are ready for sale.

Accounting Treatment of Closing Stock

According to accounting concepts and principles, every accountant should record closing stock/inventory and other current assets (say- short-term investments, marketable stocks and securities) as per the conservatism (or) prudence concept.

This concept states that closing inventory (or) other current assets must be recorded at Cost (or) Net Realizable Value (NRV) whichever is the least. Conservatism concept follows a rule that “never anticipate for future profit but the record for all possible losses occurring in an organization”.

Example- At the end of the financial year, if the value of closing stock in the books appears to be 45,000 but, its market value is 60,000. Then the surplus amount of 15,000 (60,000-45,000) will be treated as an anticipated profit that will be obtained when the stock is sold in the next accounting period.

According to the principle of conservatism, the closing stock must be valued at cost or Net Realizable Value (NRV) whichever is least. Hence Closing stock must be valued at 45,000 in the books of accounts.

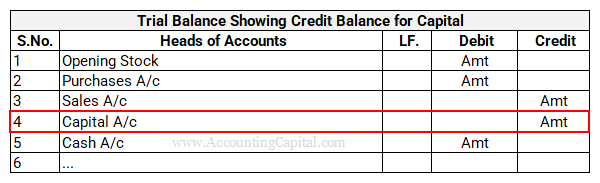

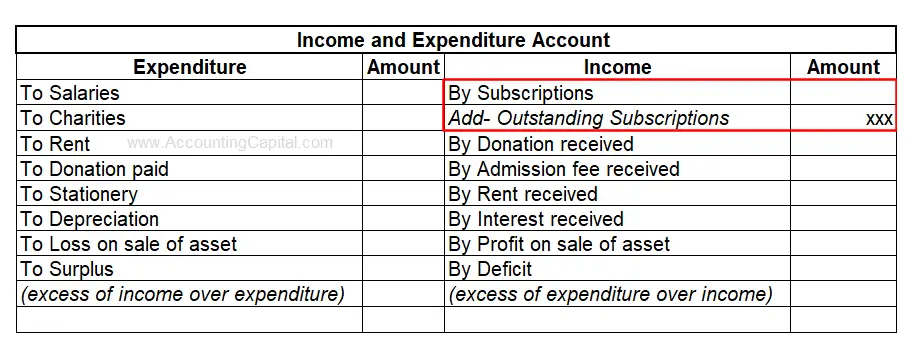

Reason for showing closing stock on the credit side of trading account

Closing stock is shown on the credit side (revenue side) of the trading account but closing stock is not revenue. It is just shown on the revenue side because of the application of the matching concept which states that “all expenses must match with the revenues of the current period”.

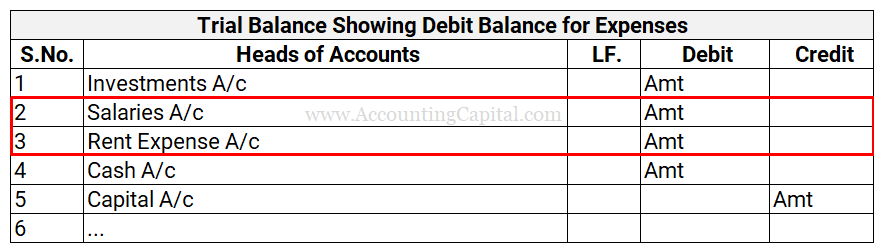

The value of opening stock, purchases and direct expenses is charged as an expense to the trading account by showing them on the debit side. The income produced by selling them is matched by showing it as sales, direct revenue on the credit side of the trading account.

Hence, if there are any unsold units left with the organization, then their cost should not be charged to the trading account. Further, their value must be reduced by recording them on the credit side of the trading account to find true or genuine gross profit.

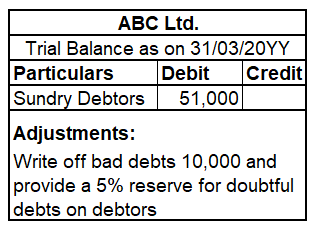

I would further like to add an example to make the above explanation easy and understandable.

Example- ABC Co. purchased 150 units of goods for 50 per unit. After a few months, they sold 100 units for 100 per unit. Calculate the value of Gross Profit based on the given two cases.

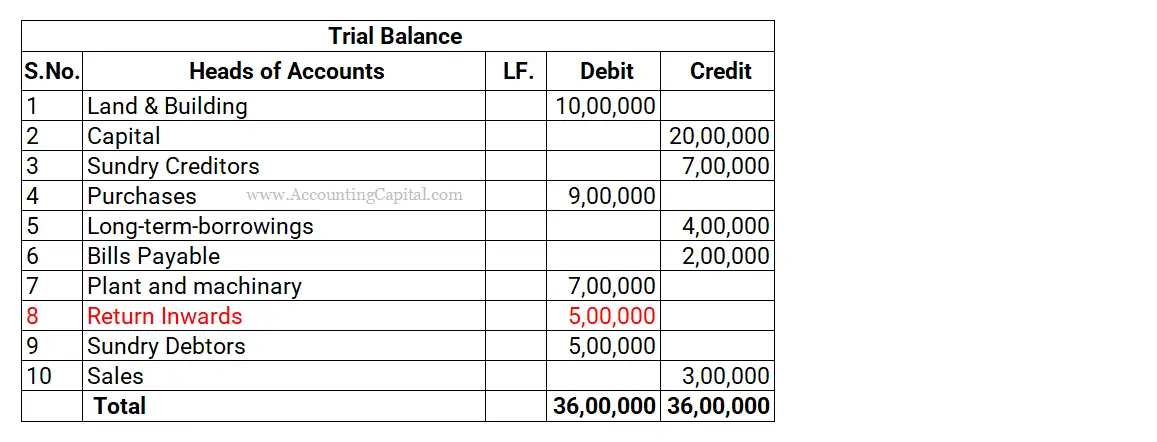

Case 1- If the Closing stock is not shown on the trading account

Case 2- If the Closing stock is shown on the trading account.

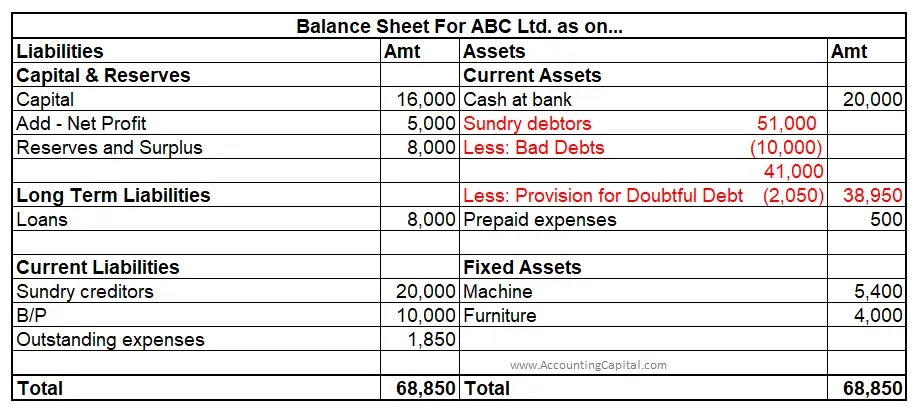

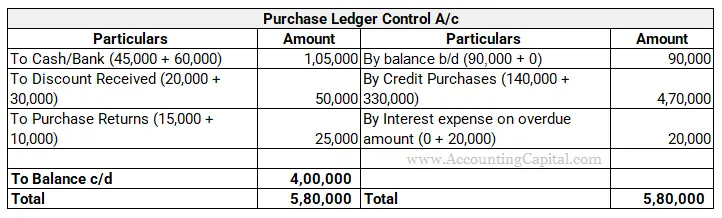

Case 1- If the closing stock is not shown on the credit side

In case 1, total revenue of the firm = 10,000 (sales) is matched with total expenses of the firm = 7,500 (purchases) then the gross profit will be 2,500 (10,000-7,500). This gross profit is untrue because the accountant has violated the matching principle of accounting by not recording 50 unsold units as closing stock.

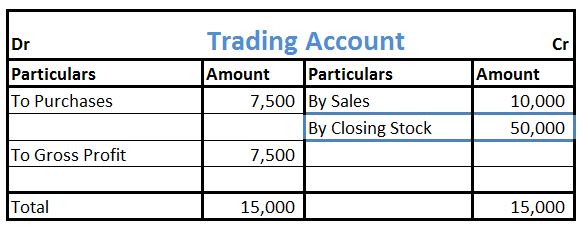

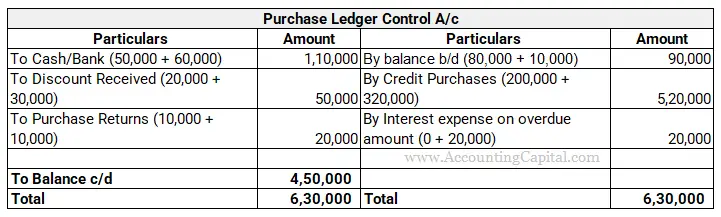

Case 2- If the closing stock is shown on the credit side

In case 2, total revenue of the firm = 15,000 (sales + closing stock) is matched with total expenses of the firm = 7,500 (purchases) then the gross profit will be 7,500 (15,000-7,500). This gross profit is true (or) genuine because the accountant has followed the matching principle of accounting by recording 50 unsold units as closing stock.

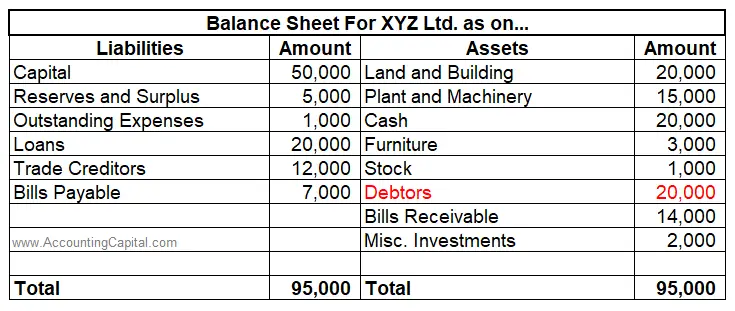

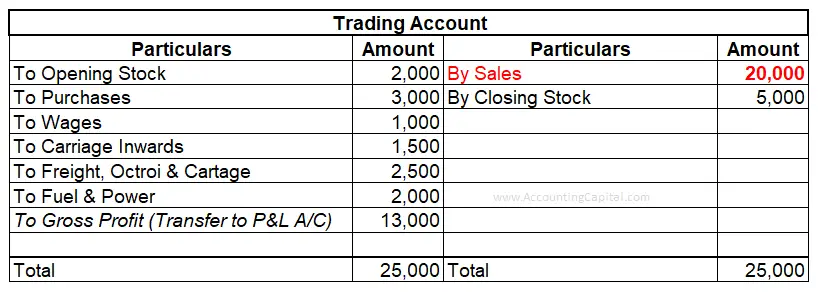

A snippet of the trading account will help you to develop a better understanding of the concept