Finance and Accounting Interview Questions (FAQs)

We have a collection of top finance and accounting interview questions compiled with real-life experiences and research with working professionals. They are a must-read for all job seekers especially freshers and intermediate-level candidates with an experience range of 0-4 years.

These accounting questions for interviews can also act as a great refresher for someone trying to brush up on their accounting fundamentals. Additionally, we recommend that you read our new blog post on “100 Accounting Terms You Must Know for Interviews“.

Bonus eBook in PDF at the end of this article!

Our research involved over 100 aspirants who went through a technical or written interview in companies such as EY, KPMG, Deloitte, PWC, Grant Thornton, Ameriprise Financial, American Express, FIS, Fluor Corporation, Genpact, Bechtel, Citigroup, Accenture, Agilent, UHG, UBS, Bank of America, HCL, Sapient, Blackstone, HSBC, FIS, WNS, AXA XL, BT, Boston Consulting Group, Royal Bank of Scotland, Whirlpool, GE, EXL, BlackRock, etc.

1. What are the three Golden Rules of Accounting?

First things first this is the most basic yet the easiest one to be taken for granted, know this well.

First things first this is the most basic yet the easiest one to be taken for granted, know this well.

In bookkeeping, three golden rules of accounting are,

Personal Account – Debit the receiver, Credit the giver

Real Account – Debit what comes in, Credit what goes out

Nominal Account – Debit all expenses & losses, Credit all incomes & gains

Understand this with examples here Three Golden Rules of Accounting with examples

Related Topic – Accounts not Closed at the End of an Accounting Period?

2. What are the three main types of accounts?

They are Real, Personal and Nominal but wait… if don’t want to sound artificial and stand out from the crowd then make sure you are explaining your answer in brief (one line about each is ideal)

Real – All assets in business either tangible or intangible classify as real accounts.

Personal – Accounts related to a person, entity or any legal body, etc. are called personal accounts.

Nominal – All accounts related to expenses & losses or incomes & gains fall under this category.

Related Topic – List of Direct and Indirect Expenses

3. Why is Depreciation not Charged on Land?

Oh! this is a classic and one that fascinates the operations manager more than often. There is no scope for leaving this one out from any list of finance and accounting interview questions.

The reason why you will never see depreciation being charged on land is that land has an infinite useful life. Without knowing how many years a fixed asset will last depreciation cannot be charged.

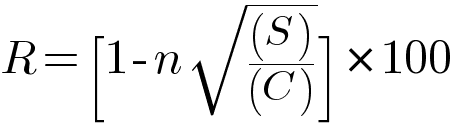

The formula to calculate straight-line depreciation is (Cost of Fixed Asset – Scrap Value)/Useful life and you don’t have a number to fill the denominator here.

Related Topic – Quiz on Accounting Fundamentals for Beginners (#1)

4. What is Amortization?

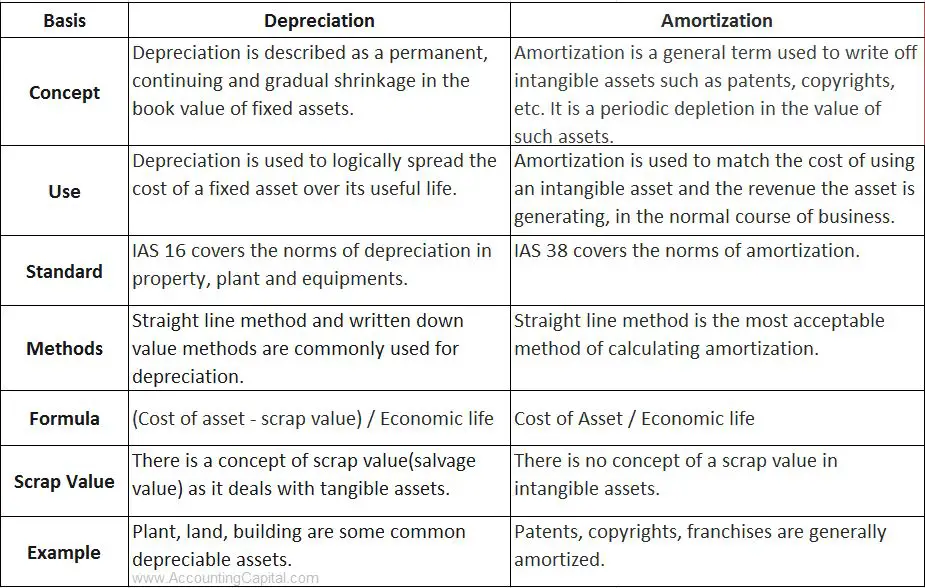

Amortization is only done for Intangible assets, unlike depreciation which is for tangible assets. Reduction in value by prorating the cost of an intangible asset over multiple accounting periods is called amortization.

Amortization is only done for Intangible assets, unlike depreciation which is for tangible assets. Reduction in value by prorating the cost of an intangible asset over multiple accounting periods is called amortization.

Example – A small-sized technology company Unreal Corp. spends 500,000 on R&D which is expected to sustain for 5 years so it may decide to amortize this & show 1,00,000 each year for 5 years in the financial statements.

If you may wish to deep dive into the topic here is our detailed article on Amortization with an example

Related Topic – How to show Amortization in Financial Statements?

5. Why is Closing Stock not Shown in Trial Balance?

Not all goods purchased in beginning & during the accounting period are sold until the end of that period, this results in a remainder balance known as closing stock.

Closing stock is a part of purchases & trial balance already includes purchases, hence if the closing stock is shown as a separate item it will double count and result in an error.

Example – Purchases for a period = 60,000, Closing Stock (remainder out of purchases) = 10,000, if both of these items are separately shown inside the trial balance the effect will double up & trial balance will error-out.

This one also stands tall among top finance and accounting interview questions asked in technical rounds by hiring managers.

Related Topic – Return Inwards in Trial Balance

6. What are the three main Financial Statements?

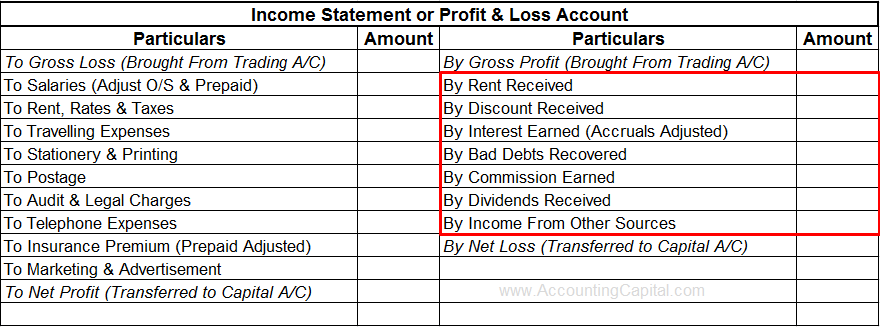

This is another very common question asked in finance and accounting interviews, especially with entry-level roles. Three main financial statements are the Income Statement, Balance Sheet, and Cash Flow Statement.

Again, follow the i.e. to add one brief statement to each one of them, but don’t over-talk it will only make you vulnerable to more questions.

Income Statement – It presents a summarized view of revenue, income, profit, and loss of a particular accounting period.

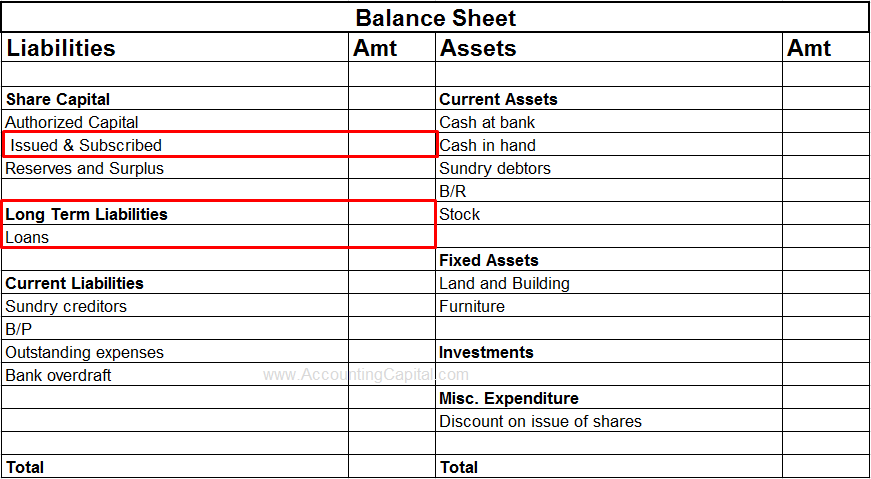

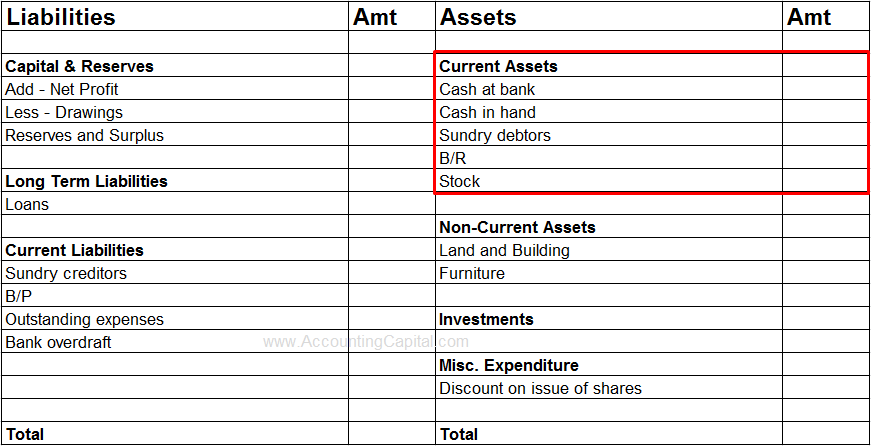

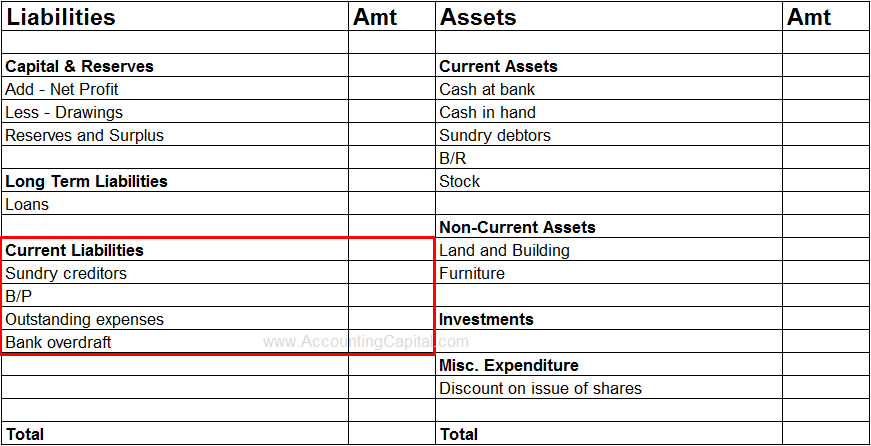

Balance Sheet – B/S would show them as on-date assets, liabilities & capital position of a business.

Cash Flow Statement – It shows the movement of cash and cash equivalents for a business during an accounting period.

Learn more on Three Main Financial Statements, Details and their Format

Related Topic – How to show Suspense A/c in Financial Statements?

7. What is Capital, type of account & where is it shown in the financial statements?

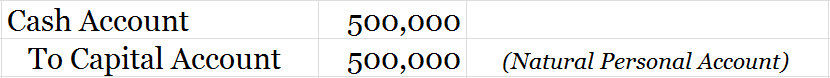

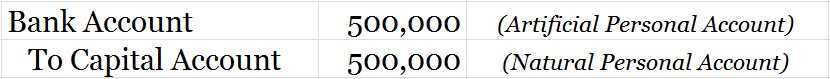

Also called net worth or owner’s equity, capital is the money brought in by the owner of the business as an investment to start the operations. Capital is a type of Personal Account which belongs to an individual or a firm (owner).

Capital is shown on the liability side of a balance sheet.

Here is our detailed article on Capital along with its Journal Entry here.

Related Topic – Is Capital an Asset or Liability?

8. What are Fictitious Assets?

Keep in mind that fictitious assets are not assets; they are fake or deceptive. They are actually expenses and losses that could not be written off during the accounting period. They are written off in multiple future accounting periods.

Examples – Preliminary expenses, promotional expenses of a business, discount allowed on the issue of shares, the loss incurred on the issue of debentures, etc.

Fictitious assets are shown in the balance sheet on the asset side.

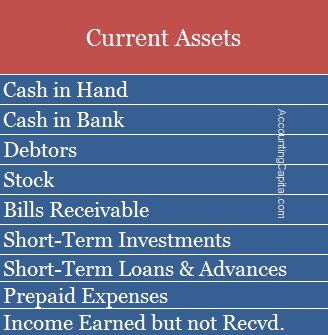

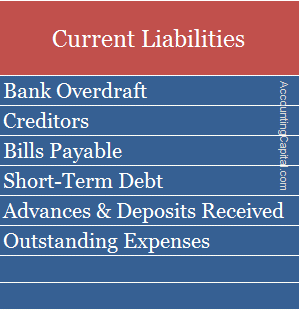

Related Topic – List of Fixed Assets & Current Assets

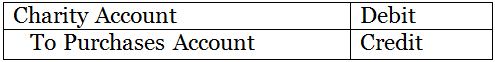

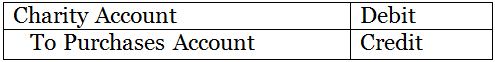

9. What is the Journal Entry for Goods Given in Charity?

When a business decides to give goods to charity it also needs to account for those goods in the appropriate financial statement(s), in this case, purchases are reduced with the exact cost of goods donated.

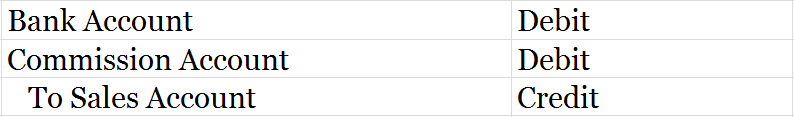

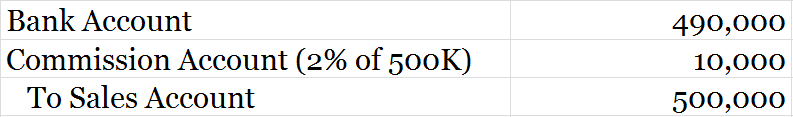

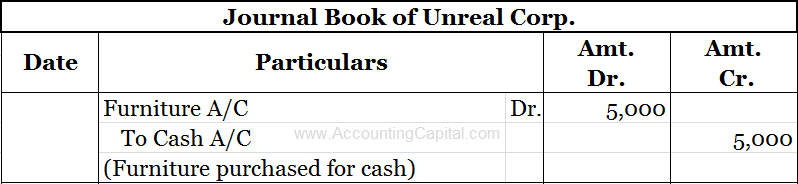

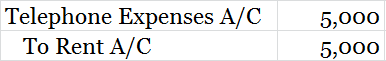

Journal entry

Related Topic – Quiz on Journal Entries for Beginners (#4)

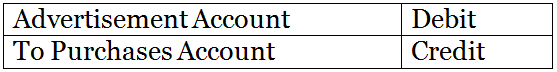

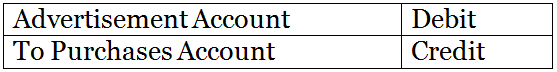

10. What is the Journal Entry for Free Samples?

When a business wants to advertise a new product or a new line of products it may decide to distribute free samples to the customer. In this case, Purchase A/c is credited and Advertisement A/c is debited.

Journal entry

Related Topic – Salary Received Journal Entry

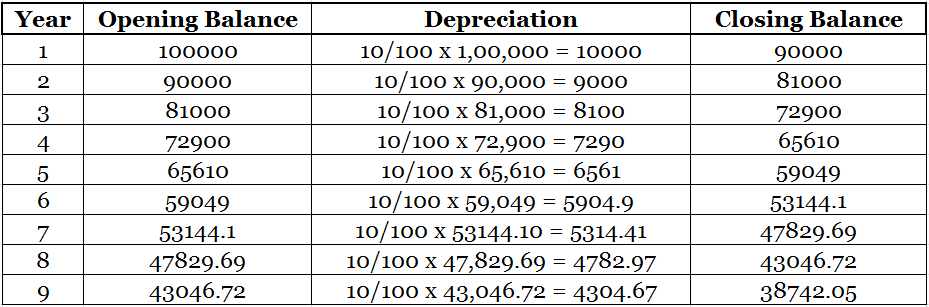

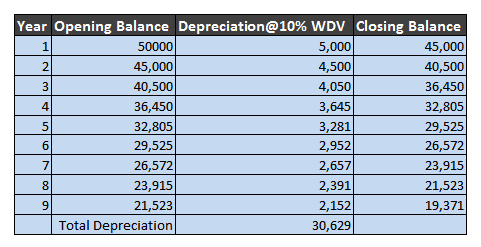

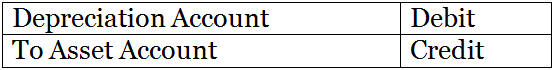

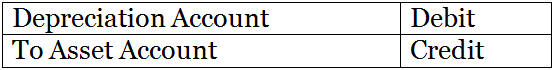

11. What is Depreciation, different types of depreciation & its journal entry?

The reduction in the value of a tangible fixed asset due to normal usage, wear and tear, new technology or unfavourable market conditions is called Depreciation.

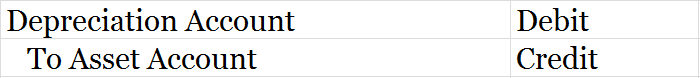

Journal entry

Types of Depreciation

- Straight Line Method

- Diminishing Value Method

- Annuity method

- Machine hour rate method

- Revaluation method

- Sum-of-the-years’ digit method

Read more on Depreciation with examples along with types of depreciation

Related Topic – Provision for Depreciation Shown in Trial Balance

12. What are Contingent Liabilities?

Contingent liabilities are those liabilities that may or may not be incurred by a business depending on the outcome of a future event. The existence of this kind of liability is completely dependent on the occurrence of a probable event in future.

Example – Let’s suppose that Apple files a case of a patent violation on Samsung and Samsung not only realizes that it may have to pay for violations but also estimates how much in total. In this case, Samsung will record the estimated amount in its books of accounts as a Contingent Liability.

Related Topic – How & Where to Shown Contingent Assets?

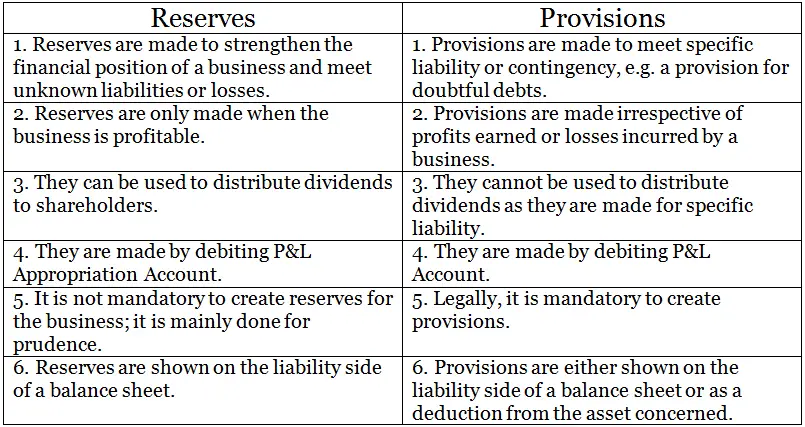

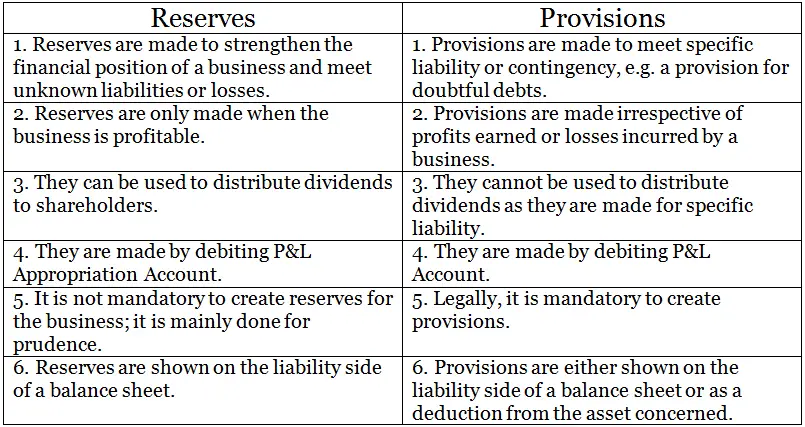

13. What is the difference between Reserves and Provisions?

Related Topic – Why is Provision for Doubtful Debts Created?

14. What are Accruals?

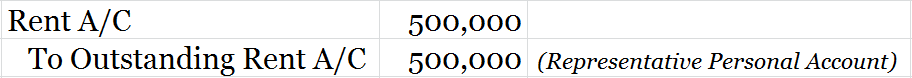

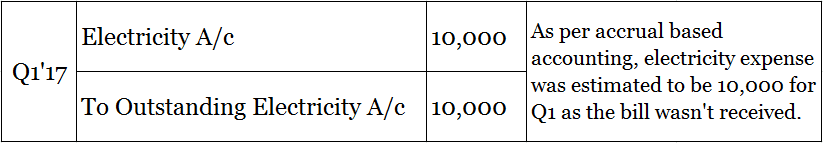

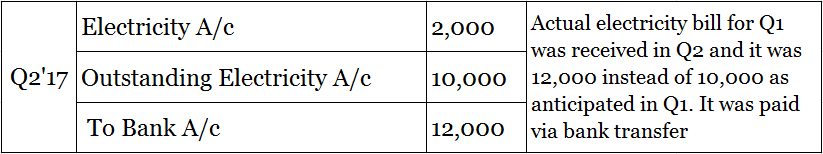

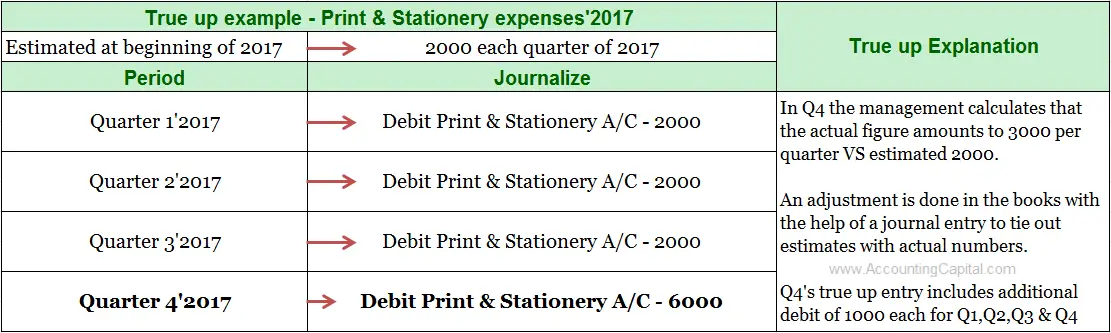

Another very frequently discussed topic in the list of finance and accounting interview questions is accruals. They are expenses and revenues that have been incurred or earned but have not been recorded in the books of accounts. Adjustment entries are incorporated in the financial statements to report these at the end of an accounting period.

Accrued Expense is an expense that has been incurred, but has not been recorded in the books of accounts presently. It will require an adjustment entry in the books of accounts to reflect this in the financial statements.

Accrued Income is income that has been earned, but has not been recorded in the books of accounts presently. Similar to accrued expenses, an adjustment entry will be required in this case too.

There is some more explanation on Accruals along with a couple of examples here.

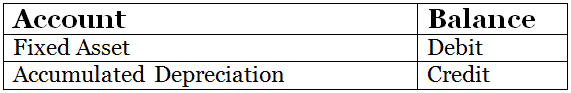

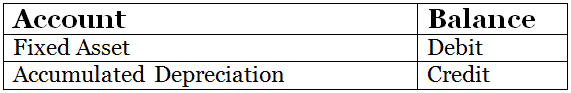

15. What is a Contra Account?

It is an account that is used to reduce or offset the value of an associated account. It holds the opposite sign for a particular type of account.

If an account has a debit balance (e.g for an Asset a/c), then there will be a credit balance in its contra account. The opposite is true for a liability account.

Example for contra accounts

Read more on Contra Account with more details and examples.

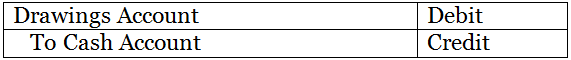

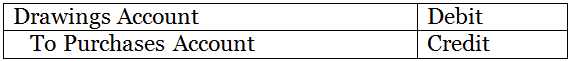

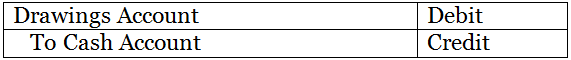

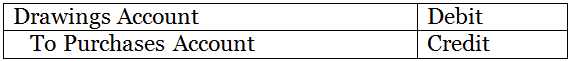

16. What are Drawings, what type of account is it & its journal entry?

When a proprietor withdraws cash or goods from their own business for personal use it is termed as drawings. It reduces capital invested and is a temporary account that is cleared at the end of each accounting period.

“Drawings” is a Personal Account & is shown on the liability side of a balance sheet.

Journal entry for cash withdrawn

Journal entry for goods withdrawn

Related Topic – Balance and Type of Account of a Petty Cash Book

17. What is a Bank Reconciliation Statement & why is it prepared?

Almost all compilations of finance and accounting interview questions include at least one question on BRS, this topic is deemed important.

Bank Reconciliation Statement or BRS refers to a statement that is made to reconcile the bank balance shown on the bank statement or passbook with the bank balance shown in the cash book.

Both internal source(s) i.e. the cash book and external source(s) i.e. the bank statement/passbook are reconciled with each other, and then all the mismatches are identified and properly recorded.

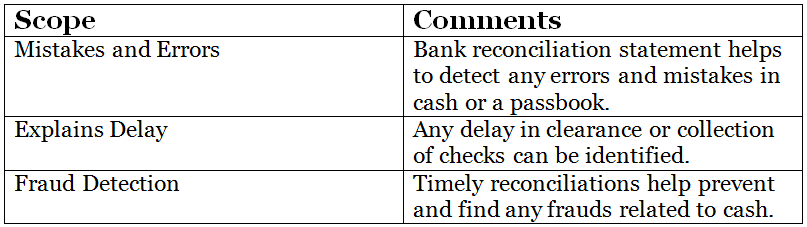

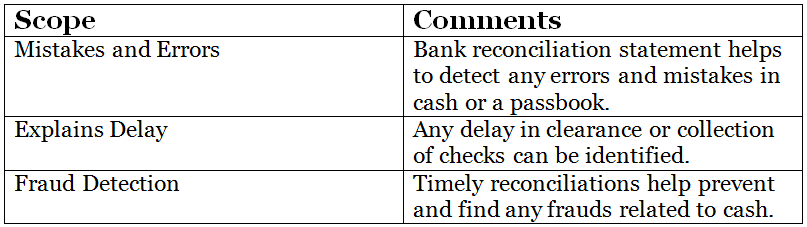

Reasons for preparing a BRS

More on Bank Reconciliation Statement and reasons to prepare a BRS

18. What is Deferred Revenue Expenditure?

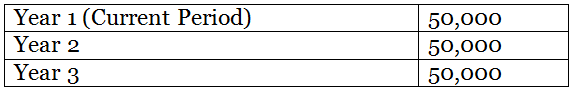

Another one among the list of commonly asked finance and accounting interview questions is Deferred Revenue Expenditure. It is an expenditure that is revenue in nature and incurred during an accounting period, but its benefits are to be derived from a number of following accounting periods.

The part of the amount which is charged to the profit and loss account in the current accounting period is reduced from the total expenditure and the rest is shown on the balance sheet as an asset.

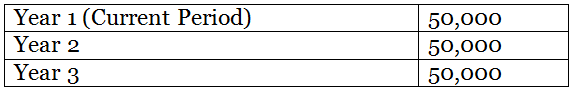

Example – A small business spends 1,50,000 on advertising which is unusually large for them. The benefits from it are expected to be derived over 3 years so the company decides to divide the expense over 3 yearly payments of 50K. This type of expense is amortized.

Related Topic – Is Deferred Revenue a Liability?

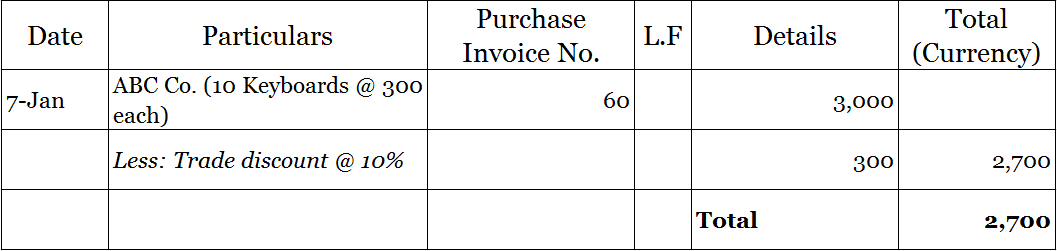

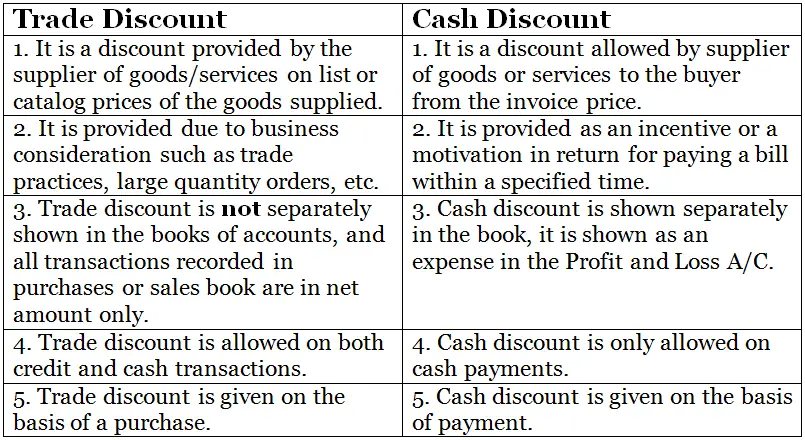

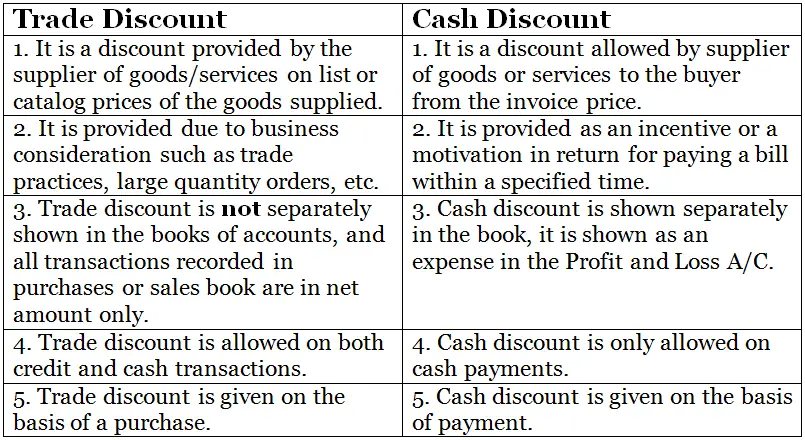

19. What is the difference between Trade Discount & Cash Discount?

Related Topic – How to Calculate Provision for Discount on Debtors?

20. What is a Credit Note and Debit Note?

Be ready for this question in accounting interviews for roles related to Accounts Payable and Accounts Receivable.

Debit Note – When a buyer returns goods to the seller, he sends a debit note as an intimation to the seller of the amount and quantity being returned and requesting the return of money.

Credit Note – When a seller receives goods (returned) from the buyer, he prepares and sends a credit note as an intimation to the buyer showing that the money for the related goods is being returned in the form of a credit note.

Related Topic – Debit Note Vs Credit Note

21. Additional 20 Finance and Accounting Interview Questions in our eBook

Get Full Version of eBook with 40 Question & Answers

The first of our two-book series “Golden Book of Accounting and Finance Interviews – Part I” contains 20 additional finance and accounting interview questions including the ones in the above article. Our eBook is a great resource for every job seeker.

*2022-23. As this eBook requires an update every year, it is no longer a free download but comes at a very nominal price of just 99 INR. This is our researched list of accounting interview questions and answers.

>Read 11 Tips to Follow for Freshers Before an Accounting Interview

>Read Compilation Journal Entries