Tax Benefits for Small Business Owners

You can be an entrepreneur who is running a start-up, a home-based business or a small firm that is trying to make a mark. While playing the lead in this role of your life you are wholly responsible for your actions i.e. generating income, profits, paperwork, legal requirements, taxes etc. No matter what you do you can’t fully escape from paying taxes but you can definitely work towards reducing your tax bills. Don’t confuse Tax evasion with Tax avoidance, where the former is totally not suggestible the latter helps you to pay the least amount of tax legally. Just be very sure with your facts and ensure to never mess with the IRS.

Home Office Deduction

The cost of the workplace where you conduct your business either if you rent or acquire it, can be deducted as a home office expense. Your declarations are considered as final and considered true while filing taxes so it is always a good suggestion to be honest and always have supporting facts in case if you are examined. It is considered as a complex deduction, hence IRS gives 2 different ways to get this done, Standard Method and Simplified Method.

The tax deduction includes expenses such as interest on mortgage, insurance, utilities, repairs, depreciation and maintenance charges which are paid during the year. For example, if your workspace is 30% of your home, then 30% of your power bill for the year is tax-deductible. The standard method needs you to calculate your actual home office expenses whereas the simplified option lets you multiply an IRS-determined rate by your home office square footage.

Travel Expenses

An expense qualifies to be categorized under this head if it requires you to be away from the vicinity of your tax home, usually for longer than 1 workday & requires you to eat, rest and sleep to meet the demands of your work while travelling. Also, this type of travelling has to be business-related where you are expected to be involved in only business-related activities such as attempts to gather new customers, gain new skills, important conferences etc.

Travel expenses that can be covered are transportation, meals, telephone, baggage and shipping, cleaning, tips etc. You must keep complete and accurate records of your business dealings as it may be asked for proof. Tax expense which will be deducible includes the transportation cost to and from, tickets, lodging, meals. Full 100% travel expenses related to the business are deductible but in case of meals and entertainment deduction is limited up to 50% of the actual cost, if you keep the records. Or it can be calculated by 50% of the standard meal allowance. Whereas, on entertainment, the IRS has numerous restrictions. If your entertainment expenses qualify for the test, it is only 50% deductible. You must keep a record of all receipts relating to tour, entertainment and meals.

Click Here to see detailed deductions on Travel, Entertainment, Gift, and Car Expenses on IRS’s website.

Telephone & Internet Charges

These charges refer to calls made & the internet used for business purposes. The common idea is to only declare deduction of the consumption that happens related to business operations, so for example if 40% was used for the business then only 40% of total charges should be claimed for deduction.

You may or may not have a separate line for your business, in the latter case when you receive your telephone bill each month you can highlight the business calls and file it accordingly. Many people carry a cell phone, especially for business calls. They can claim the full bill as tax-deductible. It is highly advisable to NOT to include your personal usage.

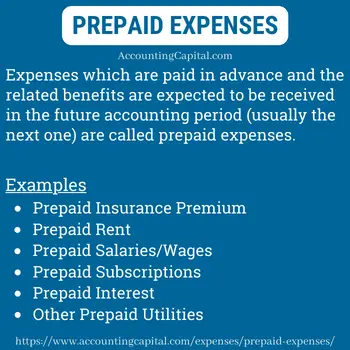

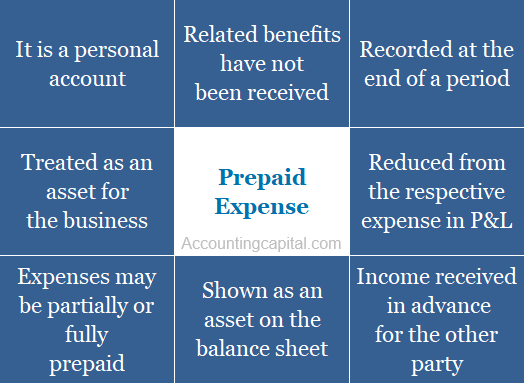

Insurance Premium

There is no business without the owner so your personal health insurance can be used as a deductible under tax laws. Whatever the amount, you can use all of it except that it cannot exceed more than the net profits of your business. You may deduct premiums that you paid to provide coverage for your spouse, dependents and your children who were below 27 at year-end, even if they are not your dependents. It can’t be claimed if you pay a different type of insurance premium, either single or jointly, such as the one offered by your spouse’s medical plan.

Two important points must be kept in mind:

1. Employment of your spouse must be real.

2. Any kind of failure in meeting these requirements may result in a court situation.

Car Mileage

When your car is used for business purposes, those expenses are tax-deductible. Make proper records of such trips and do not mix it with personal trips. The deduction can be taken out using two methods:

1. Standard Mileage

2. Actual Expense Method

- Standard Mileage: This method is the easiest because it requires record keeping and minimal calculation. Write down the dates and the miles you drove your vehicle for business purposes. At the end multiply your annual miles by standard mileage rate which is 57.5 cent per mile. The answer will be your tax-deductible amount.

- Actual Expense Method: For this, the percentage of business driving must be calculated for a full year along with operating charges such as gas, registration fees, repairs and insurance. Now let us say you spent $4000 as operating expenses and used your car for 10% business purposes, the result would be $400 as a deductible expense.

Don’t forget to keep track of your mileage. While you can’t deduct all of your mileage, you can deduct mileage that is work-related and outside of your normal commute, so you’ll want to keep track of that throughout the year says Troy Martin, a Utah CPA for Cook Martin Poulson, P.C.

Bonus – All in One Deduction

All contributions to Simplified Employee Pension – SEP -IRA, Savings Incentive Match Plan For Employees Of Small Employers – SIMPLE & Independent 401(K) are tax deductibles and help you reduce your taxable income. Why do we call them cherries on the cake is because they not only help you save tax but they also help you attain tax-deferred investment gains for later on. This year (2015) the contribution limit for Independent 401(k) has been increased to $53,000.

Small business owners’ tax deductions are quite complicated. But the above overview gives clear information about the aspects which will be helpful in a tax deduction. You may take the help of a professional in case if you don’t wish to get into all the related hassle. While we encourage you to avail all legal tax deductions for small business owners we would also like to remind you that illegal tax evasion can lead you to heavy penalties or jail time.

Click Here for IRS’s Employer’s Tax Guide