Thanks to the sheer number of startups, the landscape for small businesses is becoming increasingly competitive. To stay ahead and thrive in this dynamic market, small business owners must be able to adapt and be flexible in their operations.

One key aspect of this adaptability is having access to sufficient funds to support growth and expansion. However, many business owners in India face challenges when it comes to securing and increasing available funds. This can be due to factors such as limited access to traditional financing options, strict lending criteria, and high-interest rates.

Explore some effective ways to make your business more flexible in India, specifically focusing on strategies to increase available funds.

Understanding Cash Flow Management

Effective cash flow management is crucial for the success and sustainability of businesses. It involves monitoring and optimizing a company’s inflows and outflows of cash.

By effectively managing cash flow, small businesses can ensure they have enough working capital to meet their day-to-day operational expenses, such as paying suppliers, covering employee salaries, and investing in growth opportunities.

Small businesses may face cash shortages without proper cash flow management, leading to missed opportunities and potential financial distress. Thus, cash flow management is especially important for small businesses in India, where access to working capital and new business loans without collateral can be challenging.

Reducing Operational Costs

To minimize operational expenses for small businesses without compromising on efficiency or quality, several strategies can be implemented:

- Conducting a thorough review of existing processes and procedures can help identify areas of inefficiency or unnecessary expenditures.

- Streamlining workflows and eliminating redundant tasks can lead to significant cost savings.

- Exploring alternative suppliers or negotiating better deals with existing ones can help reduce procurement costs.

- Implementing energy-saving measures, such as using energy-efficient equipment or optimizing lighting and heating systems, can save long-term costs.

- Outsourcing non-core functions or leveraging technology solutions can also help reduce labor and administrative expenses.

- Investing in employee training and development can improve productivity and lead to cost savings over time.

Exploring Diverse Revenue Streams

Diversifying income sources is crucial for businesses seeking to increase financial stability and have more funds available. Relying solely on one revenue stream can leave a business vulnerable to unexpected market fluctuations or changes in consumer behavior.

By exploring diverse revenue streams, such as expanding product offerings or entering new markets, businesses can tap into additional sources of income. Moreover, considering working capital options like new business loans without collateral can provide the necessary funds to explore new ventures or invest in growth opportunities.

Leveraging Technology for Efficiency

Leveraging technology can significantly enhance the efficiency of small businesses, leading to streamlined operations and reduced costs. Adopting modern tools and software can automate repetitive tasks, freeing up valuable time for employees to focus on more strategic activities.

For instance, project management software enables teams to collaborate seamlessly, track progress, and meet deadlines more effectively. Additionally, cloud-based accounting software simplifies financial processes, allowing for real-time expenses, cash flow, and inventory management tracking.

Effective Debt Management

To ensure your small business’s financial stability and flexibility in India, have effective debt management strategies in place. Carefully managing your working capital loan can help you avoid unnecessary financial strain and maintain a healthy cash flow. One key aspect is optimizing your working capital, which involves balancing your current assets and liabilities to ensure sufficient funds for day-to-day operations.

By closely monitoring your accounts receivable, inventory turnover, and accounts payable, you can identify areas for improvement and implement strategies to expedite cash inflows. Also, exploring new business loans can provide additional financial support for growth while minimizing the risk to your business assets. However, it is essential to evaluate the terms and interest rates of such loans carefully to ensure they align with your business goals and repayment capabilities.

With effective debt management practices, you can navigate financial challenges confidently and maintain the flexibility needed to seize new opportunities for your small business in India.

Building Strong Banking Relationships

Building rapport with banks and other lenders can lead to better loan terms, such as lower interest rates and longer repayment periods, which can significantly impact a business’s cash flow.

By demonstrating a history of responsible financial management and prompt repayment, business owners can increase their credibility with lenders, making them more likely to approve loan applications and offer favorable terms. Furthermore, a solid banking relationship can provide access to valuable financial advice and guidance.

Banks can offer insights on budgeting, financial planning, and risk management strategies, helping small business owners make informed decisions for sustainable growth. Having a trusted financial partner who understands your business’s unique needs and goals can be immensely beneficial in navigating the complexities of the financial landscape.

Engaging in Strategic Partnerships

Working capital is crucial for small businesses in India, as it provides the necessary funds to cover day-to-day operations, invest in growth opportunities, and manage unexpected expenses. Engaging in strategic partnerships can be a valuable avenue to increase available funds. Small businesses can tap into new revenue channels and reduce costs by collaborating with complementary businesses or industry leaders.

These partnerships can range from joint marketing initiatives and co-branded promotions to shared resources and cost-sharing arrangements. Furthermore, partnerships can enable businesses to share research and development costs, innovation, and infrastructure, allowing for more efficient operations and higher profitability.

So, these collaborations can provide businesses with a competitive edge and enhance their financial flexibility without relying solely on traditional methods such as new business loans without collateral.

Investing in Employee Training

Investing in employee training is a strategic decision that can yield significant long-term financial benefits for business owners. By enhancing the skills and productivity of their workforce, businesses can improve overall efficiency and performance, leading to higher customer satisfaction and increased profitability.

Well-trained employees are more experienced at identifying and capitalizing on opportunities, contributing to the growth and competitiveness of the business. Additionally, investing in employee development can foster a positive work culture and boost employee morale, leading to higher retention rates and reduced recruitment and training costs.

Furthermore, improved employee skills can lead to streamlined processes, reduced errors, and increased operational effectiveness, ultimately resulting in cost savings. For small businesses seeking to expand and secure new business loans without collateral, a well-trained and skilled workforce can instill confidence in lenders, showcasing the commitment to ongoing improvement and success.

Final Word

There are multiple ways to increase available funds for your small business. From accessing government grants and loans to implementing cost-cutting measures and optimising your cash flow, these strategies can help make your business more flexible and financially stable.

You can equip your business with the resources it needs to thrive in India’s changing market by carefully assessing your current financial situation and taking strategic steps. Remember, staying adaptable and open to change is key to building a successful and sustainable business.

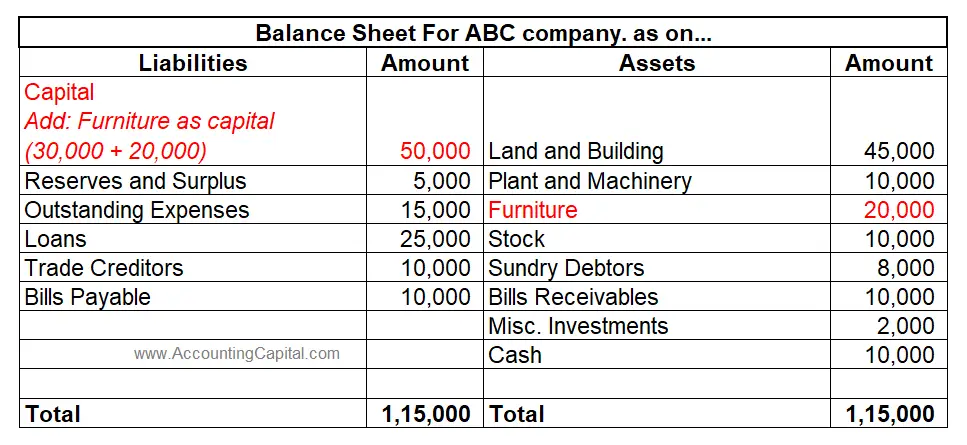

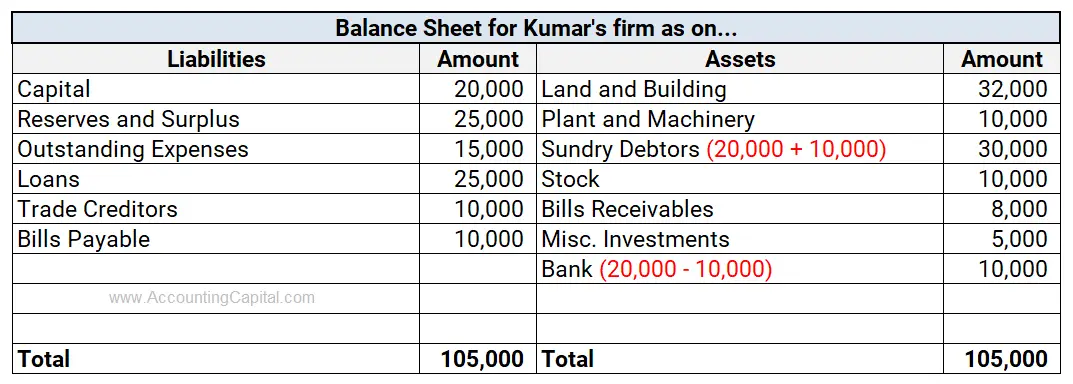

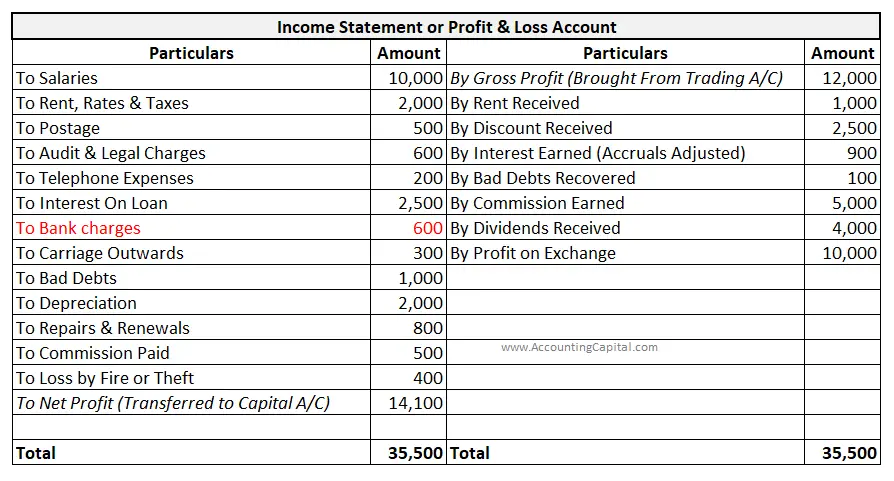

Cash Flow Statement: It is recorded as a financing activity indicating an increase in the partner’s investment.

Cash Flow Statement: It is recorded as a financing activity indicating an increase in the partner’s investment.

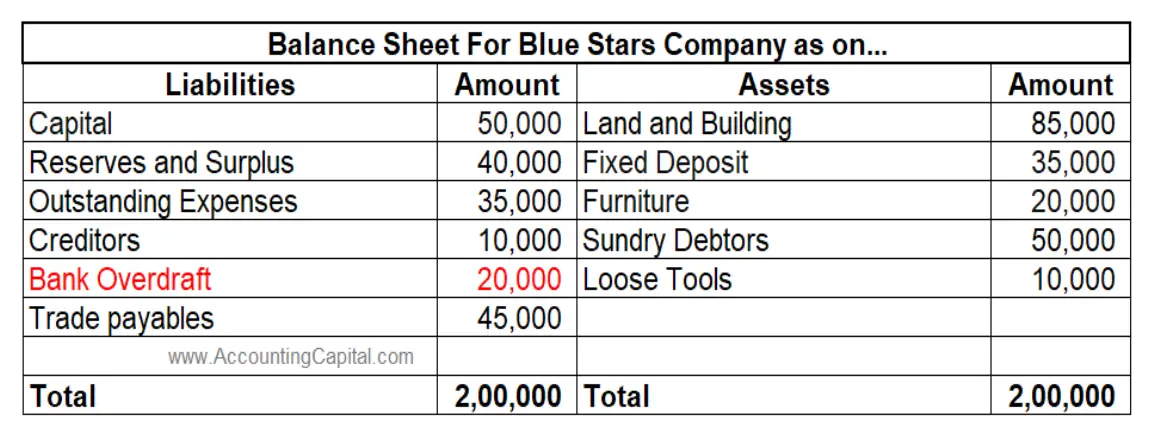

There will be no changes or impact on the liabilities side of the balance sheet.

There will be no changes or impact on the liabilities side of the balance sheet.

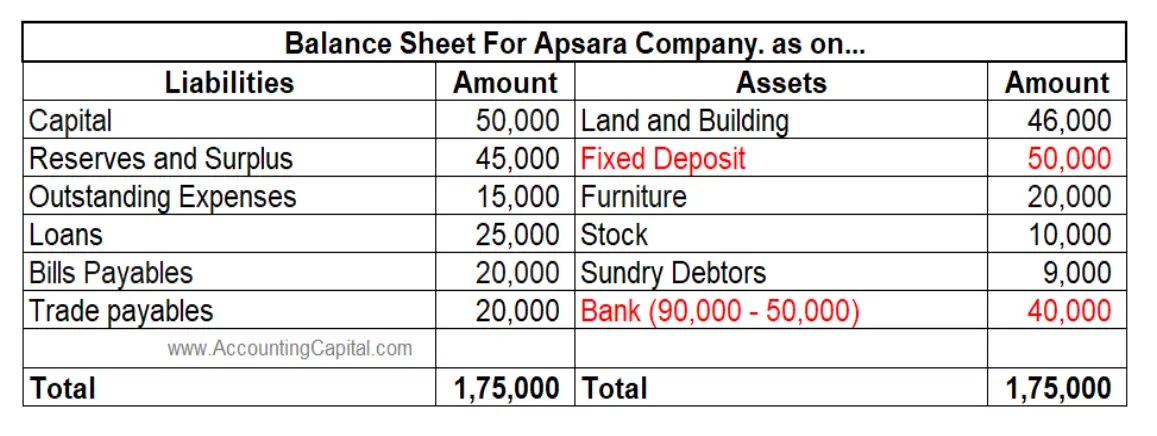

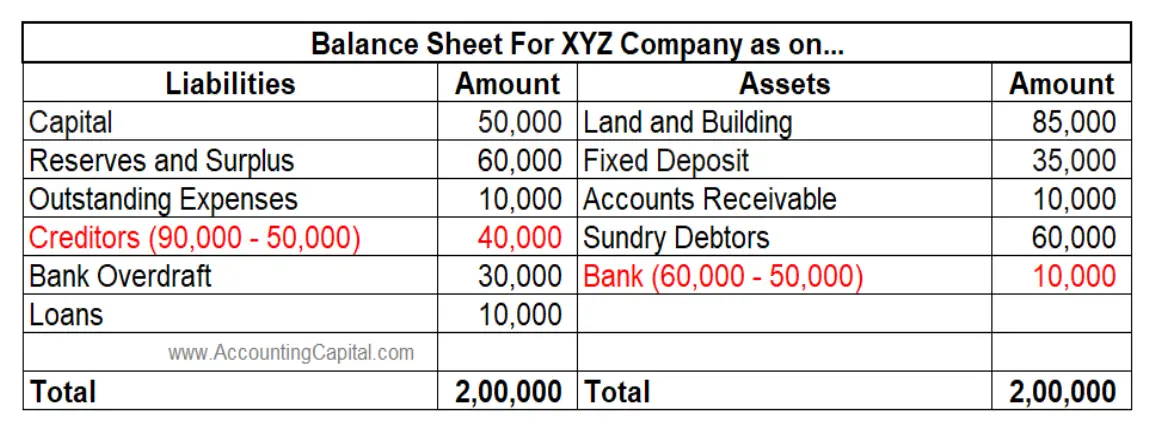

In the above image, it is imagined that the firm’s total creditors were 90,000 out of which 50,000 were paid using the official bank account. This is the reason for the reduction of 50K from both creditors & the bank account.

In the above image, it is imagined that the firm’s total creditors were 90,000 out of which 50,000 were paid using the official bank account. This is the reason for the reduction of 50K from both creditors & the bank account.

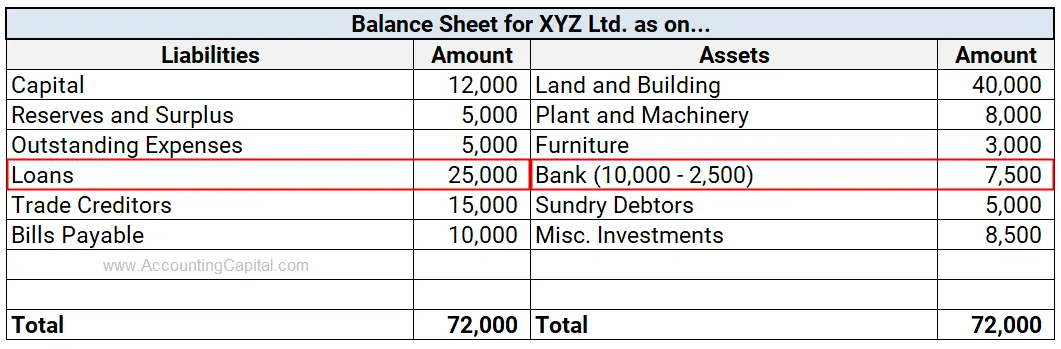

The above example shows an increase in the liabilities (current) as a “bank overdraft”.

The above example shows an increase in the liabilities (current) as a “bank overdraft”.