Nowadays, it’s not exactly unusual for us to see advertisements and social media campaigns surrounding the idea of investing. After all, during times of uncertainty (like we’re experiencing now), most of us are out there looking for ways to keep our futures secure while not putting too much of a strain on our wallets in the immediate future. How can we navigate this situation?

As you may or may not already know, there are a ton of different ways to invest. Whether you want to opt for something like stocks and bonds or you’d prefer to go with commodities and other assets, you have choices available. Curious about what some of those are and what it means to invest in them? You can check out this page for some further details before we dive in.

No matter what type of investment you’re opting for, it doesn’t hurt to learn more about it before you sink a ton of cash into it. Additionally, there are companies for pretty much all of the different fields of investment that can offer some valuable insights into how the process works. If you’re feeling stuck on any of the aspects of it, that may be a good place to start.

That all said if you’d like to get some more perspectives on how these companies operate, as well as whether or not it’s worth working with them to improve your own investment portfolio, then you’ve come to the right place. We’ll be covering all of that and more, so make sure to follow along!

Understanding Investing

Now, before we go any further today, let’s examine what investing is in the first place. Luckily, it’s a pretty simple concept. For the most part, it involves using our money in the moment to buy some sort of future or “stock” (whether that be literal or figurative) to hopefully generate more income down the line.

Something to keep in mind, though, is that there isn’t necessarily a guarantee that you’ll get your initial money back. That’s where some of that inherent risk comes into play, which you’ve probably heard at least mentioned at some point when learning about investing in the past. Although it may not seem like that big of a deal, it’s definitely one of the parts of investing that is the biggest “downside” to it.

Of course, with that said, there are ways to mitigate our risks, if not avoid them entirely. This largely will be based on what you decide to add to your portfolio. For instance, certain assets and commodities are less risky than others. In fact, most experts consider gold to be a fairly low-risk type of asset in general.

Groups like Bonds Online discuss this in more detail on their websites if that’s something that interests you more. For now, though, we’ll be focusing on some of the specifics of gold investing and why it’s considered in this category. After all, to understand the companies trying to sell their services related to it, we have to know the basics first!

Precious Metals: What are They, and How Can we Invest in them?

With the basic concept of investing out of the way, we can turn our attention to the “good stuff.” By good stuff, we mean the main meat and potatoes of today’s topic! Now, for anyone who wasn’t aware, there are several types of precious metals. They are gold, silver, palladium, and platinum.

Each has special properties that make them unique. Their high conductivity but low corrosiveness and reactivity make them quite popular in all sorts of manufacturing, beyond just the “traditional” uses for them such as jewellery and other collectables. Typically, that’s how we think of them, but this isn’t entirely correct.

Precious metals are fairly rare, which is another aspect of why they’re called that in the first place (as well as how they ended up in that classification). The rarest ones are in the platinum family, and the most common one is of course silver. Out of all of them, gold is the most popular investment.

Why is that? There are a few reasons (as you can probably expect), but it’s mostly because as an asset, it’s the most accessible while still providing good returns. Silver is easier to buy when it comes to bullion (bars), but it just isn’t as strong of a market. The prices fluctuate much more as well.

From that perspective, it’s not hard to see why so many investors gravitate towards gold. As far as what type of asset it is, it’s considered a “commodity.” Commodities are simply asset class that are raw materials used in manufacturing or other types of processes. So, they’re not a finished product (most of the time).

We can invest in them in all sorts of ways, though. Realistically speaking, we can check out pages like this one, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1023694, to get some information on the commodity side of it. Otherwise, checking out stocks and bonds for companies involved with the processing of precious metals might be the route for you to take.

Investment Companies

Next on the docket, we have the entire concept of investment companies. In the market for precious metals, they can serve as advisory groups as well as brokers for the metals themselves. Finding places to purchase bullion isn’t always easy otherwise. What can they do for us, then?

Setting up a gold IRA (individual retirement arrangement) is one of the biggest services. You see, that’s a specialized process that involves creating a self-directed IRA, which isn’t something that many of us specialize in. So, these companies such as the one mentioned in the title are there to assist us along the way.

Beyond just that, though, they can serve as an advisor for these sorts of circumstances. Certain times are inevitably going to be better to establish a retirement account that revolves around precious metals (usually gold) than others. Right now, we’re seeing a boom in the precious metals market.

Likely, this is because of all of the inflation that we’ve been seeing across the world. Paper currency loses value over time – that’s just kind of how it works. In contrast, platinum, gold, palladium, and silver tend not to lose nearly as much value, if they lose any. So, it’s hard to ignore the fact that they’re a type of investment that is relatively risk-free compared to stocks and bonds.

Are they Worth Turning to?

Even the most experienced investor can get some useful information and insider information if they decide to work with one of these groups and/or companies. That’s their purpose, really – they’re here to be an asset for all different types of investors, no matter where you are on your financial journey. No matter what, it can be a real challenge to figure out what to put your money into.

This is especially true when it comes to retirement, which is often what these sorts of companies focus on. Although we wouldn’t necessarily recommend that you sink all of your net worth into gold for your retirement years, having some in the form of bullion or an individual retirement arrangement can help mitigate any stresses that you have down the line.

Life is often unpredictable. Having a safety net is never a bad thing, in that sense. Setting that up is the hard part, especially in times like this where so many of us are strapped for cash. Investing can feel like it’s impossible, even.

If you’re feeling this way, don’t lose hope. Advisors and finance companies like these can help you figure out options that can work for you without breaking the bank. You don’t have to empty your wallet to accomplish it, either.

The important thing is that you find a company that is reputable. What might that look like, though? Being around for many years is a big one. Decades is preferable since we want experts who really know what they’re talking about.

High levels of customer satisfaction are another huge aspect that we can prioritize. No one really wants to deal with shoddy customer service or poor knowledge of the field, so check out some reviews before you decide to get an advisor or buy into a group like this. Some of the resources we’ve provided above might help with that.

Related Topic –

Related Topic –

Related Topic –

Related Topic –

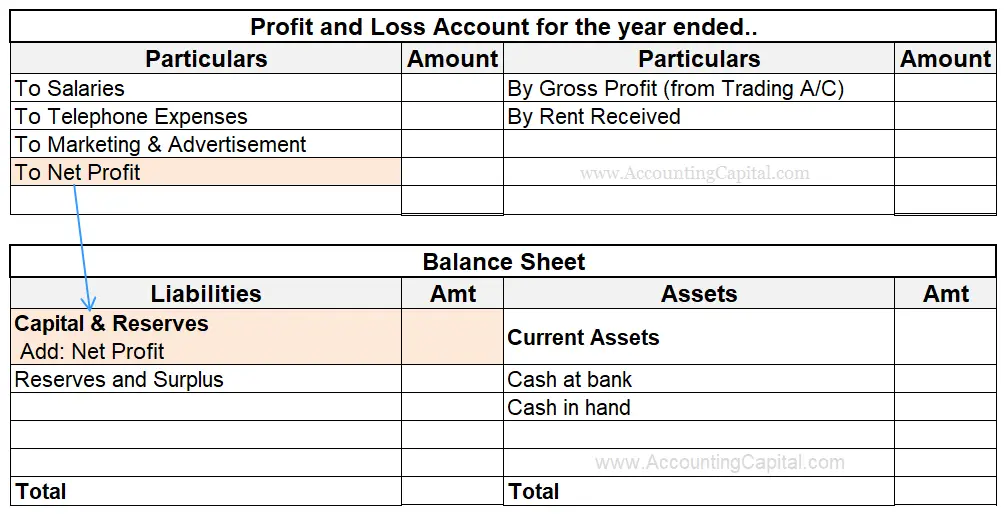

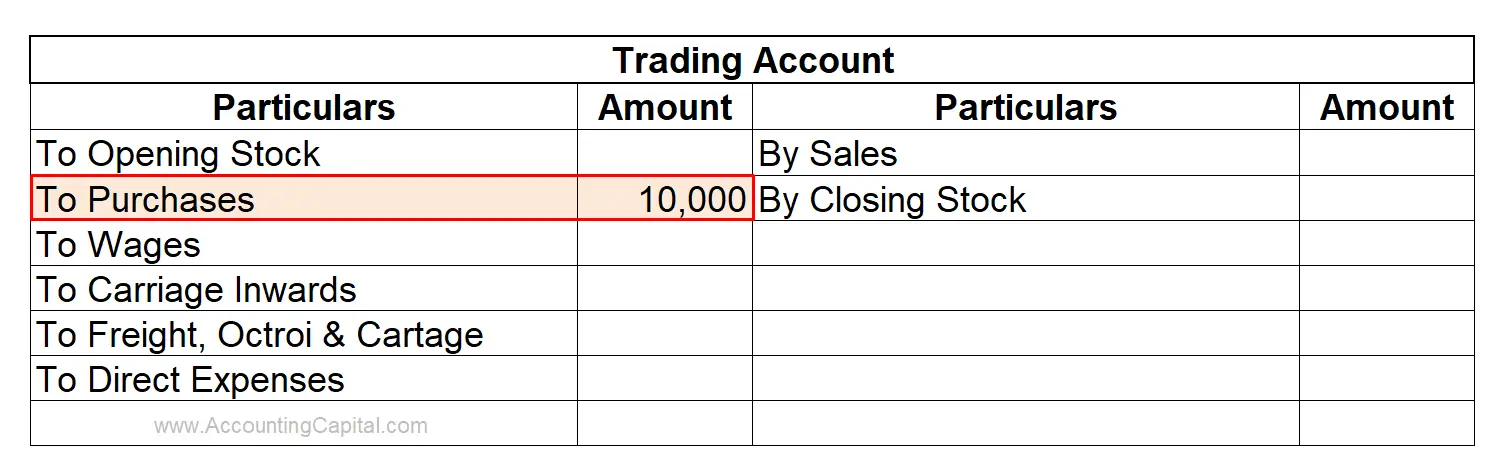

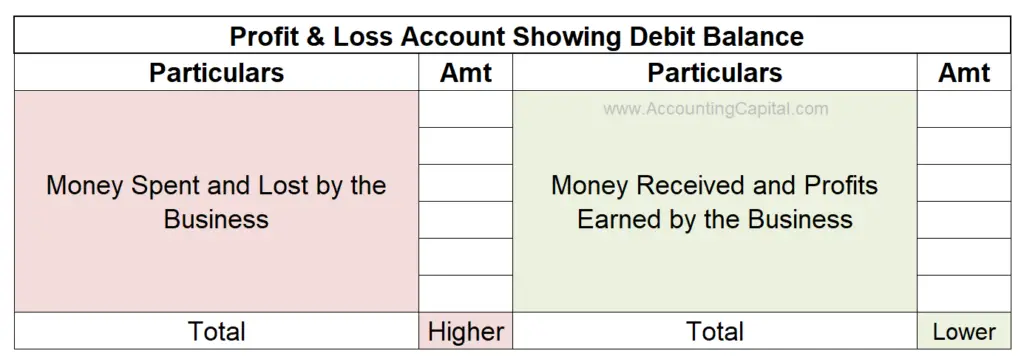

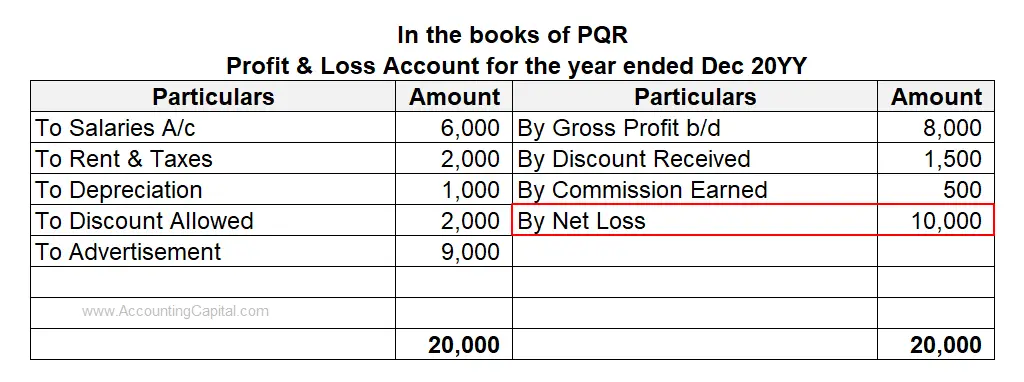

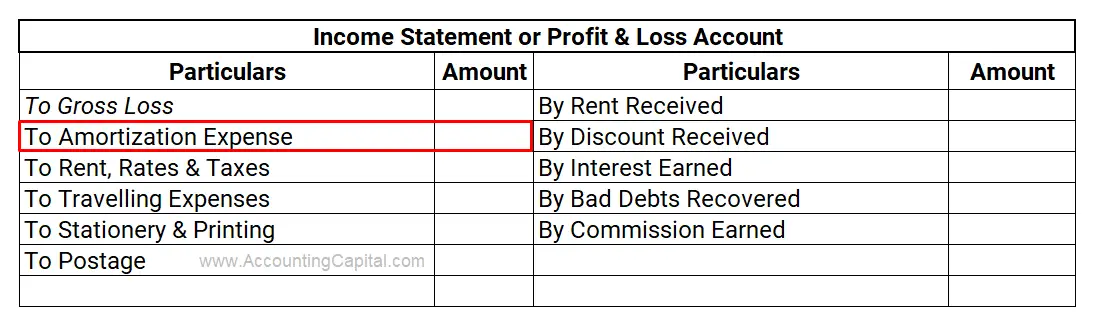

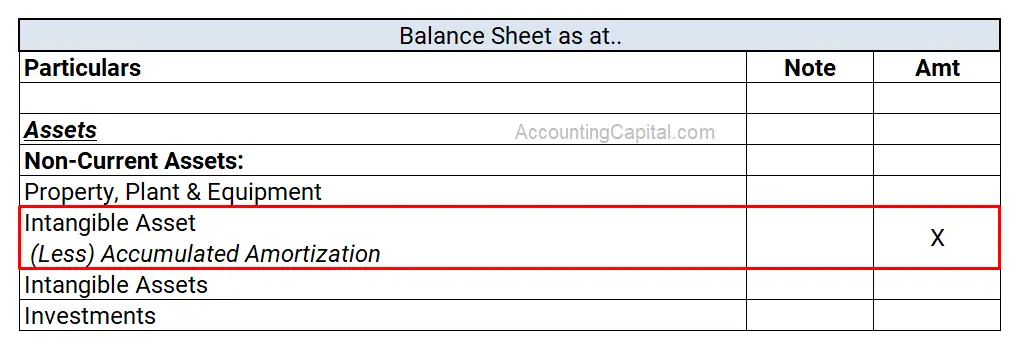

So, if you hear someone say, “We have a debit balance in our Profit and Loss account”, it’s like saying, “We spent more than we earned. We have a loss!”. Therefore Debit Balance of Profit and Loss Account means “Loss” or “Net Loss” for a business.

So, if you hear someone say, “We have a debit balance in our Profit and Loss account”, it’s like saying, “We spent more than we earned. We have a loss!”. Therefore Debit Balance of Profit and Loss Account means “Loss” or “Net Loss” for a business. In the above example, the debit total is 20,000, and the credit total is 10,000. The balance of 10,000 on the credit side represents the balancing figure, which has been highlighted in red.

In the above example, the debit total is 20,000, and the credit total is 10,000. The balance of 10,000 on the credit side represents the balancing figure, which has been highlighted in red.

Related Topic –

Related Topic –

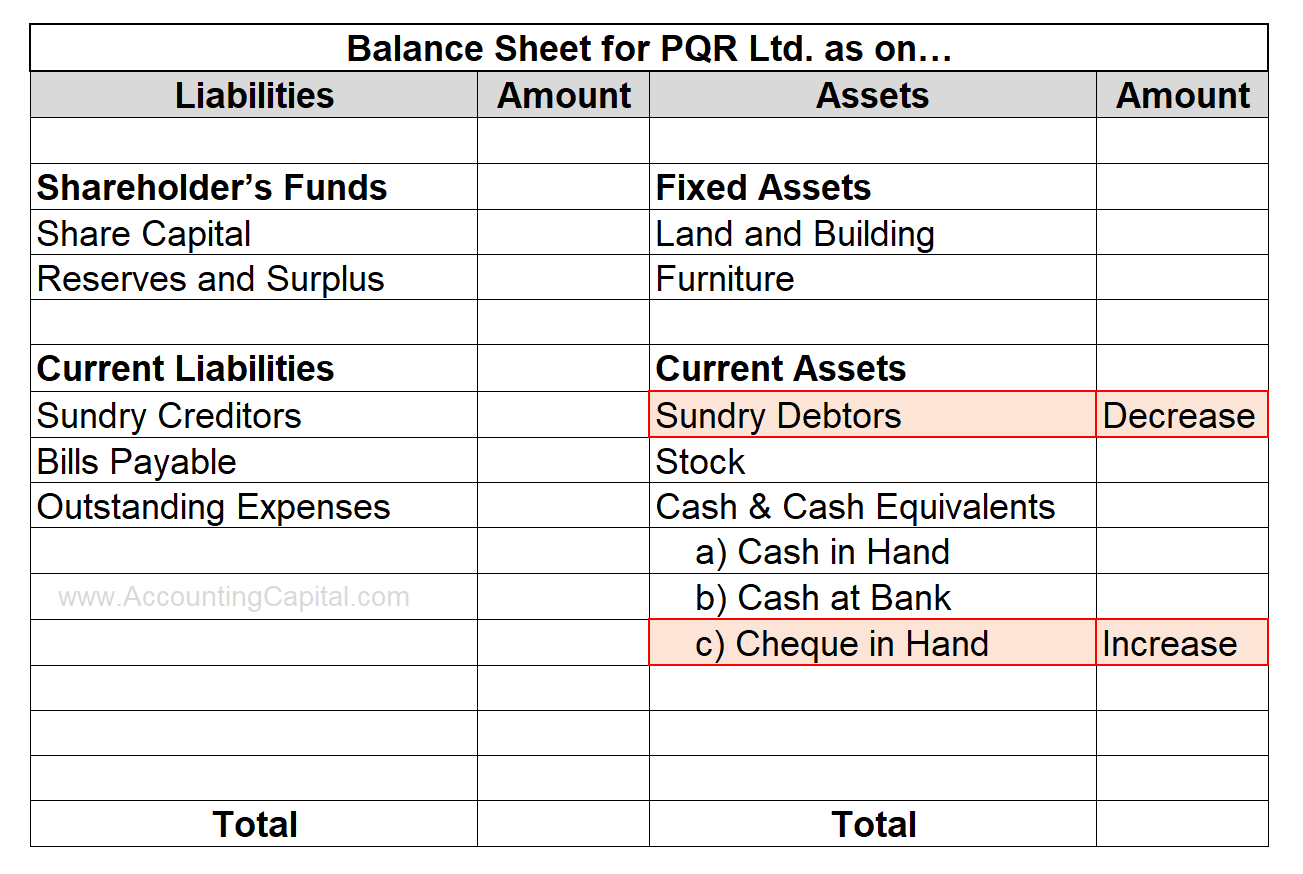

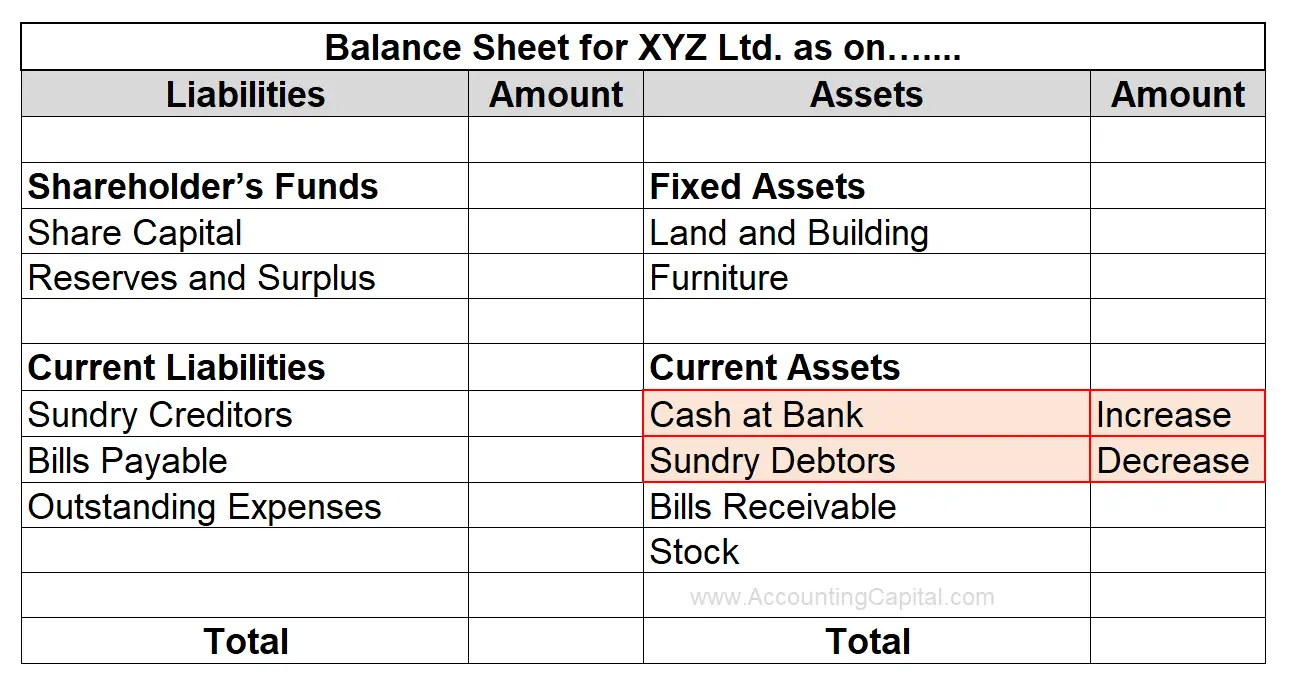

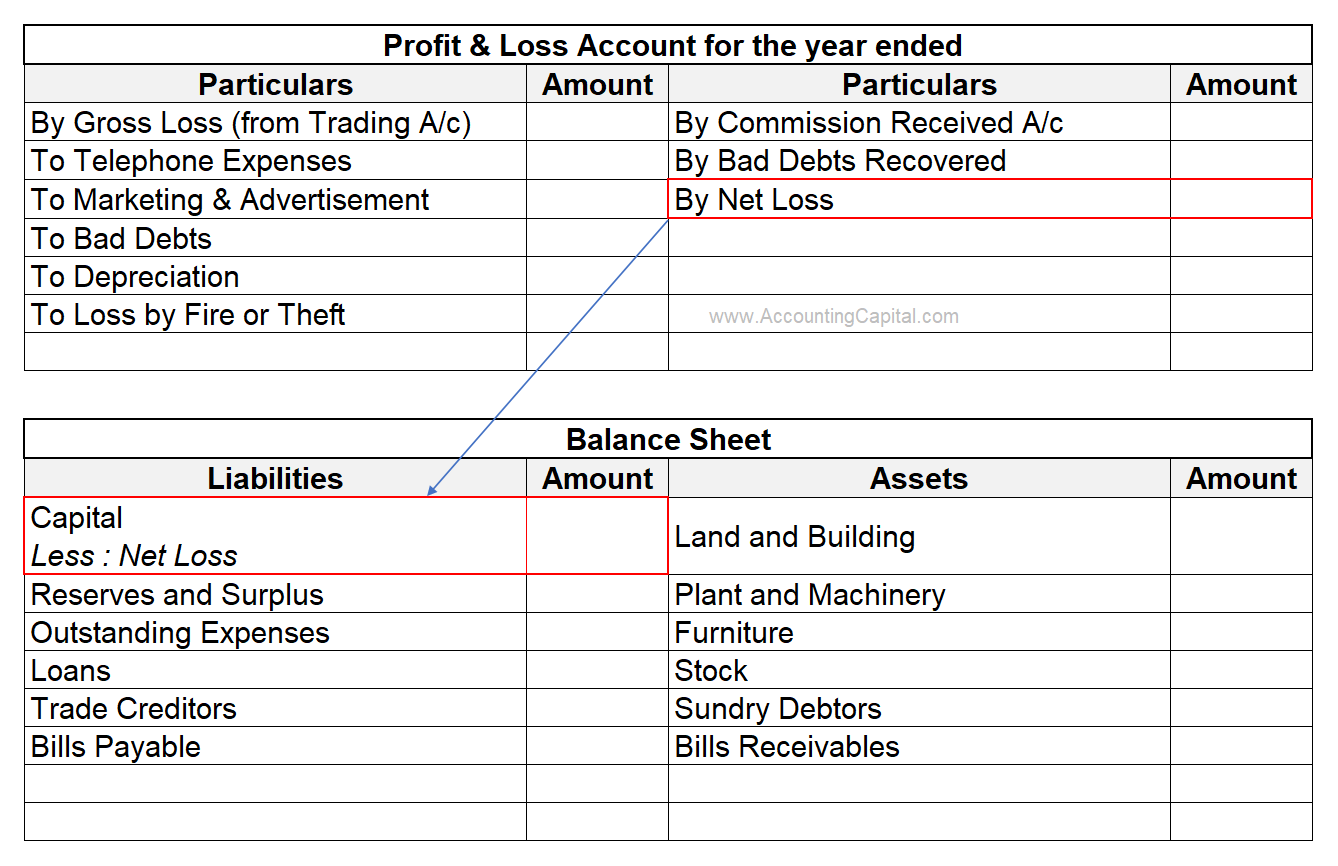

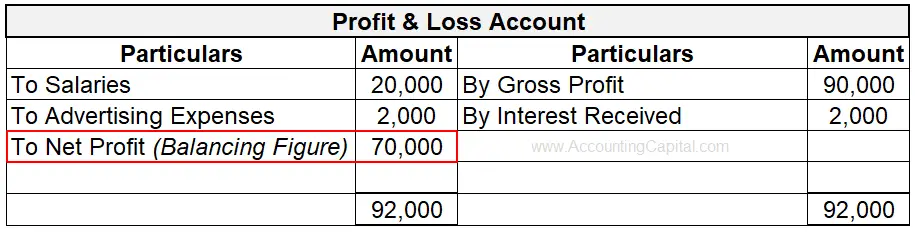

In the above example, the debit total is 22,000, and the credit total is 92,000. The balance of 70,000 represents the balancing figure, which has been highlighted in red.

In the above example, the debit total is 22,000, and the credit total is 92,000. The balance of 70,000 represents the balancing figure, which has been highlighted in red.