Outsourcing software development has become an increasingly popular strategy for businesses looking for cost-effective solutions and access to an international talent pool. Understanding the IT outsourcing costs is vital in making informed decisions and forging successful partnerships. In this article, we explore outsourcing software development costs in 2023-2024 by delving into key factors affecting pricing as well as offering insight to help navigate the outsourcing landscape successfully.

Factors That Influence IT Outsourcing Costs

Location-Based Cost Variations

One of the primary factors impacting software development outsourcing prices is the geographical location of outsourcing destinations. Labour costs differ across nations and regions, impacting the overall project budget.

North American and Western European software development rates generally tend to be higher compared with Eastern Europe, Asia, or Latin America – assess cost differentials across potential outsourcing destinations to find an economical choice that does not compromise quality.

Hourly Rates of Outsourcing Developers

Hourly rates play a pivotal role when it comes to estimating outsourcing software development costs. They can vary significantly depending on factors like project complexity, required skills and expertise levels, and the location of development teams; more specialized skills like AI, blockchain, or machine learning may command higher hourly rates.

Ensure you take into account both your project requirements and budget constraints when reviewing hourly rates to achieve a balance between quality and cost-effectiveness when making this evaluation.

Complexity and Scope of Software Development Project

The complexity and scope of a software development project have an immediate effect on outsourcing costs. Projects with complex features, advanced functionalities, or larger scopes generally take more time and resources, driving up costs significantly.

Assess the complexity of your project before communicating the requirements clearly to an outsourcing partner; discuss projected timelines and resource allocation to gain a fuller picture of associated costs.

Development Team Size and Composition

The size and composition of the development team involved in your project can have an effect on outsourcing costs. Larger teams require more resources and coordination efforts, which can impact the budget.

Furthermore, a composition such as a mix of senior/junior developers can have an effect – senior developers may command higher hourly rates while junior developers might prove more cost-effective; make your decision according to project requirements and budget constraints.

Contract Type and Duration

The type and length of the contract also have a significant effect on outsourcing software development costs. Fixed-price contracts provide clear visibility into costs from the beginning, while time and materials contracts provide flexibility but may lead to overruns if managed incorrectly.

When choosing between fixed-price contracts or time and materials contracts for your project, think about its nature, the level of uncertainty involved, the flexibility offered, and longer contracts that provide stability while possibly offering lower hourly rates as the optimal contract type – the right contract type depends entirely on both factors.

Vendor Reputation and Expertise

When it comes to software outsourcing costs, the reputation and expertise of an outsourcing vendor play an essential part. Established providers with established track records may charge higher rates due to their experience and quality assurance procedures; however, partnering with such vendors can bring long-term advantages such as reduced risks, better project management practices, and superior deliverables.

When assessing outsourcing costs, it is important to evaluate all these elements: portfolio reviews from clients as well as industry certifications of potential vendors.

Hidden or Additional Costs

When estimating outsourcing software development costs, it is critical to factor in any hidden or additional expenses that may arise during project execution.

Such expenses might include project management fees, infrastructure setup expenses, legal expenses, or travel costs related to on-site visits. Be sure to negotiate these upfront with your outsourcing vendor to prevent surprises and ensure a transparent budgeting experience.

Communication and Collaboration Expenses

Strong communication is integral to successful outsourcing partnerships. However, communication expenses like international phone calls, video conferencing tools, project management software licenses, or project management platform fees can significantly add up during an outsourcing partnership project.

When selecting the tools required for collaboration or assessment of any associated costs, it is essential that these tools fit within budget; consider cost-effective communication platforms as well as scheduling regular meetings in order to optimize collaboration without incurring excessive expenses.

Conclusion

Knowledge of IT outsourcing costs in 2023-2024 is vital for making informed decisions and optimizing the value of outsourcing partnerships. When considering location-based cost variations, hourly rates of outsourced developers and other factors mentioned above should be taken into consideration.

Related Topic –

Related Topic –

Related Topic –

Related Topic –

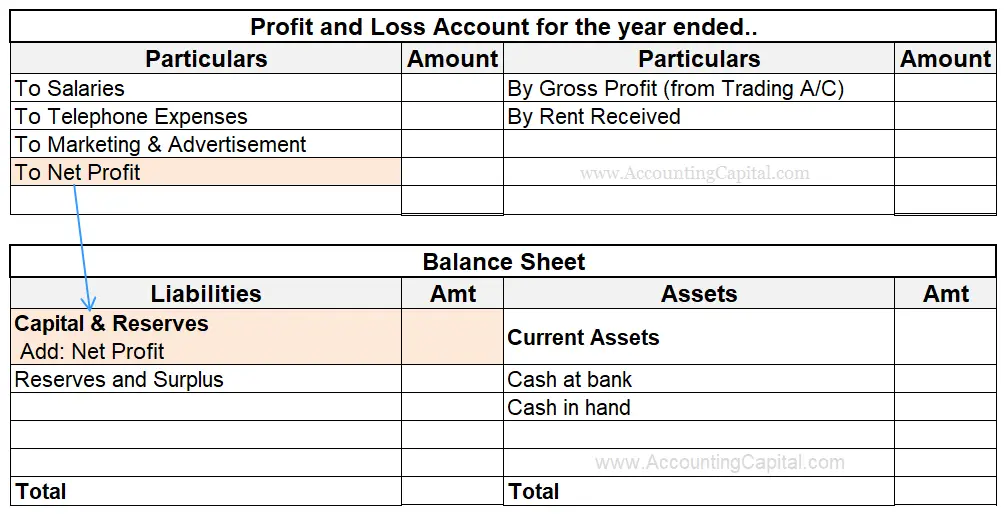

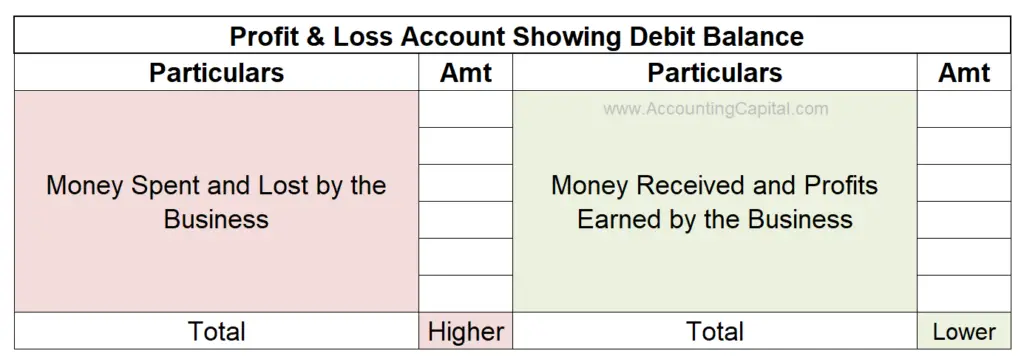

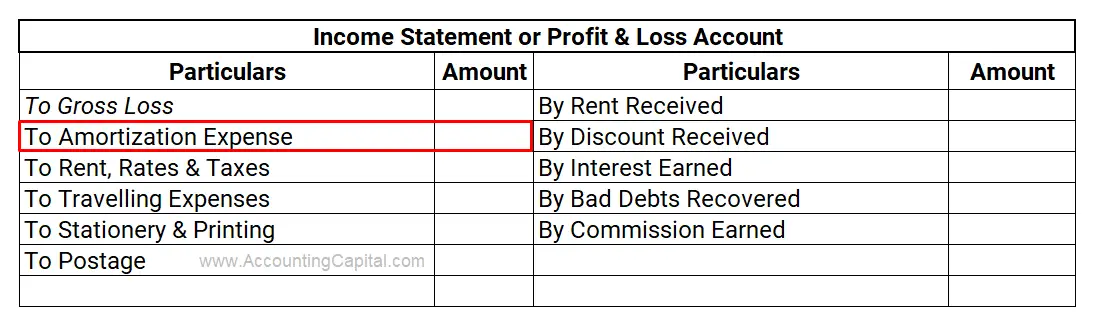

So, if you hear someone say, “We have a debit balance in our Profit and Loss account”, it’s like saying, “We spent more than we earned. We have a loss!”. Therefore Debit Balance of Profit and Loss Account means “Loss” or “Net Loss” for a business.

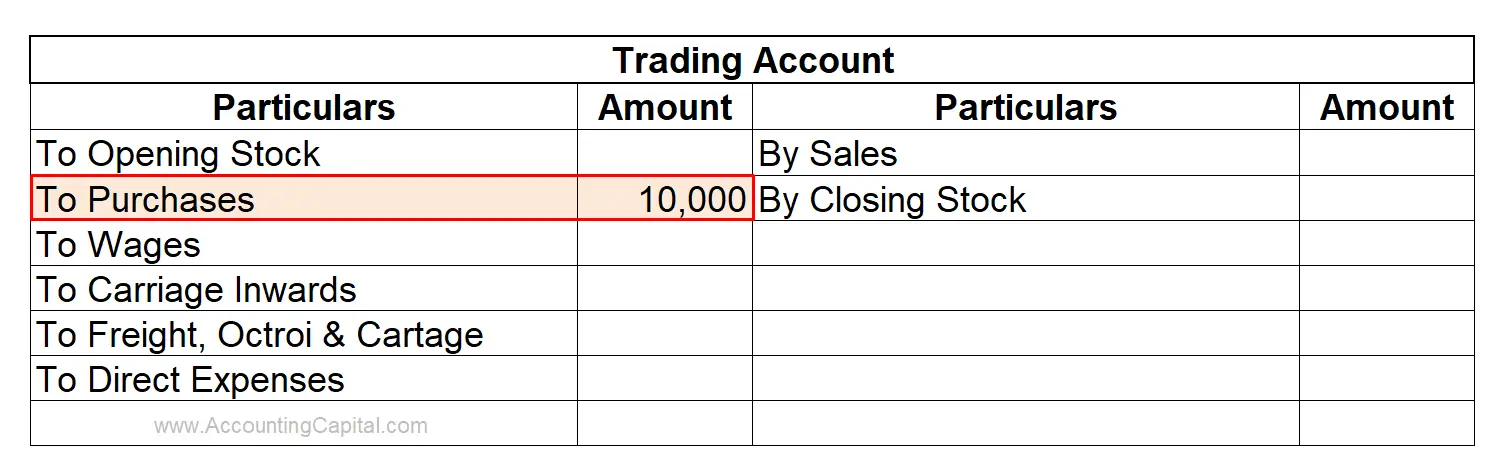

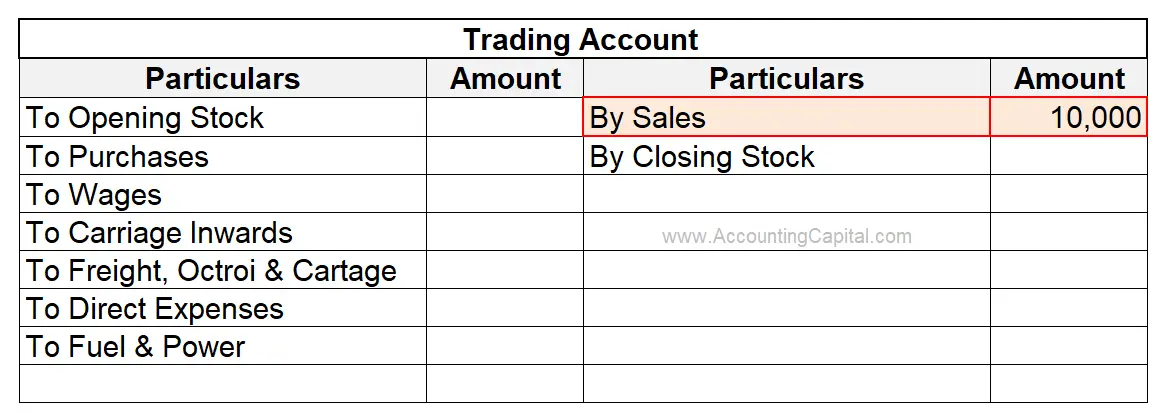

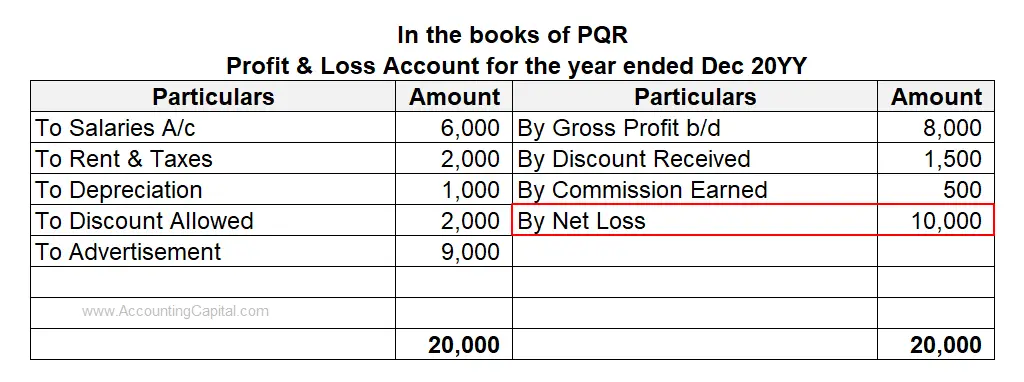

So, if you hear someone say, “We have a debit balance in our Profit and Loss account”, it’s like saying, “We spent more than we earned. We have a loss!”. Therefore Debit Balance of Profit and Loss Account means “Loss” or “Net Loss” for a business. In the above example, the debit total is 20,000, and the credit total is 10,000. The balance of 10,000 on the credit side represents the balancing figure, which has been highlighted in red.

In the above example, the debit total is 20,000, and the credit total is 10,000. The balance of 10,000 on the credit side represents the balancing figure, which has been highlighted in red.

Related Topic –

Related Topic –

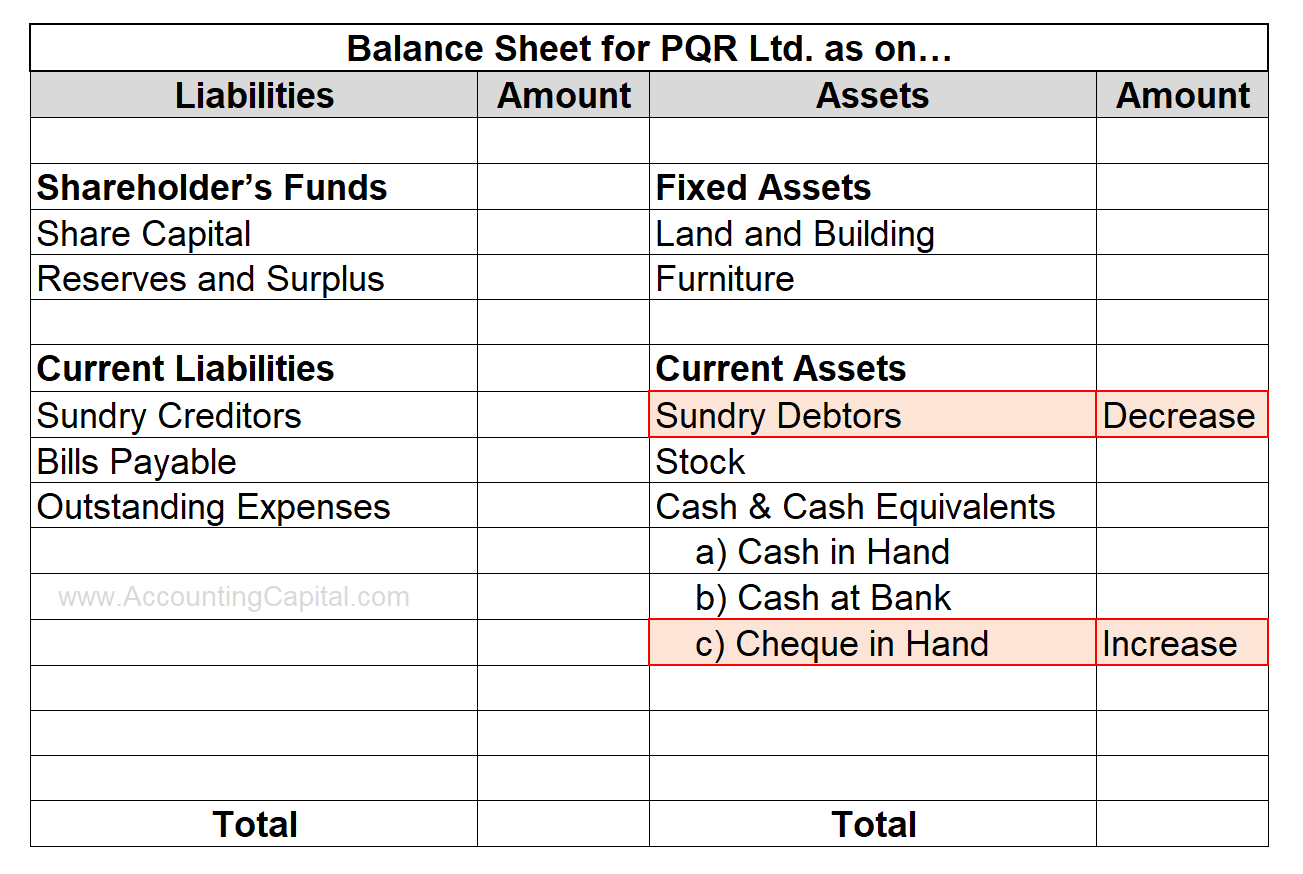

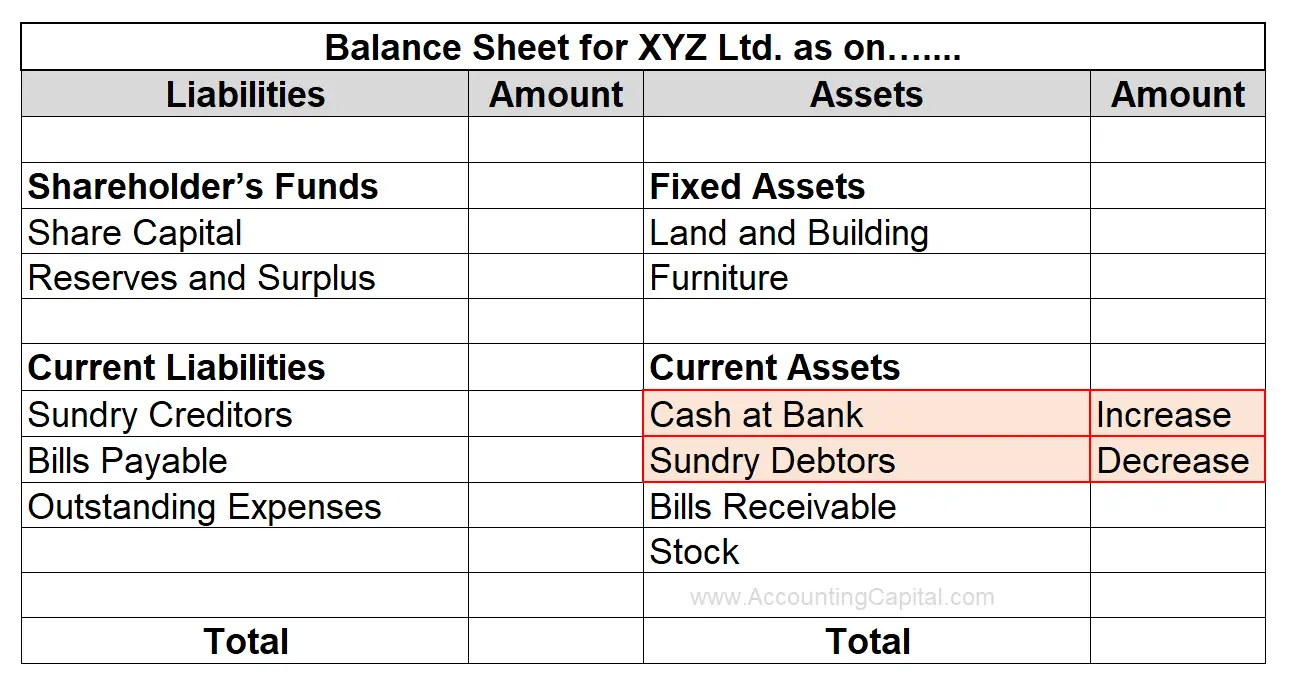

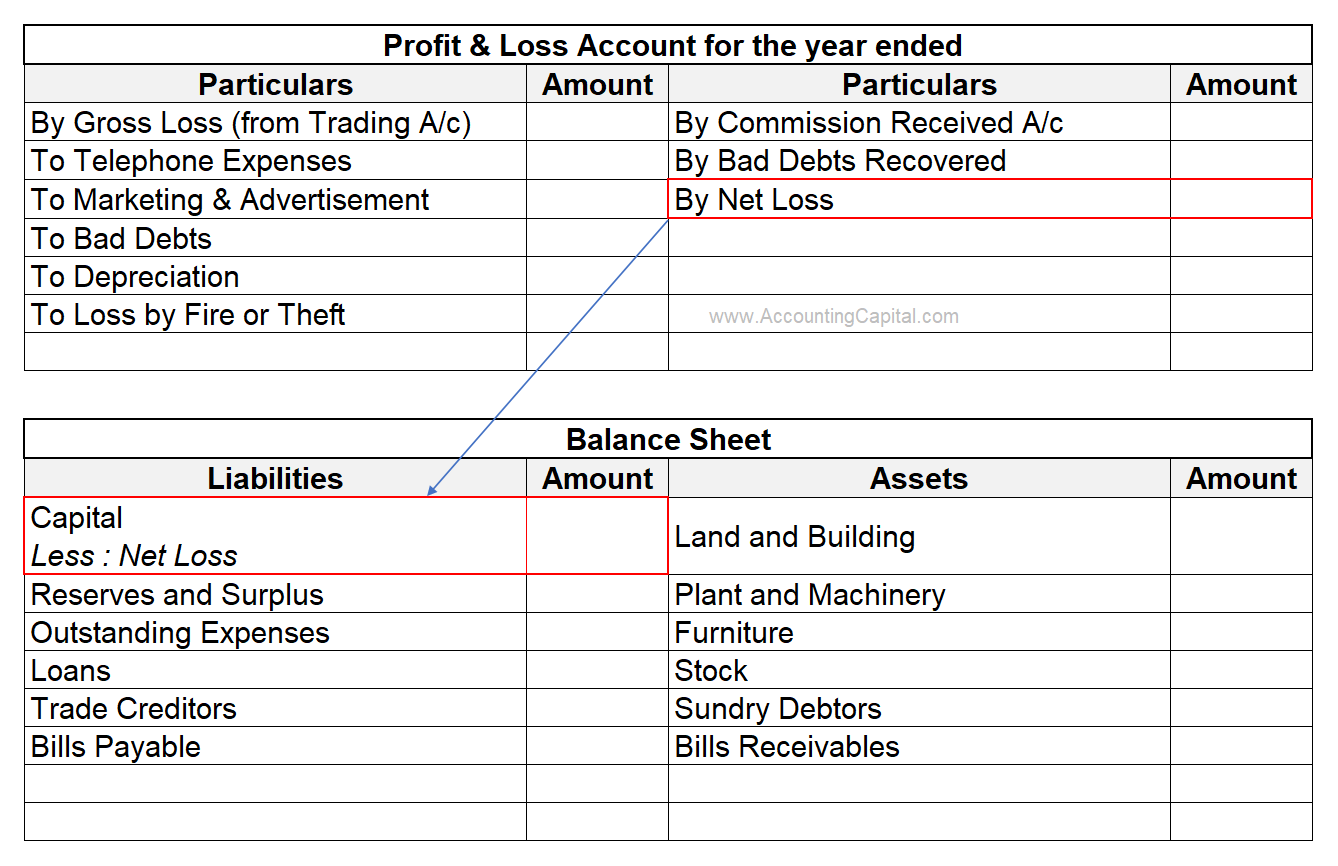

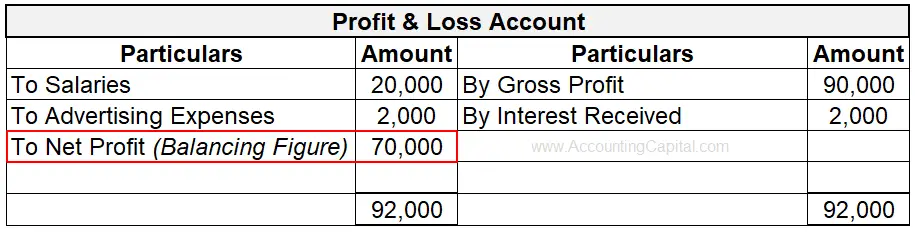

In the above example, the debit total is 22,000, and the credit total is 92,000. The balance of 70,000 represents the balancing figure, which has been highlighted in red.

In the above example, the debit total is 22,000, and the credit total is 92,000. The balance of 70,000 represents the balancing figure, which has been highlighted in red.