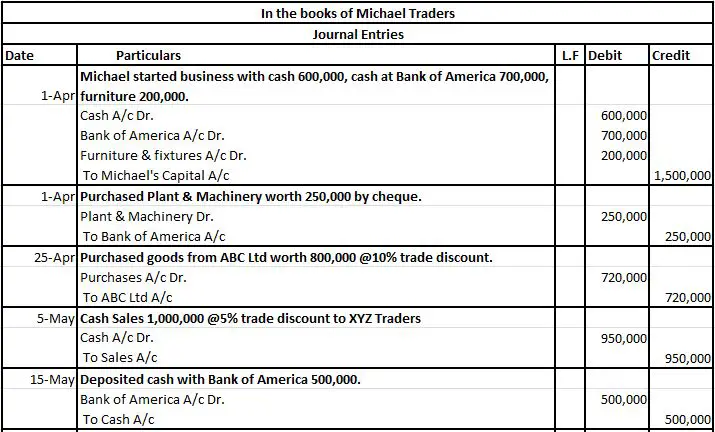

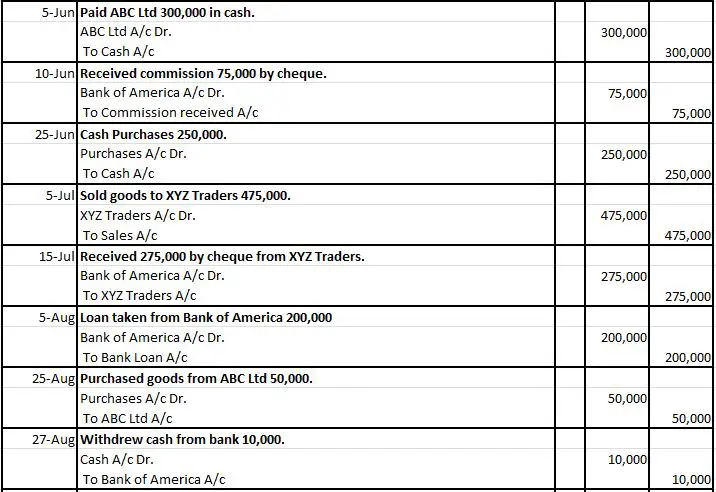

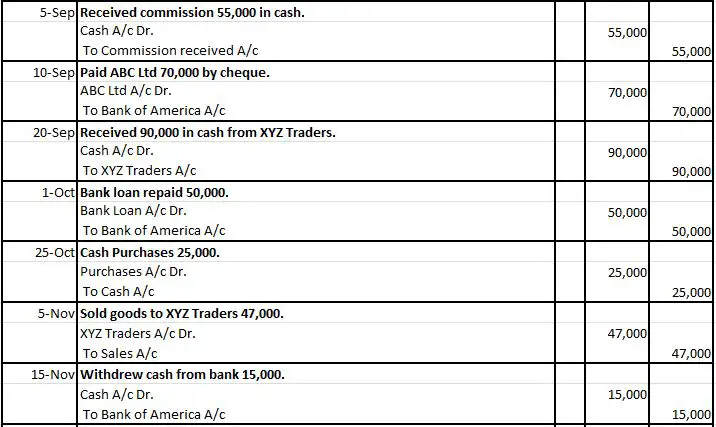

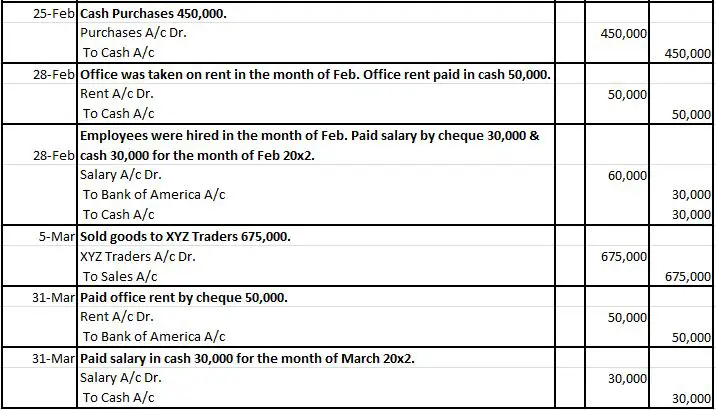

The journal book must record every business transaction, which means entries need to be made. In accounting lingo, this is called a journal entry. We will provide you with 20 frequently asked journal entry examples on Google along with their logic.

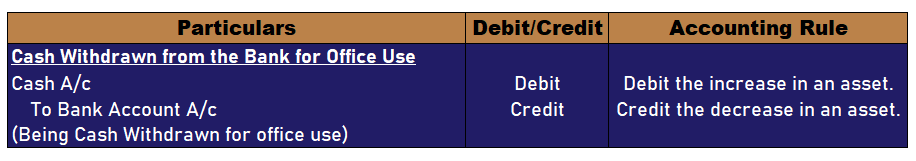

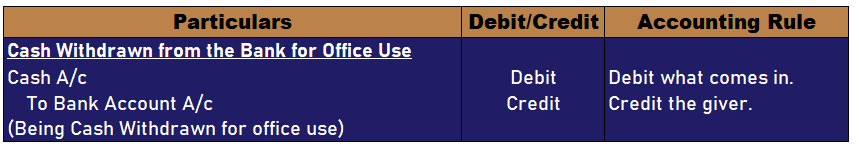

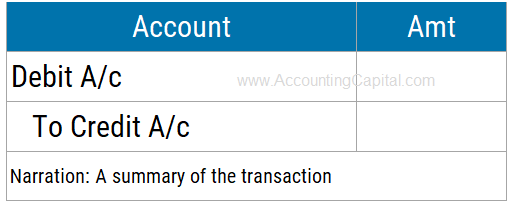

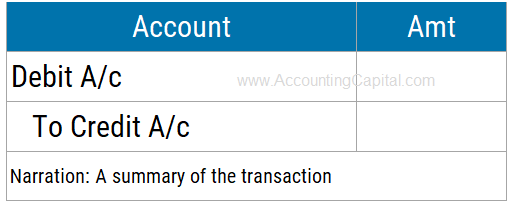

When following double-entry bookkeeping there needs to be at least 1 debit & 1 credit. The below image is helpful to understand the format of a journal entry. Knowing which account to debit and which to credit is crucial.

Examples of Journal Entries with a PDF

- Journal Entry for Business Started (in cash)

- Journal Entry for Sales (Credit)

- Journal Entry for Purchases (Credit)

- Journal Entry for Drawings (Cash)

- Journal Entry for Drawings (Goods)

- Journal Entry for Asset Purchase

- Journal Entry for Depreciation

- Journal Entry for Bad Debts

- Journal Entry for Free Samples/Charity

- Journal Entry for Discount Allowed

- Journal Entry for Discount Received

- Journal Entry for Outstanding Expenses

- Journal Entry for Prepaid Expenses

- Journal Entry for Income Received in Advance

- Journal Entry for Accrued Income

- Journal Entry for Amortization Expense

- Journal Entry for Interest on Capital

- Journal Entry for Interest on Drawings

- Journal Entry for Goods Returned

- Journal Entry for Manager’s Commission

Download our Free PDF at the End

1. Journal Entry for Business Started (in cash)

When a business commences and capital is introduced in form of cash.

| Cash A/c |

Debit |

| To Capital A/C |

Credit |

- Cash is an asset for the business hence debit the increase in assets.

- Capital is an internal liability for the business hence credit the increase in liabilities.

Example – Max started a business with 10,000 in cash.

| Cash A/c |

10,000 |

| To Capital A/C |

10,000 |

(Capital introduced by Max in cash for 10,000)

Related Topic – All Journal Entries on one Page

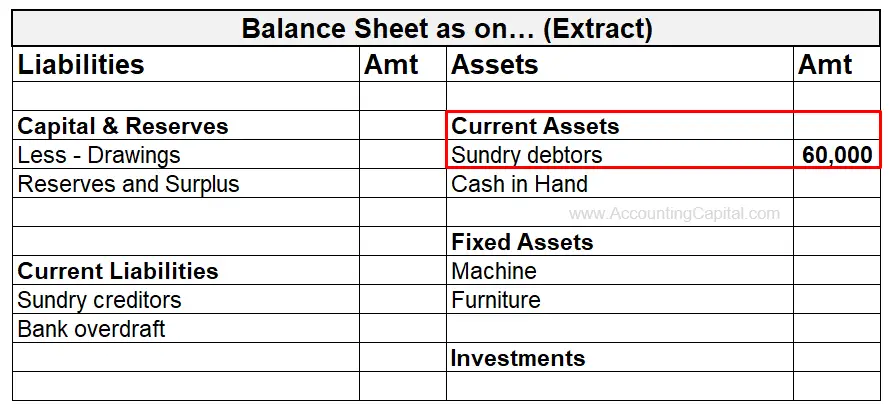

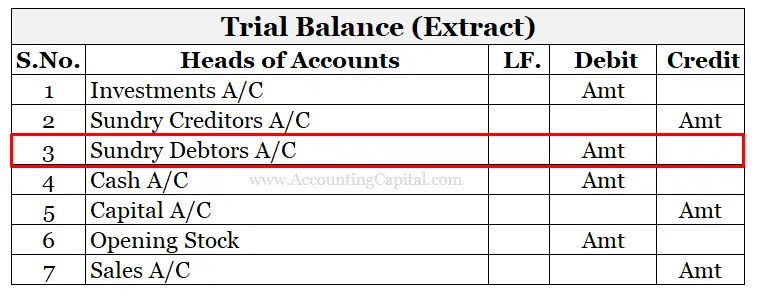

2. Journal Entry for Sales (Credit)

The sale of goods by a business on credit.

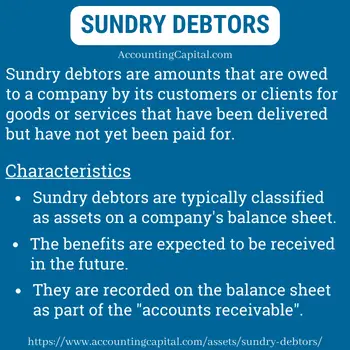

| Debtors A/C |

Debit |

| To Sales A/C |

Credit |

- Debtors are assets for the business, therefore debit the increase in assets.

- Sales are income earned by the business, therefore credit the increase in income.

Example – Sold goods worth 4,000 to ABC & Co. on credit

| ABC & Co. A/C |

4,000 |

| To Sales A/C |

4,000 |

(4,000 worth of goods sold to ABC & Co. on credit)

Related Topic – Try our Free Journal Entry Quiz for Practice

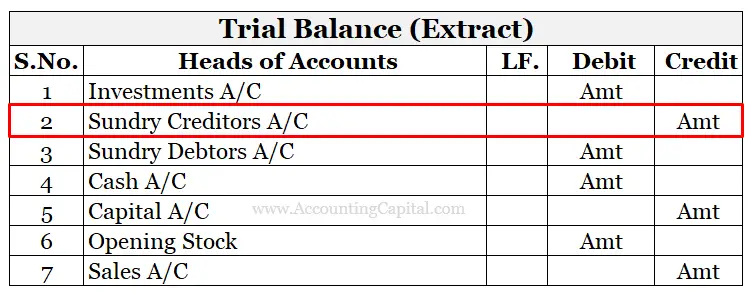

3. Journal Entry for Purchases (Credit)

When a business purchases goods from a supplier on credit.

| Purchases A/C |

Debit |

| To Creditors A/C |

Credit |

- Purchase is a direct expense for the business therefore debit the increase in expense.

- Creditors are a liability for the business thus, credit the increase in liability.

Example – Purchased goods worth 3,000 from HM Ltd. on credit

| Purchases A/C |

3,000 |

| To HM Ltd. A/C |

3,000 |

(Goods worth 3,000 purchased from HM Ltd. on credit)

Related Topic – Journal Entry for Cash Deposited in Bank

4. Journal Entry for Drawings (Cash)

Drawings are personal withdrawals made by the owner and act as a reduction in the owner’s capital.

| Drawings A/C |

Debit |

| To Cash A/C |

Credit |

- Drawings are a reduction in capital for the business therefore debit the decrease in capital.

- Cash withdrawal from the business is a reduction in current assets as a result credit the decrease in assets.

Example – Max Withdrew 1,000 in cash for personal use from his business.

| Drawings A/C |

1,000 |

| To Cash A/C |

1,000 |

(1,000 withdrawn for personal use by Max)

5. Journal Entry for Drawings (Goods)

In case an owner makes a personal withdrawal in form of goods.

| Drawings A/c |

Debit |

| To Stock A/c |

Credit |

- Drawings are a reduction in capital for the business therefore debit the decrease in capital.

- Stock is an asset for the business hence credit the decrease in assets. Alternatively, the purchase account can be credited instead of the stock account.

Example – Max withdrew goods worth 2,000 for personal use.

| Drawings A/c |

2,000 |

| To Stock A/c |

2,000 |

(Goods worth 2,000 withdrawn by max)

6. Journal Entry for Asset Purchase

When a business purchases an asset for cash.

| Asset A/c |

Debit |

| To Cash A/C |

Credit |

- A new purchase increases overall assets for the firm, therefore, debit the increase in assets.

- When a business makes a payment in cash it reduces current assets therefore, credit the decrease in assets.

Example – Purchased Plant & Machinery worth 4,000 in cash.

| Plant & Machinery A/c |

4,000 |

| To Cash A/C |

4,000 |

(Plant & Machinery bought in cash)

7. Journal Entry for Depreciation

The term ‘depreciation’ describes the reduction in the value of a tangible asset as a result of normal use, wear and tear, new technology, and/or unfavourable market conditions.

i) With Accumulated Depreciation

| Depreciation A/C |

Debit |

| To Accumulated Depreciation A/C |

Credit |

Example – Provide 10% depreciation on Plant & Machinery worth 4,000.

| Depreciation on Plant & Machinery A/C |

400 |

| To Accumulated Depreciation A/C |

400 |

(10% depreciation provided on plant & Machinery)

ii) Without Accumulated Depreciation

| Depreciation A/C |

Debit |

| To Asset A/C |

Credit |

- Depreciation is an expense to the business therefore debit the increase in expense.

- Depreciation results in the reduction of the value of tangible fixed assets therefore credit the decrease in assets.

Example – Provide 10% depreciation on Plant & Machinery worth 4,000.

| Depreciation on Plant & Machinery A/C |

400 |

| To Plant & Machinery A/C |

400 |

(10% depreciation provided on plant & Machinery)

Related Topic – Which Contra Account is used in Recording Depreciation?

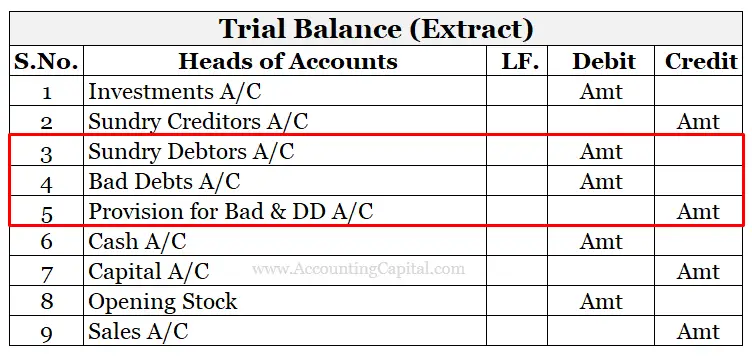

8. Journal Entry for Bad Debts

When a customer fails to repay the amount owed it is known as a bad debt. It is an expense/loss for the business.

| Bad Debts A/C |

Debit |

| To Debtors A/C |

Credit |

- Bad Debt is an expense for the business thus debit the increases in expenses.

- As the customer has defaulted and money is no longer receivable this is seen as a reduction in debtors, therefore, credit the decrease in assets.

Example – ABC & Co. became insolvent and the business is unable to recover 500.

| Bad Debts A/C |

500 |

| To ABC & Co. A/C |

500 |

(Bad debts recorded for 4,000)

Related Topic – Are Bad Debts Liabilities?

9. Journal Entry for Free Samples/Charity

Free samples or donations made to charity are treated as an advertising expense by the business.

| Advertisement A/C |

Debit |

| To Purchases A/C |

Credit |

- Advertisement is an expense for the business hence debit the increase in expenses.

- Free samples/Donations are reduced directly from the purchases. Free samples/Donations are adjusted directly from the purchases to show a reduction in inventory, therefore, credit the decrease in assets.

Example – Goods worth 500 distributed as free samples.

| Advertisement A/C |

500 |

| To Purchases A/C |

500 |

(Goods worth 500 distributed as free samples)

Related Topic – Journal Entry for Free Samples and Charity (in Detail)

10. Journal Entry for Discount Allowed

The practice of allowing discounts to customers on goods purchased.

| Cash A/C |

Debit |

| Discount Allowed A/C |

Debit |

| To Debtor’s A/C |

Credit |

- Cash is received by the business, therefore, debit the increase in assets.

- Discount allowed is an expense for the business hence debit the increase in expenses.

- Debtors are an asset to the business and therefore credit the decrease in assets.

Example – Received 1,900 from XYZ in full settlement of their dues of 2,000.

| Cash A/C |

1,900 |

| Discount Allowed A/C |

100 |

| To XYZ & Co. A/C |

2,000 |

(1,900 received from XYZ in cash with 100 as a discount)

Related Topic – Journal Entry for Discount Allowed (in detail)

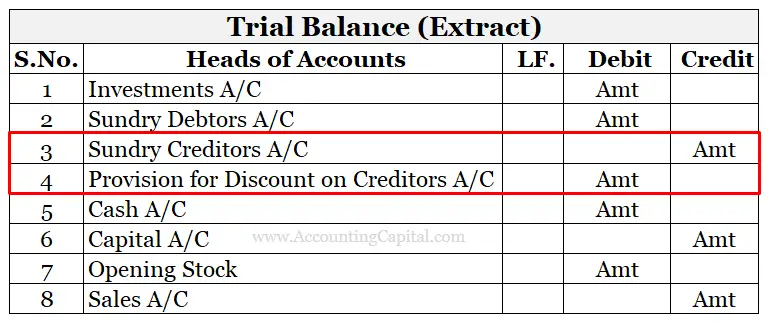

11. Journal Entry for Discount Received

It may be possible to receive discounts from suppliers in certain situations for e.g. if a firm purchases in bulk or in case of early payment.

| Creditor’s A/C |

Debit |

| To Cash A/C |

Credit |

| To Discount Received A/C |

Credit |

- Creditors are a liability for the business therefore debit the decrease in liability.

- Cash paid results in a reduction of assets hence credit the decrease in assets.

- Discount received is an income/gain for the business as a result credit the increase in income/gain.

Example – Paid 2,900 to HM Ltd. to settle their dues of 3,000.

| HM Ltd. A/C |

3,000 |

| To Cash A/C |

2,900 |

| To Discount Received A/C |

100 |

(2,900 paid in cash to HM Ltd. and received 100 as a discount)

12. Journal Entry for Outstanding Expenses

The term “outstanding expenses” refers to expenses that are unpaid after their due date.

Step 1 – At the time of recording expenses in the books.

| Expenses A/C |

Debit |

| To Outstanding Expenses A/C |

Credit |

- When an expense is recorded as outstanding it increases the overall expenses for the firm as it belongs to the current year, therefore, debit the increase in expenses.

- Outstanding expenses are treated as a liability hence credit the increase in liabilities.

Step 2 – At the time of discharging liability.

| Outstanding Expenses A/C |

Debit |

| To Cash A/C |

Credit |

- Outstanding expense is a liability that is discharged, therefore, debit the decrease in liabilities.

- Cash is paid therefore, credit the decrease in assets.

Example Step 1 – Electricity Expense of 1,000 is unpaid on the balance sheet date.

| Electricity Expenses A/C |

1,000 |

| To Outstanding Electricity Expenses A/C |

1,000 |

(Outstanding electricity expense of 1,000 recorded)

Example Step 2 – Paid outstanding electricity expense of 1,000.

| Outstanding Electricity Expenses A/C |

1,000 |

| To Cash A/C |

1,000 |

(Outstanding electricity bill of 1,000 paid in cash)

Related Topic – What are Accruals?

13. Journal Entry for Prepaid Expenses

The term “prepaid expenses” refers to expenses that are paid before the actual due date.

Step 1 – At the time of paying an expense before the due date in cash.

| Prepaid Expense A/C |

Debit |

| To Cash A/C |

Credit |

- Prepaid Expense is treated as an asset for the business therefore, debit the increase in assets.

- The payment is made in cash therefore credit the decrease in assets.

Step 2 – Adjustment entry when the prepaid expense expires.

| Expense A/C |

Debit |

| To Prepaid Expense A/C |

Credit |

- At this point, the expense is recorded in the current period and it is no more “prepaid” therefore debit the increase in expenses.

- A prepaid expense is removed which was being treated as an asset therefore credit the decrease in assets.

Example Step 1 – Paid 2,000 as advance rent in Dec for next month.

| Prepaid Rent A/C |

2,000 |

| To Cash A/C |

2,000 |

(2,000 rent paid in advance for Jan)

Example Step 2 – Rent for 2,000 paid in the previous month to be adjusted this month. Entry on Jan 1,

| Rent Expense A/C |

2,000 |

| To Prepaid Rent A/C |

2,000 |

(Rent expense adjusted from prepaid rent)

14. Journal Entry for Income Received in Advance

It is the income that is to be earned in the future accounting period but is already received in the current accounting period.

Step 1 – At the time of receiving income in cash.

| Cash A/C |

Debit |

| To Income Received in Advance A/C |

Credit |

- Cash is an asset for the business so debit the increase in assets.

- Income received in advance is a liability for the business therefore credit the increase in liability.

Step 2 – Adjusting entry when the income is actually realized.

| Income Received in Advance A/C |

Debit |

| To Income A/C |

Credit |

- Income received in advance is adjusted so the liability is removed therefore debit the decrease in liabilities.

- Income is being recognized therefore credit the increase in revenue.

Example Part 1 – Received 2,000 rent advance in Dec for next month.

| Cash A/C |

2,000 |

| To Rent Received in Advance A/C |

2,000 |

(Advance rent received for Jan)

Example Part 2 – 2,000 rent received in the previous month to be adjusted this month.

| Rent Received in Advance A/C |

2,000 |

| To Rent Income A/C |

2,000 |

(Advance rent adjusted and income recorded)

15. Journal Entry for Accrued Income

Income earned during a period of accounting but not received until the end of that period is called accrued income.

Step 1 – When Income is earned, but not received.

| Accrued Income A/C |

Debit |

| To Income A/C |

Credit |

- Accrued income is receivable for the business therefore debit the increase in assets.

- Income is business earning therefore credit the increase in income. This is because as per the accrual concept, income should be recognised when it is earned and not when it is received.

Step 2 – When Accrued income is received in cash.

| Cash A/C |

Debit |

| To Accrued Income A/C |

Credit |

- Cash is received therefore debit the increase in assets.

- Accrued Income is an asset that is to be reversed therefore credit the decrease in assets.

Example Part 1 – Interest income of 2,500 related to the current year is due on the balance sheet date.

| Accrued Interest A/C |

2,500 |

| To Interest Income A/C |

2,500 |

(Accrued interest income recorded)

Example Part 2 – Received interest of 2,500 that belongs to the previous year.

| Cash A/C |

2,500 |

| To Accrued Interest A/C |

2,500 |

(Interest received for the previous year)

16. Journal Entry for Amortization Expense

Amortization is the same as depreciation but is charged as an expense only on intangible assets.

i) With Accumulated Amortization

| Amortization Expense A/C |

Debit |

| To Accumulated Amortization A/C |

Credit |

- Amortization is an expense to the business thus debit the increase in expenses.

- Accumulated amortization is a contra account therefore credit the increase in accumulated amortization.

Example – Patents worth 1,500 to be amortized.

| Amortization Expense A/C |

1,500 |

| To Accumulated Amortization A/C |

1,500 |

(Patents worth 1,500 amortized)

Related Topic – List of Tangible and Intangible Assets

ii) Without Accumulated Amortization

| Amortization Expense A/C |

Debit |

| To Intangible Asset A/C |

Credit |

- Amortization is an expense to the business thus debit the increase in expenses.

- Value of the related intangible asset is reduced thus credit the decrease in assets.

Example – Patents worth 1,500 to be amortized.

| Amortization Expense A/C |

1,500 |

| To Patents A/C |

1,500 |

(Being patents worth 1,500 amortized)

Related Topic – Where is Amortization shown in financial statements?

17. Journal Entry for Interest on Capital

In return for the amount of capital employed by a partner in the business, he/she may seek a fixed rate of return.

Step 1 – At the time of providing interest to the partner via his/her capital account.

| Interest on Capital A/C |

Debit |

| To Partner’s Capital A/C |

Credit |

- Interest on Capital is an expense for the business therefore debit the increase in expenses.

- Partner’s Capital is a capital account, therefore, credit the increase in capital.

Step 2 – At the time of transferring interest to the P&L appropriation account.

| Profit & Loss Appropriation A/C |

Debit |

| To Interest on Capital A/C |

Credit |

Generally, interest on capital is an appropriation of profit, which means in case of loss, no interest is to be provided. Hence, debit the Profit and loss appropriation A/C and credit Interest on capital A/C at the time of transferring Interest on Capital.

Example – Provide Interest @5% on partner’s capital 10,000.

| Interest on Capital A/C |

500 |

| To Partner’s Capital A/C |

500 |

(Interest on partner’s capital provided)

| Profit & Loss Appropriation A/C |

500 |

| To Interest on Capital A/C |

500 |

(Interest on partner’s capital transferred to P&L appropriation)

Related Topic – Is capital an asset or liability?

18. Journal Entry for Interest on Drawings

Drawings are goods or cash withdrawn by a proprietor for their personal use from the business. In this case, the proprietor may be charged interest at a fixed rate.

Step 1 – At the time of charging interest on drawings from the proprietor.

| Drawings A/C |

Debit |

| To Interest on Drawings A/C |

Credit |

- Drawings are a reduction in capital for the business therefore debit the decrease in capital.

- Interest on drawings is an income for the business hence credit the increase in income.

Step 2 – At the time of transferring interest to the P&L appropriation account.

| Interest on Drawings A/C |

Debit |

| To Profit & Loss Appropriation A/C |

Credit |

Related Topic – Some Difficult Adjustments in Final Accounts

Example – Charge interest @ 10% on partner’s drawings for 3,000.

| Drawings A/C |

300 |

| To Interest on Drawings A/C |

300 |

(Interest on partners’ drawings)

| Interest on Drawings A/C |

300 |

| To Profit & Loss Appropriation A/C |

300 |

(Interest on drawings transferred to P&L appropriation)

19. Journal Entry for Goods Returned

Journal Entry for Sales Return

Sales returns are the goods returned by customers or debtors to the company.

| Sales Returns A/C |

Debit |

| To Debtor’s A/C |

Credit |

- Sales return is a decrease in income, therefore, debit the decrease in income. It is a contra-revenue account.

- Debtors are an asset for the business and therefore credit the decrease in assets.

Example – Goods worth 200 sold on credit are returned by XYZ Ltd.

| Sales Returns A/C |

200 |

| To XYZ Ltd. A/C |

200 |

(Goods returned by XYZ Ltd.)

Journal Entry for Purchase Return

Purchase Returns are the goods returned by the company to the seller or creditors.

| Creditor’s A/C |

Debit |

| To Purchase Returns A/C |

Credit |

- Creditors are a liability for the business therefore debit the decrease in liability.

- Purchase Returns decrease the expense for a business and therefore credit the decrease in expense. It is a contra-expense account.

Example – Goods worth 100 purchased on credit from HM Ltd. returned by us.

| HM Ltd. A/C |

100 |

| To Purchase Returns A/C |

100 |

(Goods returned to HM Ltd.)

20. Journal Entry for Manager’s Commission

Companies may offer managers a fixed percentage of their net profit as a commission in addition to salaries.

| Manager’s Commission A/C |

Debit |

| To Cash/Bank A/C |

Credit |

- Manager’s commission is an expense for the business therefore debit the increase in expense.

- Money paid in cash or via bank is a decrease in assets therefore credit the decrease in assets.

Example – Paid manager commission @2% of the Net profit of the Current period after charging such commission. Net profit for the current period is 10,000

| Manager’s Commission A/C |

196 |

| To Cash/Bank A/C |

196 |

(Manager commission @2% paid)

Download our Journal Entry Examples PDF

>Read Adjustments in Final Accounts

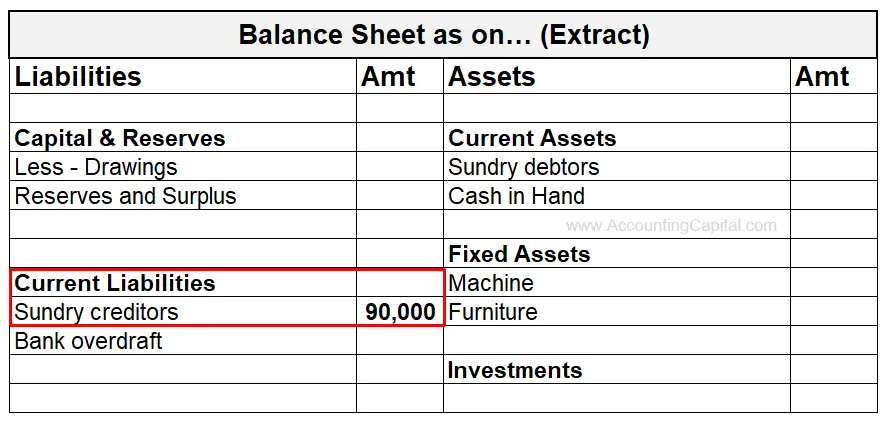

Note: Debtors in the books of Daniel Constructions will also increase by 90,000 on account of credit sales done for 90K construction material.

Note: Debtors in the books of Daniel Constructions will also increase by 90,000 on account of credit sales done for 90K construction material.