Meaning and Definition

Sales refer to the number of goods or services sold by a business entity.

Sales can be of two types :

Sales where the buyer’s payment obligation is settled immediately with the help of currency notes, bank cards, etc. are called cash sales. Cash sales reduce the risk of bad debts and help support routine business operations.

Sales where the buyer’s payment obligation is settled at a later date sometimes after many days, weeks, or months (based on a payment agreement) are called credit sales. It is recorded as “debtors or accounts receivable” in the balance sheet.

Credit sales refer to the total value of sales an organization (or) company makes on credit. If the company offers any discount to its customers on the credit sale of goods (or) if sales returns occur, then such amounts must be deducted from the total value of credit sales to arrive at the Net Credit Sales figure.

In simple terms, net credit sales refer to the total revenue generated by the company when it sells goods and services to its customers on credit, reduced by the amount of sales allowance and sales return from the total credit sales.

Example of Net Credit Sales

Cakes and Bakes made total credit sales of 100,000. A discount of 10,000 was allowed on all the sales made. A customer that had purchased goods from the entity, returned 5,000 worth of goods. Calculate net credit sales.

Net credit Sales = Total credit sales reduced by sales return and discount allowed.

= 100,000 – 10,000 – 5,000

= 85,000

Related Topic – Return Inwards and Return Outwards Deducted From?

Net Credit Sales Formula

From the above explanation, a formula to calculate Net Credit Sales can be derived.

Total Credit Sales – Sales Returns – Discount on Sales

- Total Credit Sales = It is the amount of total sales made by an entity on a credit basis.

Total credit sales are calculated by adding up all the sales for which payment obligation is to be settled on a later date or it can also be calculated by reducing cash sales from the total of all the sales made by an entity in a given period.

Total credit sales = Total sales – Total cash sales

- Sales Returns = It is the amount of goods returned by the customer to the entity.

At times the buyer may return goods due to poor quality, inaccurate quantity, untimely delivery, or other reasons. The value of all the goods returned to the entity is added up to arrive at the figure of sales return for a given period.

- Discount on Sales = It is the reduction in the price of goods or services offered by an entity at the time of sale.

Discount is generally calculated on a percentage basis. For example; A discount of 10% is offered by an entity on the sale of certain products. The total credit sales made by the entity are 4,00,000. Therefore, the discount on the credit sales shall be 10% of 4,00,000 i.e. 40,000.

Related Topic – Types of Accounts for Purchase Returns and Sales Returns?

Example of How to Calculate Net Credit Sales

Apple Inc. furnishes you with the following sales information. Calculate the value of Net credit sales.

| Particulars |

Amount |

| Total Sales |

4,50,000 |

| Cash Sales |

1,50,000 |

| Credit Sales |

3,00,000 |

| Goods Returned by Customers |

1,00,000 |

| Sales Allowance/Discount |

60,000 |

Net Credit Sales = Credit Sales – Sales Returns – Discount allowed on Sales

= 3,00,000 – 1,00,000 – 60,000

= 1,40,000

Related Topic – How to Calculate Days Sales Outstanding?

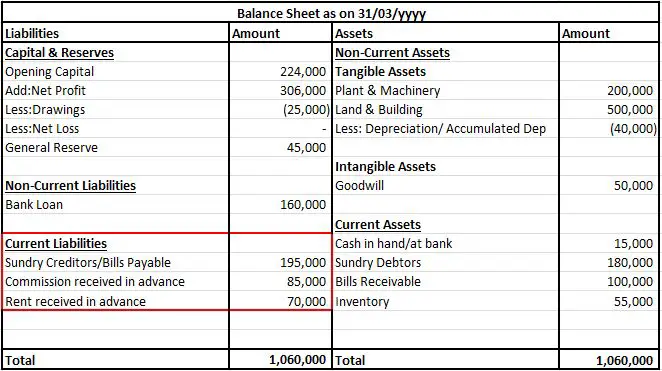

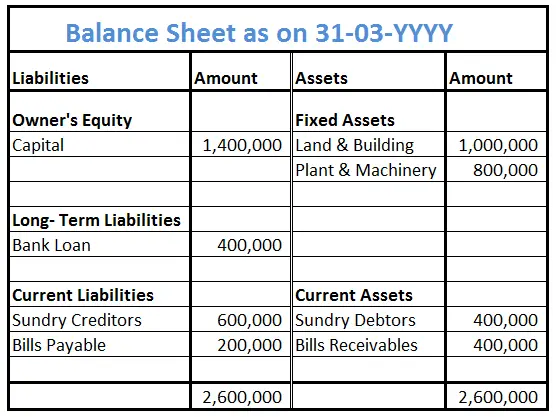

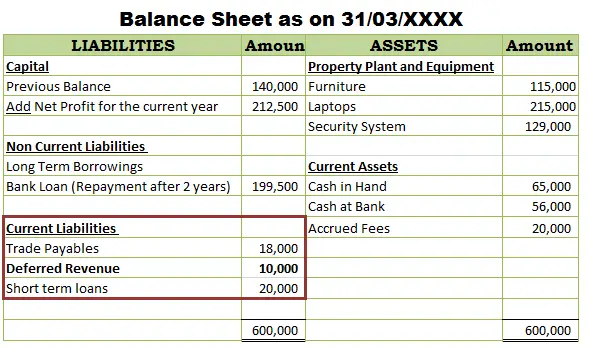

Net Credit Sales in the Balance Sheet

Net credit sales are shown in the Balance Sheet in the “Current Assets” section under the head “Trade Receivables”.

In the case of credit sales, the payment may be received by the entity in some days, weeks, or even months so it is recorded as “debtors/accounts receivable” under the head Trade Receivables.

Net credit sales are used to calculate the Debtor’s turnover ratio, Working capital turnover ratio, and Accounts Receivable turnover ratio.

>Read Is a Purchase Order Legally Binding?